The great workplace experiment continues through 2023

The pandemic has set off a series of discussions on the future of the office. Here are the key observations that will shape the ongoing Asia-Pacific workplace experiment in 2023.

3 minutes to read

The past three years of COVID restrictions have provoked the world to reflect on our work behaviours, which then set off a series of discussions on the future of the office.

As workplaces continue to put more emphasis on people and how better to foster culture, learning and productivity, we expect to see more clarity on the ongoing Asia-Pacific workplace experiment in the upcoming year.

Here are the following observations that are set to run through 2023:

Talent vs Real Estate

Sparked by the global pandemic, talents have changed the way they view work and the role they want it to play in their lives. In the upcoming years, it will be vital for companies to create working environments that support a variety of work styles for their workers and enable them to do so comfortably and productively.

Companies will have to tackle how best to cater for the occupying space – such as having more fluidity in office requirements or increasing user-centric workplace designs – for employees since ways of working in the office have changed.

The social value of the office space should also be leveraged on, and businesses need to be concerned about their employees' social, physical, and psychological welfare.

As such, we may see more businesses adopt or consider strategies on how they can best provide for their employees and take steps to curate the most desirable workplace for them.

Reshuffling of Occupancy Costs

Catalysed by the weakening economic and operating environment, tenants tend to be more cautious in making leasing decisions with a view to safeguard their cash flow.

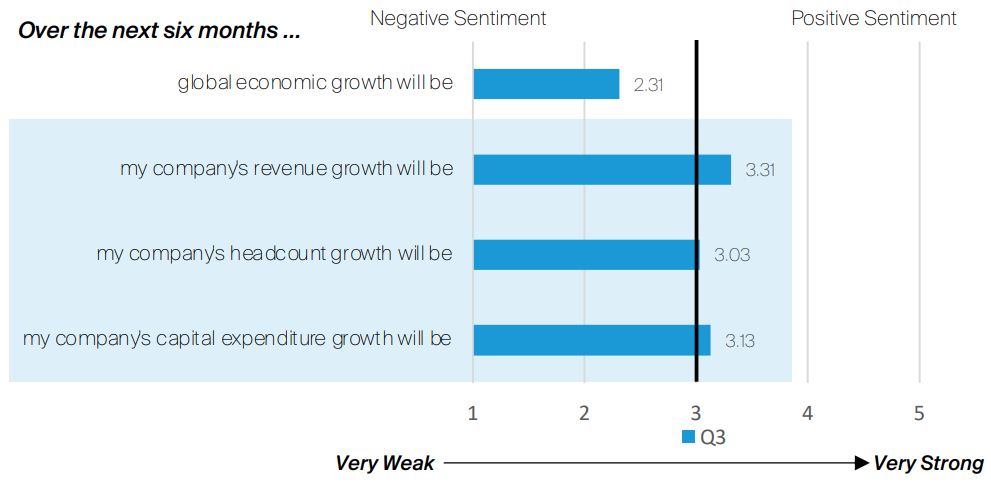

Real estate, the second largest operating expense after payroll, would be an area where companies adopt a more defensive stance. However, revenue, headcount and CAPEX growth expectations over the next six months are set to remain positive or marginally neutral.

Q3 2022 Knight Frank Cresa Corporate Real Estate Sentiment Index Survey Result comparing Quarterly Growth Dynamics

(Source: Knight Frank Cresa)

Emergence of ‘shadow spaces’

With the adaptation to hybrid working and external pressures to reduce their cash outflow or employee headcount, companies may be forced to review underutilised supplementary spaces, resulting in the emergence of shadow space.

While we foresee an increased supply of shadow space, significant space reductions from occupiers across Asia-Pacific should be few and far between, given the more optimistic outlook compared to other regions, such as in the US and Europe.

Higher space utilisation due to productivity paranoia

With the world coming to the tail-end of the pandemic, many employers are issuing stronger mandates for staff to fully return to the office – with almost one-fifth of employers affirming that they would terminate staff who refused to go back to their desks (source: poll by OSlash, a productivity software company).

As most employees are obligated to return to the office full-time due to heightened concerns for job security and opportunities for promotion, we may expect to see an increase in space utilisation for some firms.

As the majority of employees are obligated to return to the office full-time due to heightened concerns for job security and opportunities for promotion, we may expect to see in increase in space utilisation for some firms.

___

The Asia-Pacific Outlook Report is an annual publication that delves into the repercussions of the pandemic, increasing interest rates, and rising mortgage rates on the Asia-Pacific residential landscape using official statistics and outlines the forecast for 2023.

For more insights, please download the full report here.