Squashing optimism the central banking way

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Three things

Here are three things that we didn't know this time last week: -

1. Inflation has peaked

We covered this on Wednesday so I won't go into detail, but barring some unforeseen event it looks like the headline rate of inflation will keep ticking down both in the US and the UK over the coming months. Europe looks more problematic, but attention will now turn to the pace of any slowing across all three economies. During the most recent five months, US inflation has climbed at an annual rate of just 2.5%, so there are reasons to be cheerful.

2. Wages are the problem

The Fed, the Bank of England and the European Central Bank all raised interest rates by 0.5% this week, in line with expectations. A sell-off followed - the FTSE had its worst day in two months, the S&P had its worst day in a month. The tightness of the labour market and particularly wage growth comes to the fore in all three sets of minutes. While optimism in markets had been underpinned by signs inflation is subsiding without unemployment rising substantially, policymakers are clearly still spooked by the prospect of a wage/price spiral and will act forcefully to avoid it.

3. Predictions of 2023 rate cuts look optimistic

Research suggests that the time lag between a hike taking place and the real world impacts take between a year and 18 months. The Fed and the Bank of England say they are worried about overdoing it, so the focus has shifted from 'how fast' can we hike to 'how long' shall we hold at the peak. On Wednesday, Fed funds futures were pricing in three quarter point cuts by the end of 2023, which now looks optimistic. Similarly, UK interest rate swaps now show investors expect rates to peak at 4.46% as late as August.

BOE doves

The Bank of England minutes read as the most dovish of the three central banks. Two of the nine-strong Monetary Policy Committee voted to hold the base rate at 3%, six voted to move to 3.5%, while one voted to hike to 3.75%.

Yesterday's hike will have little impact on fixed rate mortgages, which are still elevated in the wake of the mini-budget. Lenders continue to announce marginal cuts to their ranges, which should continue through January. The gap between the best tracker products, now at 4%, and the best five year fixed products, now at about 4.6%, is narrowing.

The ONS house price index for October out Wednesday, showed prices in London fell 0.9% during the month, compared to a 0.3% increase nationwide. The more current Nationwide index for showed prices fell 1.4% during November. Tom Bill explains why much of the most recent house market data is masking the longer term trends.

Consumer confidence continues to run close to all-time lows. Joe Staton, client strategy director at GfK, says the eight months of readings at -40 or worse is the first time such a run has occurred in the survey's nearly 50-year history.

