Strategic third spaces considered by APAC occupiers

This year’s (Y)OUR SPACE survey showed that the concept of shared workspaces continues to be entrenched across the occupier landscape.

1 minute to read

Coworking’s existence has been fraught with tension and intense competitive pressures. However, while its operators’ fortunes will wax and wane according to real estate dynamics.

Faced with a preponderance of evidence that hybrid working is here to stay, occupiers are showing more willingness to experiment and integrate flex space into their office portfolios. As uncertainty continues to brew, the inability of landlords to offer flexibility has been indicated by 32% of respondents with an Asia-Pacific remit as the industry’s top peeve.

This implies demand for greater flexibility in leasing terms - which predates Covid - has intensified, with occupiers seeking flexibility at every turn, even within conventional spaces. More than ever, companies would prefer not to commit to long-term lease agreements, given economic and operational pressures. The solution: shorter lease terms and growing adoption of flex spaces.

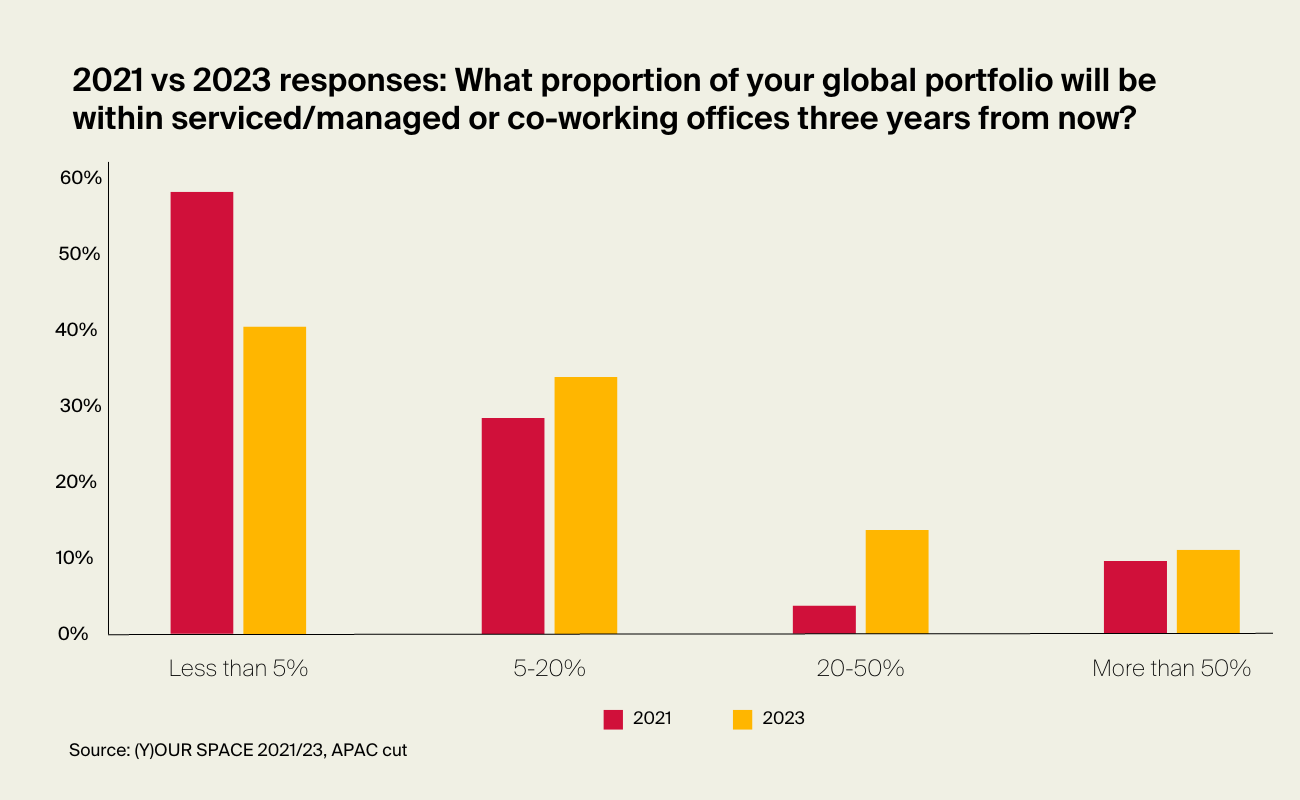

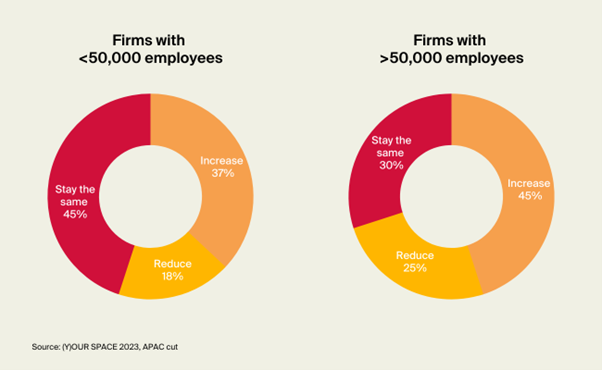

Compared to the survey from 2021, Asia-Pacific-based occupiers are more willing to expand the proportion of flexible or coworking spaces to become more responsive to changing workplace needs. The survey shows this will increasingly be considered by bigger companies.

Of those with over 50,000 workers, 45% indicate the likelihood of increasing the proportion of flex spaces. However, the sweet spot for most companies in Asia-Pacific is likely to be at most 20%. This points to the growing popularity of 'core & flex' models of occupancy whereby occupiers will have the rest of their portfolio within conventional office space.

Discover more

Delve deeper into (Y)OUR SPACE research to discover data-led insights about the future direction of travel in corporate real estate