Energy-efficient new builds show huge cost-saving benefit

A roundup of the latest data and insights from the residential development sector.

3 minutes to read

The energy efficiency of homes is now front and centre for both buyers and tenants following sharp rises energy prices and an enhanced focus on environmental issues.

Although wholesale energy prices are expected to fall back later this year, it is unlikely that mindsets will change quickly. Government support for households is due to end in March, so it’s worth highlighting our research into the potential savings new-build homes offer.

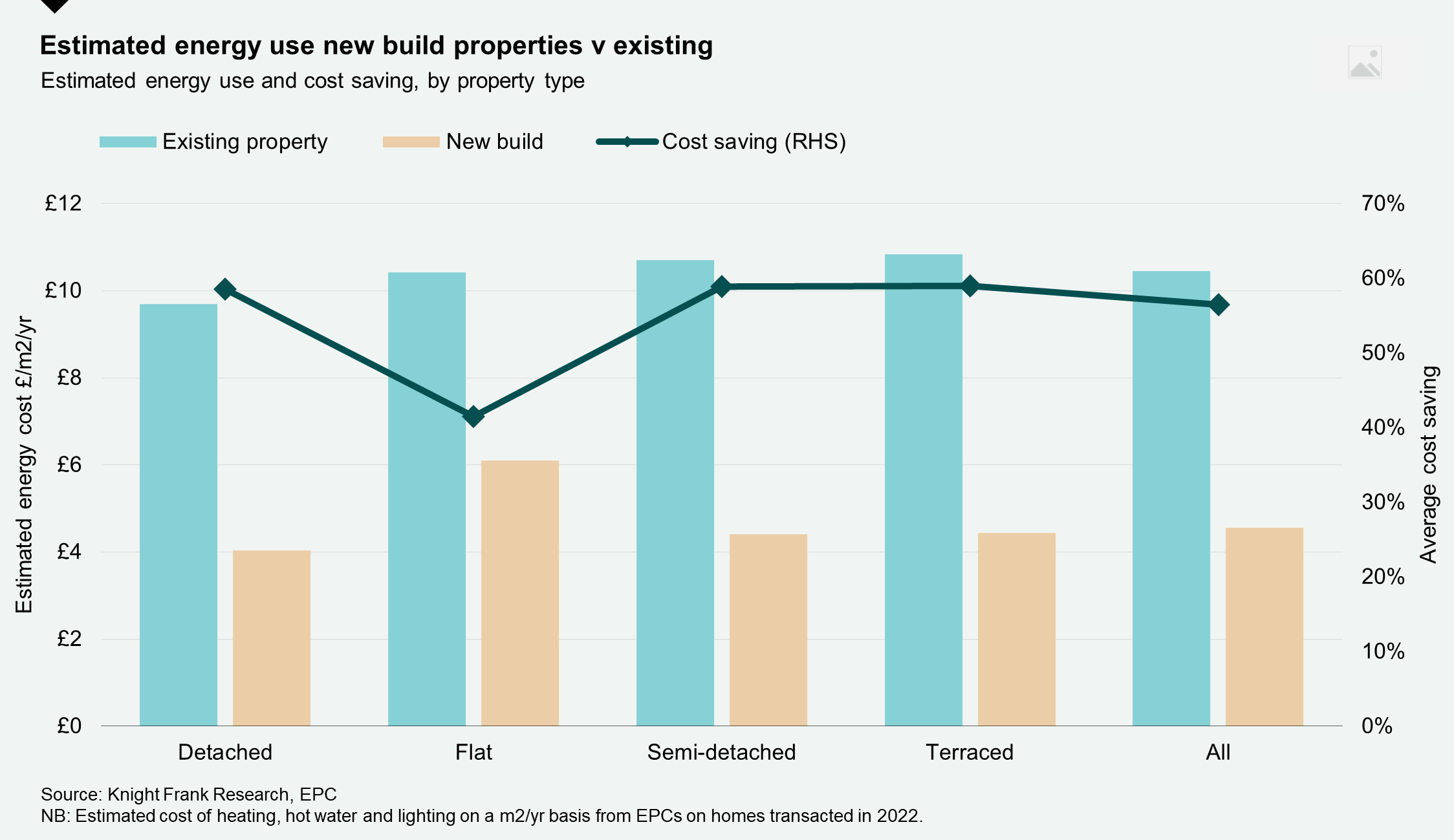

The numbers are compelling. Our analysis of EPC data from more than 600,000 new and existing properties transacted over the last three years points to an average 56% saving on annual energy costs (lighting, heating and hot water) when comparing a new-build with an existing property.

Detached, semi-detached and terraced properties offer the largest potential savings (all at 59%). The saving between new and existing flats is smaller thanks to lower external wall exposure and the fact they tend to be grouped in blocks, but it is still a significant 42%.

