Leading Indicators | Downgraded Credit Outlook | Tight Labour Markets | Elevated Oil Prices

2 minutes to read

Discover key economic and financial metrics, and what to look out for in the week ahead.

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

UK credit outlook downgraded

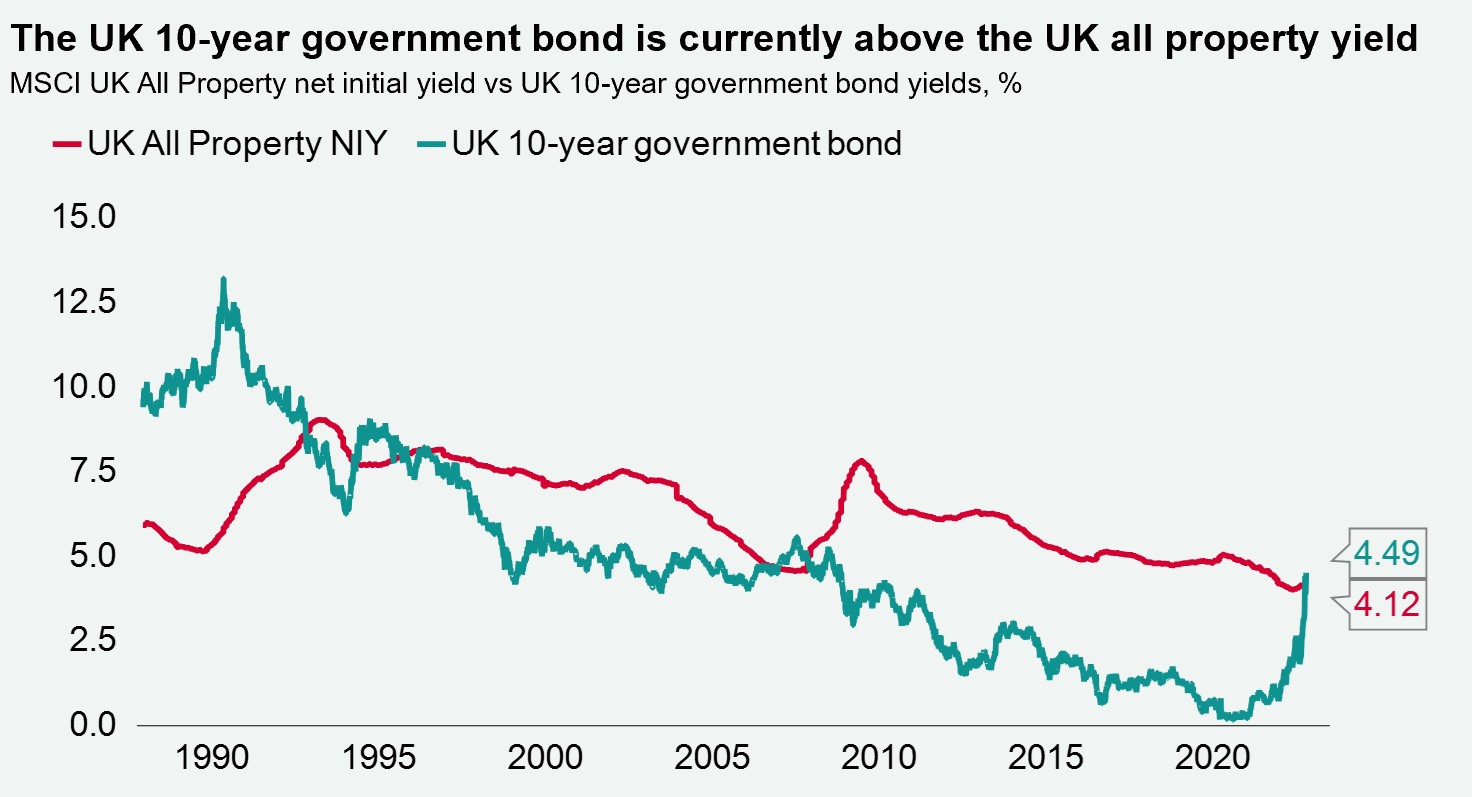

Rating agencies, Fitch and S&P cut the outlook for the UK’s credit rating for British government debt to “negative” from “stable”. Fitch stated that the “large and unfunded fiscal package announced as part of the new government's growth plan could lead to a significant increase in fiscal deficits over the medium term”. UK SONIA swap rates are elevated alongside this news, with the UK 5-year swap rate currently at 5.14%, up from 4.73% last week. However, this remains below the 5.38% record high it hit on 27th September.

Labour markets remain robust

The US unemployment rate in September fell to 3.5%, from 3.7% in the month prior and matching July’s 29-month low. There is a similar story in the UK, with UK unemployment contracting to 3.5% in the three months to August 2022, its lowest level since 1974 and below market expectations of 3.6%. Due to these robust labour statistics, markets are expecting another 75bp rate hike from the US Federal Reserve when it next meets in November and a 100bp rate rise from the Bank of England at its next meeting on 3rd November.

Elevated oil prices

The Opec+ group agreed to cut production targets by 2 million barrels per day, an equivalent of 2% of global supply. In response, oil prices have increased, with Brent Crude at $94.08 per barrel currently, compared to $88.50 on Friday, an increase of c.6%. This comes as the British National Grid stated that it expects to be able to meet electricity and gas demand this winter but that the unprecedented and uncertain situation in Europe had led them to look at a range of scenarios. In an “unlikely” scenario, some customers across the UK could be without power for “pre-defined periods of the day” assumed to be for three-hour blocks.

Download the latest dashboard