House prices slip as demand softens in UK residential market

Activity subdued in residential property market due to reduction in buyers’ spending power.

5 minutes to read

House prices slipped in July, albeit at the gradual pace seen in the last few months.

Nationwide reported prices had edged down by 0.2% month on month in July, while lender Halifax recorded a 0.3% fall in the same period. On an annual basis average UK prices were down by 3.8% and 2.4%, respectively.

This leaves the average UK house price down between 3% to 4.5% since last August’s peak.

It comes after 14 consecutive interest rate increases to 5.25% from the Bank of England, which has taken the cost of borrowing to highs not seen since 2008 and the global financial crisis, stretching affordability for buyers.

UK property transactions remained muted in June, increasing by 6% month on month to 85,870 but remaining 15% lower than the 101,490 transactions in the same month last year.

Mortgage approvals for purchase, a leading indicator of future demand, showed a similar pattern with an increase of 7% to 54,662 month on month in June. While this was the highest since last October, monthly approvals remained 13% lower than in June 2022.

However, while there is a growing expectation that we are now nearing the end of the interest rate raising cycle, our latest Knight Frank sentiment survey suggests a dramatic rebound in fortunes in the UK property market isn’t imminent.

A third of respondents to our survey told us that they had seen their spending power fall due to the increase in the cost of borrowing, which will continue to weigh on activity. For 17% of survey respondents the hit to their spending power has exceeded 10%.

It is why we expect house prices will remain under pressure, falling by 10% through the remainder of this year and next.

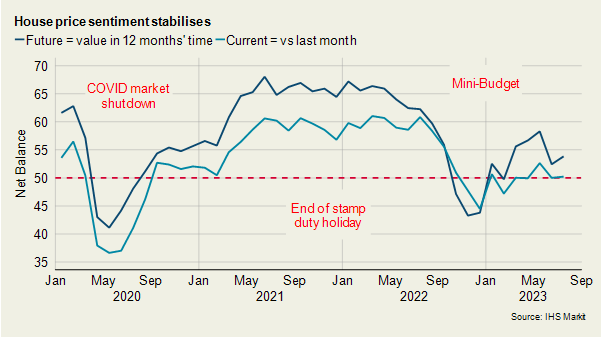

For now, the direction of travel appears to have brought stability after a period of falling confidence triggered by last September’s poorly received mini-Budget.

While IHS Markit’s House Price Sentiment Survey found little change in regard to current house prices, recording a score of 50.2 compared with 50 in June, the index showed households believe things will improve.

Asked what their home would be worth in 12 months’ time, there was an increase in the index from 52.4 in June to 53.8 in July (see chart).

A score of more than 50 signals strengthening price expectations.

The latest RICS Sentiment Survey provided further evidence that the sales market is set for a slower period, with new buyer enquiries and sales volume declining.

While new enquiries at a net balance of -45% in July were similar to -46% in June, agreed sales record their weakest performance since April 2020, with a net balance of -46% in July compared with -36% in June.

The net balance is the proportion of respondents reporting a rise minus those reporting a fall.

At a national level, demand continues to outstrip supply in the lettings market (although a different picture is emerging in prime London markets, see below).

Tenant demand in the three months to July showed a net balance of +54%. This was the strongest quarterly pick-up in rental demand since the start of 2022. In contrast, landlord instructions continued to decline, falling to a net balance of -30% in the three months to July, which will keep upwards pressure on rents.

Prime London Sales

The prime London property market has not been immune to the uncertainty in the mortgage market.

Despite the greater concentration of cash buyers inside zone 1, the higher-end of the property market doesn’t operate inside an air-tight vacuum, and sentiment has suffered as talk of house price falls has gathered momentum.

Average prices in prime central London fell 0.9% in the year to July, which was the largest drop since April 2021. Meanwhile, prices declined by 0.2% in prime outer London, which was the first fall since March 2021.

That said, London markets have outperformed the rest of the UK over recent months, according to a range of Knight Frank indicators.

Prime London Sales Report - July

Prime London Lettings

The number of lettings instructions in July in London was 18% higher than the same month last year and the highest for any single month since October 2020, Knight Frank data shows.

The reason is the current uncertainty facing the sales market as rising mortgage rates put downwards pressure on prices and sales volumes.

Rental value growth has continued to calm as supply improves but it’s still strong by historical standards.

Average rents grew by 13.7% in the year to July in prime central London, which is down from almost 30% at the height of the stock shortage in April last year.

In prime outer London, rents grew 12% in the year to July, which exceeded the growth of 11% seen over the decade before the pandemic.

Prime London Lettings Report - August

Country market

Following the heightened activity seen over the pandemic period, the country market continues to moderate in 2023.

Exchanges were down 9.8% versus the five-year average (excluding 2020) in July. This was the best reading this calendar year, with transactional activity having been subdued in the country market since the shock caused by the mini-Budget.

The ratio of new prospective buyers to new instructions, a leading indicator of future supply versus demand, climbed to 7.3% in July. While this is down from pandemic highs when demand outstripped supply at times, it is close to the ratio average of 7.6 seen in the five years to 2019.

It shows that while prices are under pressure in the country market due to higher borrowing costs, rather than suffering a dramatic fall, activity has reset to pre-pandemic levels and demand is proving resilient.