2023 – a fresh wave of retailer fall-out?

10 minutes to read

In the wake of Paperchase’s collapse, this week’s Retail Note again revisits Knight Frank’s Retail Property Outlook report (‘Riders on the Storm’) and details our observations on potential retail occupier failures.

Key Messages

- Paperchase becomes 1st retailer casualty of 2023

- Business collapsed into administration this week

- Tesco acquired the brand and intellectual property

- The high street network of 100+ stores likely to close

- Previously undertook a pre-pack administration in Jan 2021

- A victim of a series of PE ownerships, rather than weak consumer demand

- Unlikely to spark / herald a wave of other retailer failures

- Less occupier distress / fall-out than previous recessions

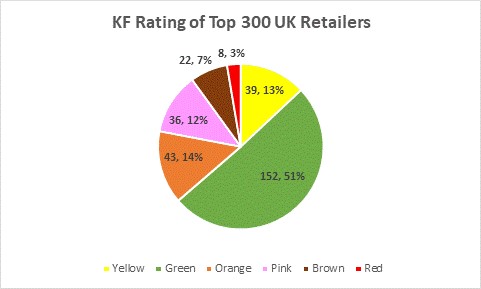

- On KF’s 300-strong Retail Watch-List, 191 (64%) present ‘No Immediate Risk’

- 36 (12%) store-based operators present ‘A Major Risk’

- 22 (7%) online pure-players present ‘A Major Risk’

- KF’s ratings underpinned by a number of considerations:

- Previous distress/ownership structure/trading performance/balance sheet/consumer demand/market rumour all key factors.

Paperchase this week became the first retail casualty of the year. The stationery retailer collapsed into administration, before being bought up by Tesco for an undisclosed (but presumably small) fee. But Tesco has only acquired the name and intellectual property of the business, meaning the 100+ high street stores will probably all close.

Cue the usual nodding heads amongst wise-after-the-event retail ‘experts’, who supposedly foresaw this and can cite any number of reasons for Paperchase’s demise. Few of them probably get beyond lazy cost of living crisis reasons, when the actual causes are far more basic (read on to the end for those).

But the bigger question is whether Paperchase is just a pre-cursor to wider, mass fall-out on the high street. A timely juncture to revisit our narrative on that very subject from our recent Retail Property Outlook Report.

Overview

The storm clouds are gathering. The cost of living crisis will inevitably give way to full-blown recession and 2023 will again prove to be a survival of the fittest. Many, particularly in the property investment community, are already predicting another retail occupier bloodbath, with an inevitable spate of CVAs, collapses and administrations. After all, retail does have considerable track record in this area and during previous recessionary times, many household names fell by the wayside and former high street stalwarts were consigned to the annals of history.

But is the past necessarily a portent for what is to come this time around?

2022 YTD (Dec): all quiet on the fall-out front

By all accounts, there was very little retail occupier distress in 2022. According to the Centre of Retail Research, there have been 22 companies ‘failing’, with 1,678 stores and 30,276 staff ‘affected’. Compare this with 54 ‘failures’ (and 5,214 / 5,793 stores ‘affected’) during the maximum stress years of 2020 and 2008 respectively.

Source: Centre for Retail Research, Knight Frank

Even these figures significantly overstate the scale of actual fall-out. On the one hand, they include a number of operators that barely qualify as retailers (has anyone heard of the likes of Dawnfresh, J C Rook, Tree of Life, Carzam, Jupiter Group?). On the other hand, any hint of distress is logged as fall-out, whether that operator survives or not. For example, c-store chain McColl’s went into administration in May but was subsequently acquired by Morrison’s. Morrison’s has since declared that of the 1,165-strong McColl’s portfolio, only 132 stores will actually close. This reduces the ‘stores affected’ figures reported by the Centre of Retail Research by over 1,000 (62%) at a stroke.

