Strategising the 2023 Asia-Pacific landscape

With interest rate hikes weighing on sentiment across Asia-Pacific, what are some of the key investment themes for the upcoming year?

2 minutes to read

After over a decade of abundantly available capital, the rapid reversal in macroeconomic fundamentals is changing the playbook for real estate investment globally as well as in the region.

Despite the challenging climate, cross-border investments have remained remarkably resilient, gaining 11.8% in the first nine months of 2022. With macroeconomic headwinds remaining significant, we expect to see a period of price discovery as asset managers, investors, and developers reconcile the gap between the asking and bidding prices to find a new market equilibrium.

As we reach the cusp of a new era, here are the major themes that will underpin the new investment landscape in 2023:

1. Strengthened interest in commercial real estate

Commercial real estate which exhibits income growth potential, diversification benefits and relative stability will see strengthened interest in the coming year.

Investor preference for type of real estate

(Source: Knight Frank Research, Active Capital: Real Estate Strategies for Volatile Times webinar, Oct 2022)

With elevated building costs, we might see increased refurbishments and repurposing of assets to capture alpha-based returns.

2. Focus on core, liquid assets in prime locations

For commercial real estate to serve as an effective inflation hedge, landlords will be required to successfully push through positive rental reversions.

With the focus on ESG, there will be an increased differential between core, well-located prime assets with good ESG credentials and more secondary assets with low sustainability credentials.

As such, we expect investors to focus particularly on core, liquid assets in prime locations with attractive yields relative to the cost of debt in 2023.

3. Rise of dollar investors

We expect increased demand from dollar-denominated investors from North America, the Middle East, and parts of Asia, looking to take advantage of the strong currency and diversify their portfolios into the region's core markets.

Investors that are watching the re-pricing of markets closely will be ready to move quickly when conditions stabilise.

4. Increased dominance of private and sovereign investors

Real estate offers good diversification benefits with a relatively low correlation to equities and bonds, and there remains a large pool of capital waiting to be deployed into direct real estate once bid-ask spreads narrow.

With longer horizons and deep pockets, investors are prepared to move quickly to secure prime assets while there is limited competition – especially with private investors being the most aggressive buyers for trophy office assets in the region’s safe-haven markets.

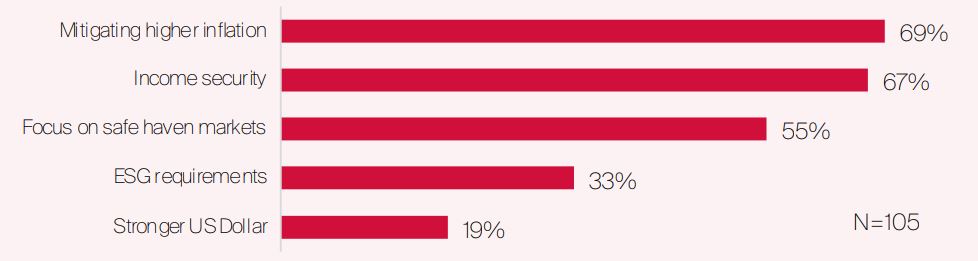

Poll result about investment strategy

(Source: Knight Frank Research, Active Capital: Rising Capital in Uncertain Times webinar, June 2022)

The Asia-Pacific Outlook Report is an annual publication that delves into the repercussions of the pandemic, increasing interest rates, and rising mortgage rates on the Asia-Pacific residential landscape using official statistics and outlines the forecast for 2023.

For more insights, please download the full report here.