Singapore the wealth hub

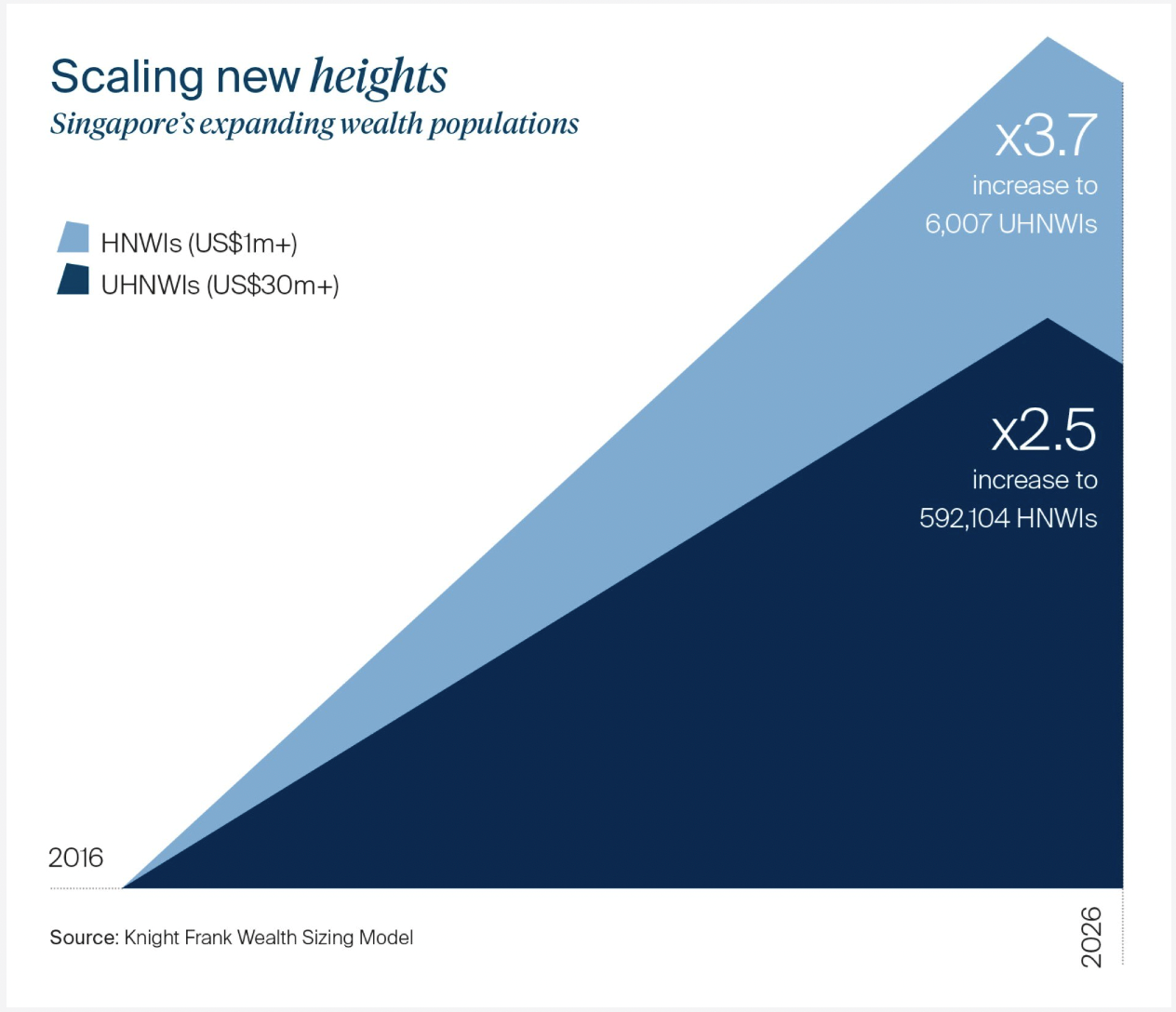

In this year’s Wealth Report, we took a deep dive into Singapore's growing status as a leading regional wealth hub. Tax incentives and grants from the city-states economic development board were having an impact, and the number of individuals with at least US$1 million of net assets (HNWIs) soared 126% to 526,370 between 2016 and 2021.

The FT picked up where we left off earlier this week. The boom in single family-office creation is continuing, driven largely by wealthy Chinese families. Numbers of single family offices have jumped nearly threefold since the pandemic began and, according to some estimates, now total as many as 1,500, according to the FT's report.

We believe this has further to run (see chart). The number of HNWIs in Singapore will expand another 13% by 2026, according to the Knight Frank Wealth Sizing Model. The number of individuals worth at least US$30 million, now at 4,206, will expand another 43% by 2026.

The price of of golf course memberships is a useful indicator of what is happening. Bloomberg reports that the cost for an expatriate to join the 36-hole Sentosa Golf Club overlooking the Singapore Strait has more than doubled since the end of 2019 to S$840,000 ($618,000). For citizens and permanent residents, the membership price has surged to as much as S$500,000.

In other news...

Our experts step back and condense the key real estate themes across Europe. Read it here.

Kate Everett-Allen on the countries with the highest proportion of mortgage-free households.

Elsewhere - Ministers consider planning shake-up to boost affordable housing (FT), rich Norwegians flee to low-tax Switzerland as wealth levy bites (FT), China hints at more property support (Bloomberg), and finally, hydrogen or heat pumps: how will we heat our homes in the future? (Times).