New data strengthens the hands of the hawks

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Bad good news

A string of economic data published yesterday revealed that the western economies are holding up far better than expected, renewing fears that central banks will act more robustly to stamp out inflation during the coming months. US stocks had their worst day in two months.

S&P Global Purchasing Managers Indexes from the US, the UK and the Eurozone all came in above economists' expectations in February. There were signs that inflationary pressures are easing across all three, but the releases strengthen the case that central bankers have more leeway to keep squeezing economies in order to remove any chance that inflation returns.

Commentators have suggested that the Fed in-particular remains haunted by the 1980 decision of then Fed chair Paul Volcker, who famously blinked in the face of rising employment. Inflation then remained at 12% through the end of 1980 and only returned to 3% in 1983 following a brutal period of hikes that saw the federal funds rate hit almost 20%.

The UK consumer

While the US release largely represented a stabilisation of private sector activity, UK and Eurozone activity rebounded. Both the manufacturing and service sectors achieved a return to growth in the UK, reversing six months of falling output. Survey respondents cited rising customer demand and improving business confidence due to lower economic uncertainty, fewer supply shortages and falling inflation.

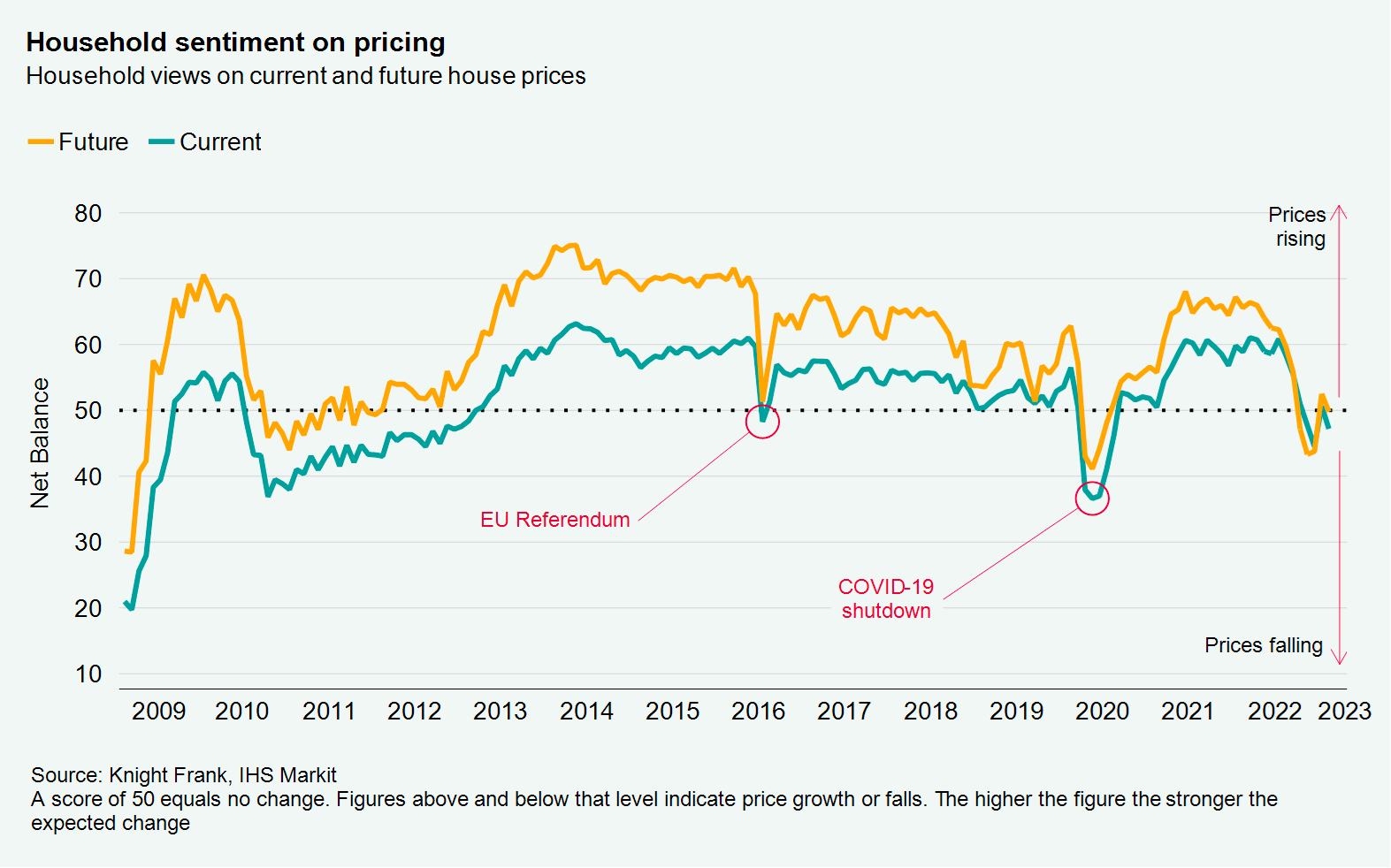

It's not just businesses, either. Stronger than expected retail sales figures for January, published last week, suggest that consumer confidence is more than holding up. You can read Stephen Springham's in-depth take on those figures here. Not all of the data is clear cut and we're likely to get lots of mixed messages in the coming weeks. That rebound in household views on the trajectory of house prices proved short lived, for example (see chart).

Regardless, financial markets now point to a 95% chance of an increase in the Bank of England base rate in March, up from 90% early yesterday. In the meantime mortgage rates continue to tick down, albeit slowly. HSBC is set to be the latest to cut rates across its range this morning.

Selling up

A third of buy-to-let landlords expect to sell some of their properties this year, according to National Residential Landlords Association data shared with the Times last week. That's the highest level of planned divestment in more than six years.

The prospect of further reform, including through potential changes to EPC requirements for rental properties, will be a challenge for some landlords. Separate data from the English Private Landlord Survey suggests that changes to legislation are the most common reason for landlords choosing to decrease their portfolio size or to leave the sector.

Shortages of rental stock will see rents rise for those landlords remaining in the sector, and the case for investing in build-to-rent is strengthening. The pipeline is growing, but remains a small proportion of the overall private rental market - Ollie Knight shared the below chart with me last week. You can read more in our latest Multihousing report.

US home sales stabilise

More signs that the US housing market is reaching the bottom - existing home sales slipped to 4 million in January, down 0.7% from the previous month, according to the National Association of Realtors (NAR).

Sales have declined 37% from the 6.34 million homes sold in January 2022 and are unlikely to fall much further, according to NAR Chief Economist Lawrence Yun:

“Home sales are bottoming out... Inventory remains low, but buyers are beginning to have better negotiating power.”

In other news

The share of UK buyers that viewed a property just once before purchasing it was the second highest in a decade last year, according to figures compiled by Chris Druce.

Elsewhere - in search for sustainable materials, developers turn to hemp (NYT), UK planning laws need ‘modernisation’, Segro chief executive says (FT), world's largest four day week study shows few are going back (Bloomberg), and finally, Hong Kong cuts tax rates for first time buyers (Bloomberg).

Photo by Avi Waxman on Unsplash