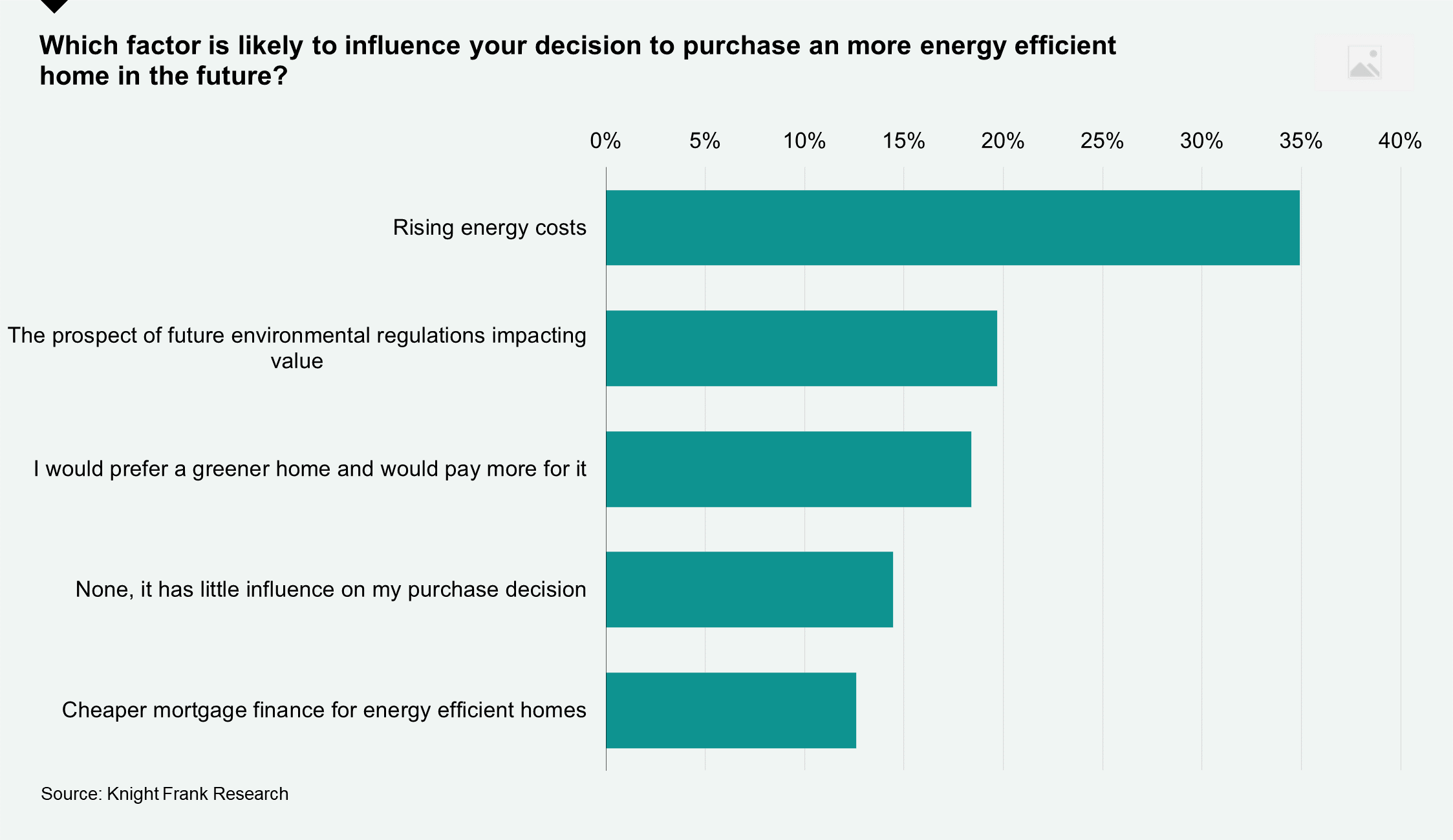

Our own housing market sentiment survey confirms that higher energy costs are the key driver for those looking to move to a more energy efficient home. More than a third of our survey respondents cited rising energy costs as the key factor, while 20% cited the spectre of future environmental regulations affecting the value of inefficient homes.

Interestingly for the new homes market, some 18% said they have a preference to live in a greener home and said they would pay more for it, if necessary.

This all chimes with a recent RICS survey , which revealed that 40% of agents (that had an opinion on the matter) were seeing greater interest in homes that are more energy efficient.

Encouraging updates from housebuilders

Last month, I cited Knight Frank data which suggested that demand for new homes had help up well so far in 2023. Recent trading updates from the major listed housebuilders all point to a similar narrative, with sales rates rebounding from the lows of Q4. While generally still down year-on-year, it definitely marks an improvement in trading conditions.

Encouragingly, there is little sign of major price cuts at this stage (albeit there are a higher number of incentives on offer for buyers). It is early days, but it suggests the new homes market will fare better than the scenarios set out in our wider housing market forecasts.

