Looking for a second home abroad? Why it pays to keep one eye on currency markets

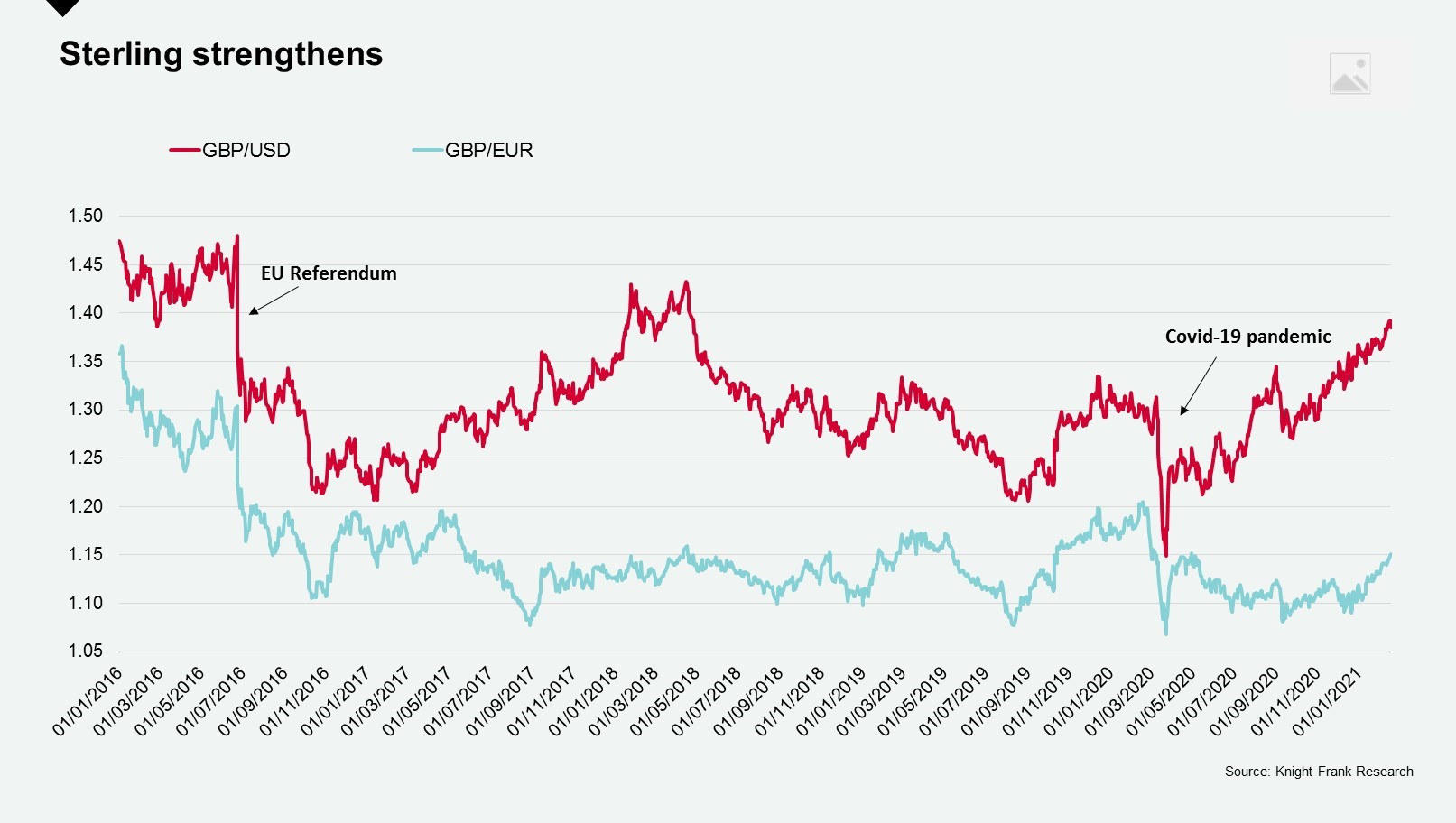

Sterling hit a two-and-a-half year high against the US dollar and a nine-month high against the euro this week.