Of the 22 companies ‘failing’ in 2022 YTD (Dec), only McColl’s and Joules could be classified as store-based operators of any scale. In what we see as a major turning point and direction of travel for next year, the majority of ‘failing’ retailers are online pure-plays. The highest profile of these were undoubtedly former e-commerce stars Missguided, Made.com and Eve Sleep (all subsequently acquired by multi-channel operators). Other lower profile online pure-players to collapse this year include Big Home Shop, Studio Retail, Shabby Store, Click It Local and Spirit.ed.

These failures aside, activity has thankfully been very muted this year, for two key reasons. Firstly, for most of the year, the trading environment for retailers has been fairly benign, a period of relative calm bookended by the chaos of COVID/lockdown and the mounting cost of living crisis. Secondly, the wheat has effectively already been separated from the chaff during the pandemic, the weaker players already succumbing to leave a much fitter residual competitor set. The decks have already been cleared, to a certain degree.

The latter is a key factor in our conviction that the degree of occupier fall-out will be less severe in 2023 than in previous recessions. Trading will undoubtedly become far tougher in 2023 than it has been in 2022, particularly in terms of rising operating costs. But most retailers are much fitter than they were coming into previous recessions and while by no means immune to the storm, they at least have stronger defences. There will undoubtedly be casualties, but maybe fewer than the market is anticipating – and no bloodbath.

KF’s Watch List – what constitutes a red flag?

Be that as it may, we anticipate considerable recourse to our internal Retailer Watch List in the coming weeks and months.

The Knight Frank Retailer Watch List is our assessment of occupier health and likelihood of distress. The base data is Mintel’s 2022 Retail Ranking, which is a listing of the UK’s leading operators based upon annual turnover. Our Watch List focusses on the Top 300 retailers in Mintel’s ranking, all of which generate turnover of £50m or more.

Each operator is allocated one of six colour-coded classifications. Four of these apply to store-based and multi-channel operators, the other two to online pure-players.

Store-based / Multi-Channel

- Red: already in administration or currently/recently undertaken a CVA

- Pink: major risk: severely under-performing or CVA/administration rumoured

- Orange: moderate risk: some downsizing/ store rationalisation likely, or already being implemented

- Green: no immediate apparent risk.

Online Pure-Play

- Brown: major risk: severely under-performing or CVA/administration rumoured

- Yellow: no immediate apparent risk.

Although the assessments are largely subjective, they are driven by a host of considerations and datapoints and are thoroughly sense-checked against our own retail intelligence and experience. Key factors that determine our ratings include the following:

- Previous distress. Experience shows that many CVA protagonists are effectively ‘repeat offenders’, previous restucturings having only bought that operator breathing space and time, rather than permanent salvation.

- Ownership structure. Publicly-listed PLCs or family-owned operators tend to be more transparent and robust than those under private equity ownership. Again, there is a strong historic correlation between retailer failures and private equity ownership (current and past) that is hard to ignore.

- Trading performance. Top level analysis of operators’ profit and loss accounts to understand the robustness of current and historic trading, with a particular focus on operating profit (and margin). Loss-making companies, particularly over a long timeframe, are more likely to raise a red flag.

- Balance sheet. Top level analysis of operators’ balance sheets to assess their financial strength. High levels of debt / gearing and creditors / liabilities far outweighing assets are more likely to downgrade an operator’s overall rating.

- Consumer demand. As recession bites, the level of consumer demand will vary massively between retail sub-sectors. Some sub-sectors will see a marked and sudden deterioration, providing greater challenges for weaker operators in those markets.

- Market rumour. We would also factor in ‘market talk’, although we are by no means slave to rumour. There is a trade off behind the notion of ‘no smoke without fire’ and the dangers of Chinese whispers.

KF Watch List – anonymised outputs

The KF Retailer Watch List is an internal resource used by our agency, capital markets and valuation teams to inform their respective advisory services. Although clients may have access to it through these channels, the information is highly sensitive and it is therefore not publicly available. For this reason, any public outputs or disclosures must be anonymised.