Boon for BTR as landlords look to sell

From cautious optimism in new homes sales to an expected exodus of private landlords. According to the results of a survey from the National Residential Landlords Association a third of buy-to-let landlords expect to sell some of their properties this year. That reading marks the highest level of planned divestment in more than six years.

Private landlords are clearly feeling the pinch from a combination of rising mortgage costs, changes to mortgage interest relief and the planned erosion of capital gains tax. The prospect of further reform, including through potential changes to EPC requirements for rental properties, is only going to reduce private landlord numbers further (or push more to look at energy efficient new homes).

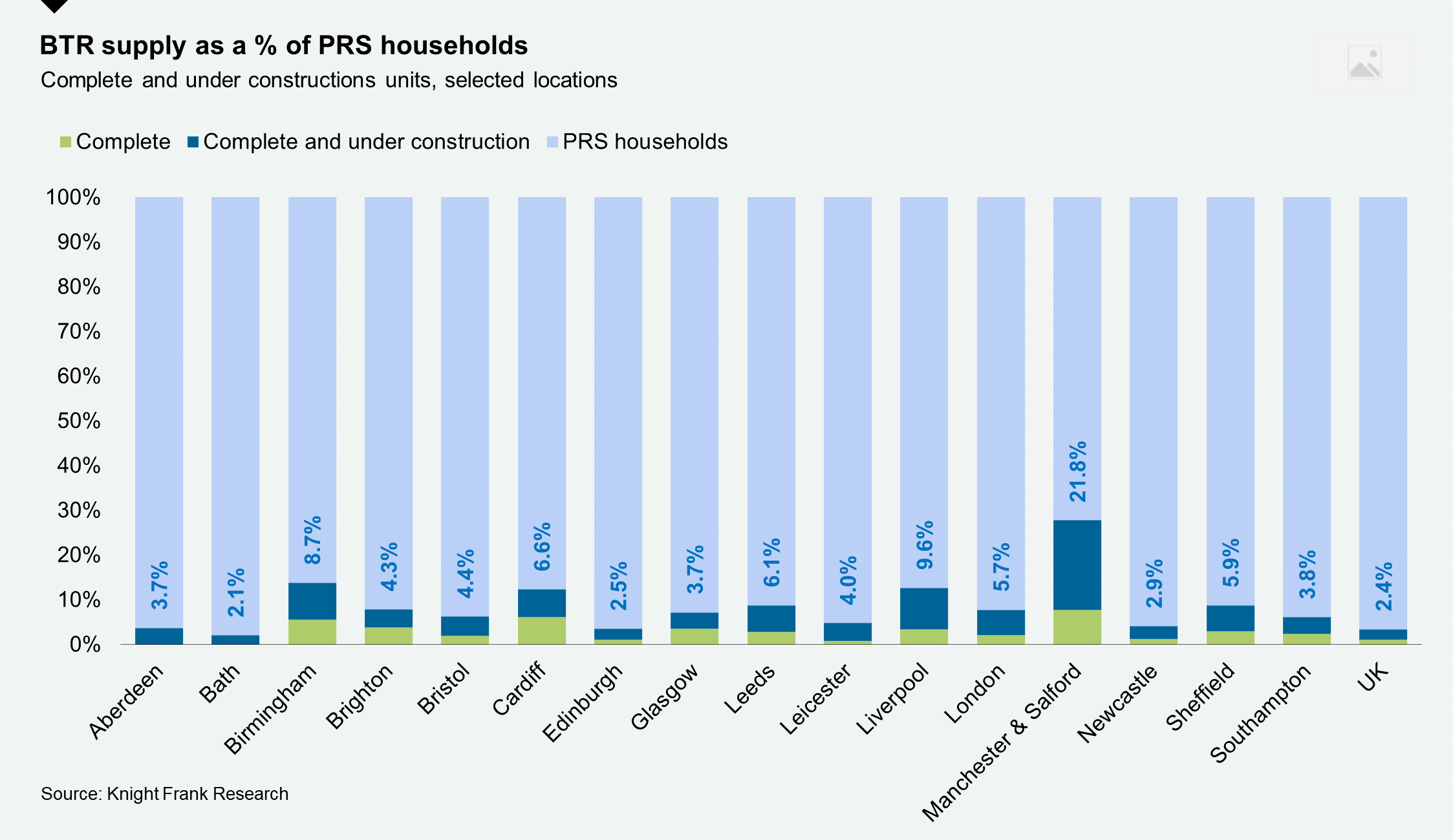

With supply falling, the need for further investment and development from institutional landlords into the growing Build to Rent sector is stronger than ever. 2022 marked a third consecutive record year for investment in the UK – we tracked £4.33 billion worth of deals. Accordingly, the development pipeline is growing, but it remains a small proportion of the overall private rental market (see chart). You can read our thoughts on the future of the sector here.