New-build family rental housing, and the UK budget summary

We also look at better-than-expected housing market data, NPPF consultation and what developers need to know about biodiversity.

4 minutes to read

Budget

Last week’s Budget was lightweight on policy changes for the housing market, with little to indicate that the government has a strategy for maintaining (let alone boosting) supply in a challenging market.

Instead, the headlines centred on news that UK economic conditions are improving.

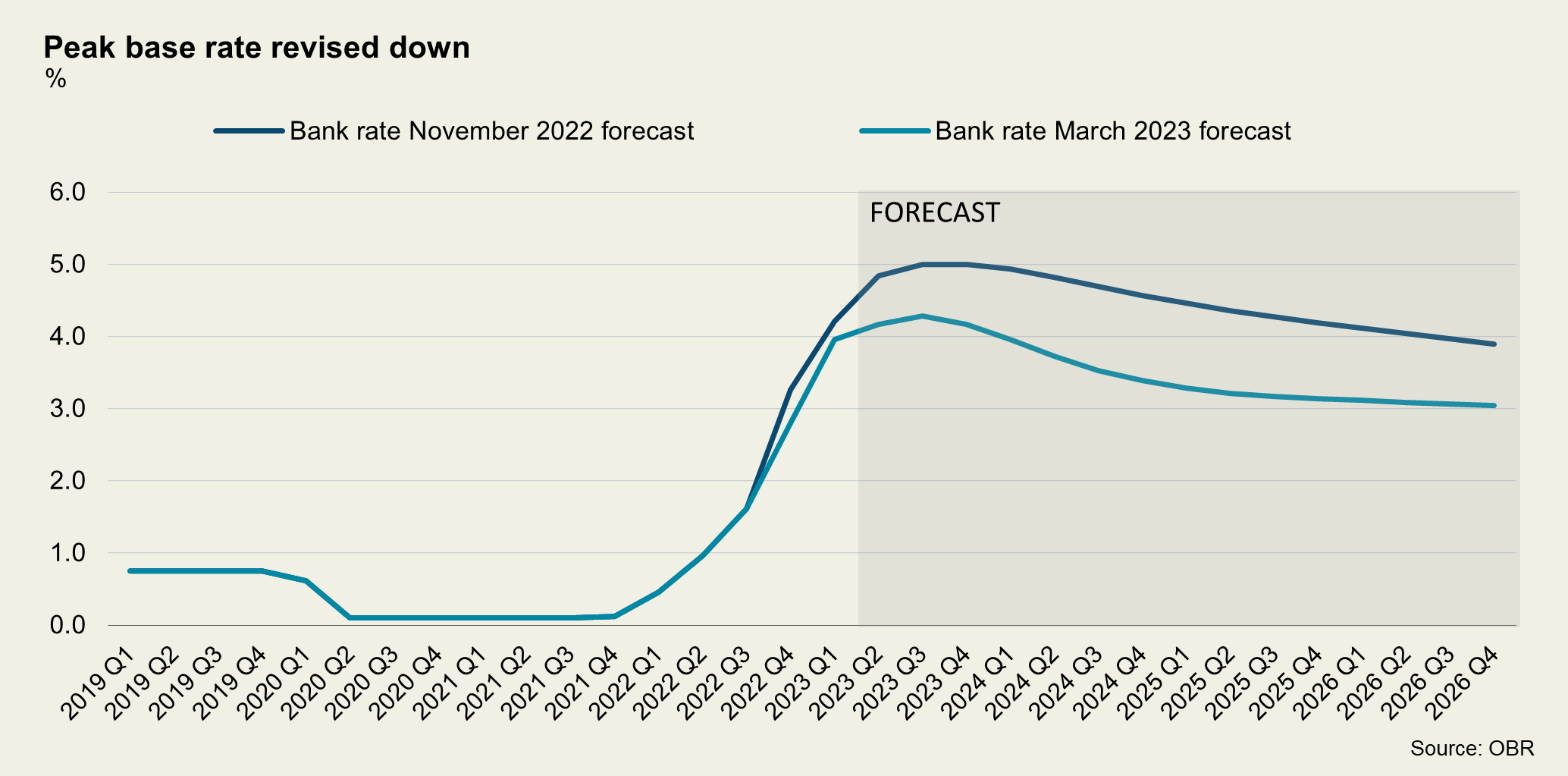

The base rate is now expected to peak at 4.25%, rather than the 5% the OBR forecast in November. Similarly, only four months ago, the Bank of England said the UK was facing its longest recession on record and unemployment would peak at 6.5%. Last week the OBR confirmed the UK will not see a technical recession and revised its unemployment forecast down to 4.4%.