2 minutes to read

For a GBP-denominated buyer looking to purchase a €1 million home in France, Italy or Spain this means the property would currently cost around £868,600 compared to £936,600 in late March 2020.

Add in the decline in property prices over that period in some local markets, including Madrid and Marbella and the saving increases further from 7% to 12%.

In the US, the saving for a GBP buyer is even greater, with a $1 million property now around £718,000, down from £870,300 at the start of the pandemic when the GBP/USD exchange rate slumped to a low of 1.15.

Again, factor in the decline in prime prices in some US markets – New York saw prime prices dip 5% in 2020 – and the potential discount moves from 17% based on currency alone to 22%.

Will the pound strengthen further?

Prospective buyers may question whether it is worth waiting in case sterling strengthens further, but as always there is a trade-off in terms of supply, demand and pricing.

Supply is already starting to shrink in popular villages across Provence for example, and once travel bans ease it is likely we will see another surge in pent up demand which may put further pressure on inventory levels.

Added to this is a growing desire amongst some buyers to expedite their purchase irrespective of currency fluctuations, enabling them to make up for lost time with family and friends as a result of the pandemic.

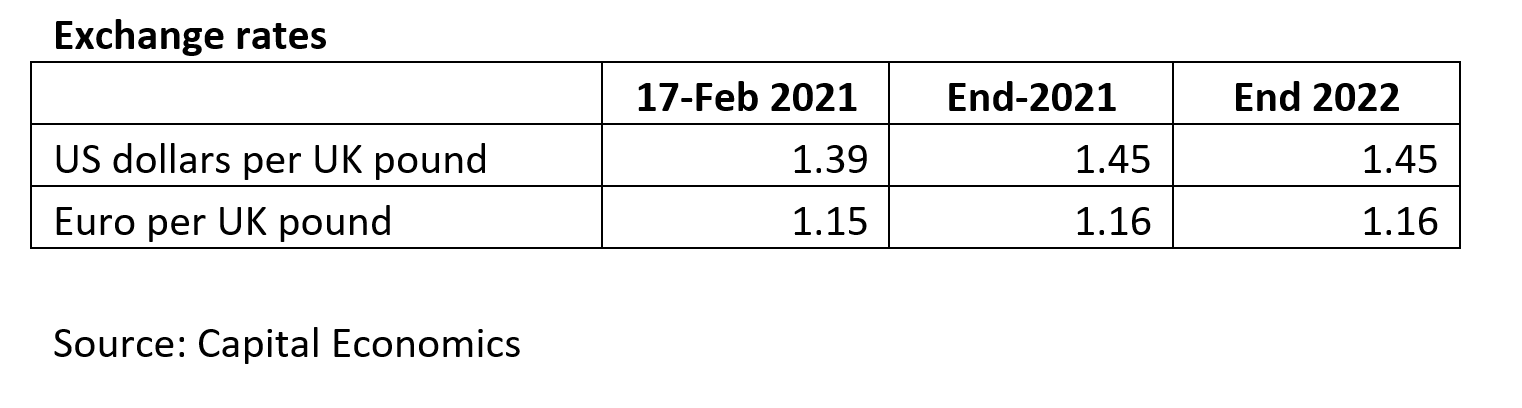

The table below sets out Capital Economics’ view on how the pound will fare in 2021 and 2022 with further gains against the dollar but only a marginal increase against the Euro expected.

What’s behind the dollar’s slide?

A combination of the vaccine roll-out programme, Joe Biden’s election victory, additional stimulus packages and the Federal Reserve’s accommodative monetary policy stance has heightened analysts’ expectations for reflation in 2021 which will lead to a weaker dollar.

For more information on European and US property markets or to sign up to receive our research updates please do get in touch.