Prime London sales market slows by less than UK

July 2023 PCL sales index: 5,423.6

July 2023 POL sales index: 275.1

2 minutes to read

The UK’s return to more normal lending conditions after 14 years of near-zero rates was not unexpected.

However, the journey was not supposed to be this volatile.

While the previous government went too far, too fast for financial markets, the Bank of England has been accused of doing too little, too late.

The result has been a chaotic lending market over the last eleven months that has unsettled buyers, sellers and anyone re-mortgaging.

Mortgage lenders have cut rates following July’s better-than-expected inflation reading and the cycle of 14 consecutive rate hikes may be nearing its conclusion.

The prime London property market has not been immune to this uncertainty.

Despite the greater concentration of cash buyers inside zone 1 (around half according to the Land Registry), the higher-end of the property market doesn’t operate inside an air-tight vacuum and sentiment has suffered as talk of house price falls has gathered momentum.

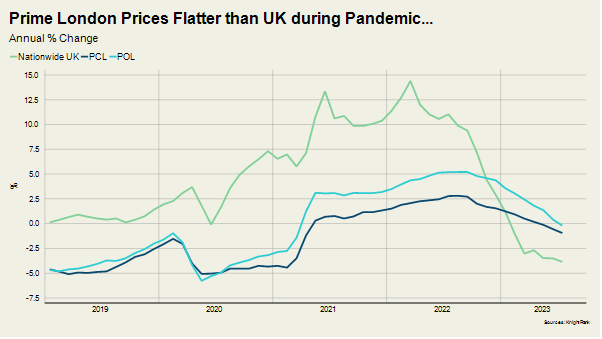

Average prices in prime central London fell 0.9% in the year to July, which was the largest drop since April 2021. Meanwhile, prices declined by 0.2% in prime outer London, which was the first fall since March 2021.

While it’s true that first-time buyers in mainstream markets are feeling more financial pain, the discretionary nature of higher-value markets in the capital means demand has cooled while the outlook remains unclear.

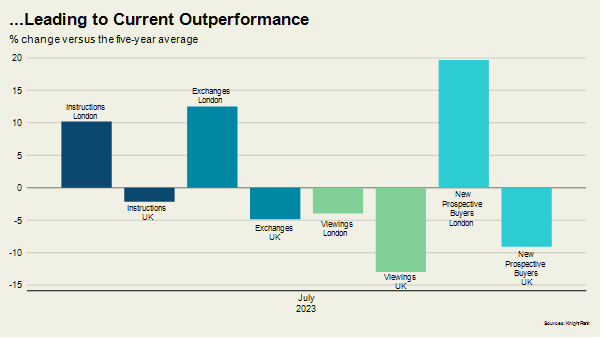

That said, London markets have outperformed the rest of the UK over recent months, according to a range of Knight Frank indicators.

The reason is that prices have been so flat for so long compared to areas of the country that benefitted from a surge in demand for space and greenery during the pandemic, as the charts show.

Knightsbridge, for example, was an area that suffered disproportionally from international travel restrictions and the fact it is largely a market of flats rather than houses. Prices there rose by 3.3% in the year to July, making it the strongest performing area in prime central London.

As a result, exchanges were 13% higher than the five-year average in July in London, while they were 5% down across the rest of the UK.

We expect prices will continue to drift lower in prime London markets during the rest of this year, but by less than mainstream UK markets as the capital continues to benefit from the fact its housing market experienced a relatively subdued period during the pandemic.

Our latest forecasts can be found here.