Several challenges remain - gas prices are more than twice their pre-pandemic level, business investment has stagnated since 2016 and labour market inactivity is stubbornly high - but there is little doubt that the near-term outlook has improved. The greater optimism should offer support to property markets.

A full round-up of Budget reaction, across real estate sectors, is published here.

Asking prices

A narrative that things are proving better-than-expected extends to the housing market, as we noted here and here. The latest price index for Rightmove, suggests asking prices for UK homes rose 0.8% in March, taking annual growth to 3%.

According to the portal, the data points to "a market on a much more stable footing than many anticipated and cautiously transitioning towards the activity levels of the more normal market of 2019".

Interestingly, the strongest recovery in sales volumes has been for typical first-time buyer (FTB) properties (two bedrooms or fewer) which, in the last two weeks, were just 4% behind the same period in 2019.

It mirrors more positive news from housebuilders so far in 2023, with recent trading updates all suggesting that site visits and reservations have rebounded from the lows of Q4. While generally still down year-on-year, it marks an improvement in trading conditions.

A pick-up in demand from FTBs is welcome news. Help to Buy closed to new applications back in October last year, effectively drawing the curtain on government support for households looking to take the first step onto the housing ladder and purchase new-build housing. In total, more than 370,000 households used the scheme to purchase a home, 84% of whom were FTBs.

Single Family Housing

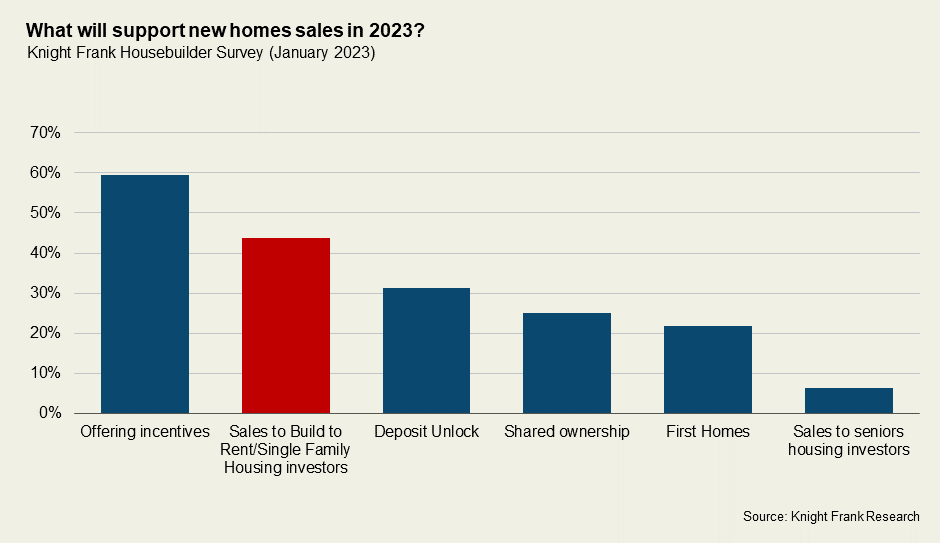

Housebuilders have been pondering the question of what is going to plug the inevitable Help to Buy sales gap for some time. Most have already adjusted strategies – including looking at the product mix and price point of homes they are delivering. Others are looking at ways to de-risk sites including through diversifying product and tenures.

Our latest quarterly survey of volume and SME housebuilders gives some insight into the latter strategy. Some 44% of survey respondents state that sales to BTR investors (of both apartments and houses) will play a greater role in the market this year, up from just 17% in Q2 2022.

The appetite is certainly there from investors. Our Single Family Housing (SFH) for rent report, released this week, identified more than £8 billion of institutional capital committed and ready to be deployed into the sector within the next five years.

Consequently, we expect to see more partnership agreements and bulk sales between housebuilders and SFH investors agreed this year. You can read the full report here.

NPPF consultation

The consultation on the latest proposed changes to the National Planning Policy Framework (NPPF) closed earlier this month. Whether meaningful change to a system in desperate need of an overhaul materialises remains to be seen. In the meantime, however, Roland Brass and our Planning team have put together this handy guide to the proposed changes.

“Taken as a whole, the proposed changes clearly seek to simplify the plan-making process and provide LPAs with more power to set their own growth strategies. Our concern is that the current pressures might shift but they will remain in some shape or form a prominent feature of the process,” says Roland.

In other news…

New developments will need to enhance biodiversity. A 10% uplift in biodiversity due to a new development will be required for large sites from November this year and smaller sites from November 2024. Check out Knight Frank’s overview of what landowners, natural capital investors and developers need to know and insights from the team here.