The accompanying pie charts provides a breakdown of the Top 300 Retailers by classification.

We can be explicit on the eight (3%) that are classified as Red as these are already in the public domain. As Mintel’s ranking is slightly lagging, the Reds include Debenhams and Arcadia, both of which failed during the pandemic and whose brands were acquired by Boohoo and ASOS respectively. The list also includes Gap, which, although not an administration as such, marked a complete withdrawal from the UK market (excluding a partial tie-up with Next). More recent failures included Missguided and Studio Group (both acquired by Frasers Group), McColl’s (Morrison’s), Made.com and Joules (both Next).

Source: Mintel, Knight Frank

The outputs of KF’s Watch List are not wholly negative by any means. Just over half of the Top 300 (152, 51%) are rated Green. Coupled with the online pure-play Yellows, a total of 191 (64%) of the Top 300 retailers present no immediate apparent risk of failure.

Our Watch List currently identifies 58 operators ‘at risk’ (19%). Of these, 36 (12%) are multi-channel/store-based (Pink) and 22 (7%) are online-only (Brown). Many of the former fall into the ‘previous distress’ camp, while the latter tend to tick the ‘poor trading performance’ or ‘flaky balance sheet’ boxes (usually both).

Key messages

“Knight Frank says one in five retailers is at risk of failure” would be the somethat lazy conclusion to draw from our Watch List analysis. The reality is that not all of these failures will come to pass by any means and this is the absolute worst case scenario.

In terms of wider messages, there are two key takeaways. 1. Scale and longevity are important. 2. Being online-only does not provide immunity.

To the first point, no retailer is “too big to fail”. Former market leaders such as MFI, British Shoe Corporation, Sears Group, Woolworths, BHS, C&A and more latterly Debenhams and Arcadia are (non-) living proof that scale is never a guarantee of survival. But our analysis suggests fewer ‘at risk’ operators in the Top 100 versus those ranked 101 – 300. Extrapolating this further, the very smallest operators and independents are going to find 2023 exceptionally tough, hikes in operational costs likely to prove too much for many to bear.

The second point goes against perceived wisdom, that online pure-plays are sufficiently nimble to adapt to any challenge in the market and are effectively bullet-proof. On the contrary, many lack the experience, operational nous and firm financial footing to ride out the impending storm that will undoubtedly unfold during 2023.

Perceived wisdom is about to about to undergo a severe reality check…

Paperchase

Where did Paperchase feature on KF’s Watch List? It was most definitely rated a ‘Pink’, the key drivers behind this being 1. a chequered history of private equity ownership. 2. previous track record of failure. On the latter issue, the business undertook a pre-pack administration in January 2021, blaming massive losses during the 2020 festive season on the back of lockdown.

But the root cause was its ‘pass-the-parcel’ private equity history, the latest in a long line of similar retailer/F&B failures. In a nutshell: buy a business, leverage up, over-expand it, extract cash, somebody else’s problem further down the line. That simple, that brutal.

Paperchase the victim of the cost of living crisis? A low price point, fairly non-discretionary purchase is unlikely to be at the sharpest end of any slowdown in consumer demand. Indeed, according to the ONS Books and Stationery enjoyed value growth of +18.3% in 2022, with ‘real’ growth (i.e. stripping out inflation) of +11.1%. Over Christmas (Q4 2022) values and volumes were ahead by +13.8% and +5.7%. Put simply, Paperchase did not fail because people stopped buying greetings cards and stationery.

Nor was/is it a bad business. It is actually a very strong brand, with market research from Mintel suggesting that it was the most liked specialist stationery operator amongst consumers. Its product range strong and largely unique, its stores well-executed. Operating in a high margin, high volume retail sub-sector. Nothing untoward to see here.

Retail failures often have little to do with the operating company or front end of the business – it is usually what lurks beneath. All is not necessarily what it seems.

Click here (or on the thumbnail below) to access the full report.