Re-densification for a more efficient office footprint

Following the pandemic, there was an initial push for de-densified offices to reduce the risk of infection and enhance workplace safety, our research suggests that this may be less prevalent than expected.

2 minutes to read

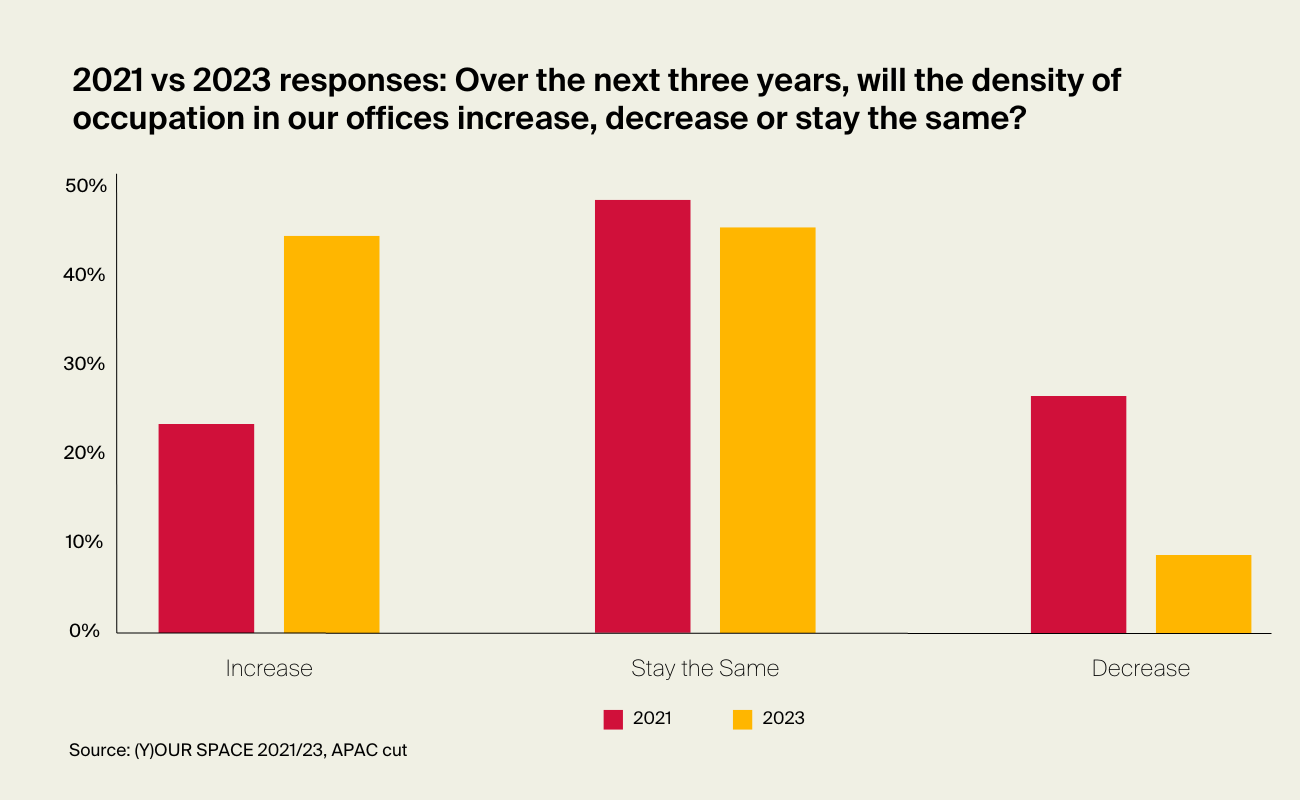

One noteworthy insight from Knight Frank | Cresa's latest (Y)OUR SPACE Survey is the emergence of a re-densification trend in the workplace. Less than 9% of respondents in the Asia-Pacific region are planning to decrease office density in the next three years, a significant drop from the over a quarter reported in the 2021 survey.

In contrast, the proportion of respondents expecting office density to increase has nearly doubled. This trend holds true across sectors and firms of varying sizes in terms of employee numbers.

The result makes economic sense. Once our understanding of the virus and its transmission improves and immunisation rates rise, de-densification will be downplayed in favour of the pressure to rationalise cost. However, office rents in a number of cities in the region, such as Hong Kong and Singapore, are constantly ranked among the top ten highest globally. As such, a long-term shift towards de-densification is unlikely to be sustainable.

While high-density work environments are often linked to lower worker satisfaction, this might not necessarily be the case with appropriate design. In a more agile work environment, office density and utilisation rates can be vastly different. The notion of one level of occupational density is being challenged, as distinctly different high and low values of actual occupation will be generated across a workweek. Other areas of the workplace will have a less densified profile in order to enable collaboration, socialisation, informal gathering or delivery of wider amenities.

Across the spectrum of options in the hybrid working ecosystem, each occupier will evolve its own optimal space mix to provide various levels of experience and choice for its workers. The corollary is that Asia-Pacific occupiers will continue to strive for a more efficient footprint.

Discover more

Delve deeper into (Y)OUR SPACE research to discover data-led insights about the future direction of travel in corporate real estate.