Daily Economics Dashboard - 18 February 2021

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics on 18 February 2021 2020.

Equities: Globally, stocks are mostly lower. In Europe, losses have been recorded by the CAC 40 (-0.6%), STOXX 600 (-0.5%), DAX (-0.4%) and the FTSE 250 (-0.2%) this morning. In Asia, the Hang Seng (-1.6%), KOSPI (-1.5%), TOPIX (-1.0%) and Nikkei 225 (-0.2%) all closed lower, while the S&P / ASX 200 was flat on close. In the US, futures for the S&P 500 are -0.5% this morning.

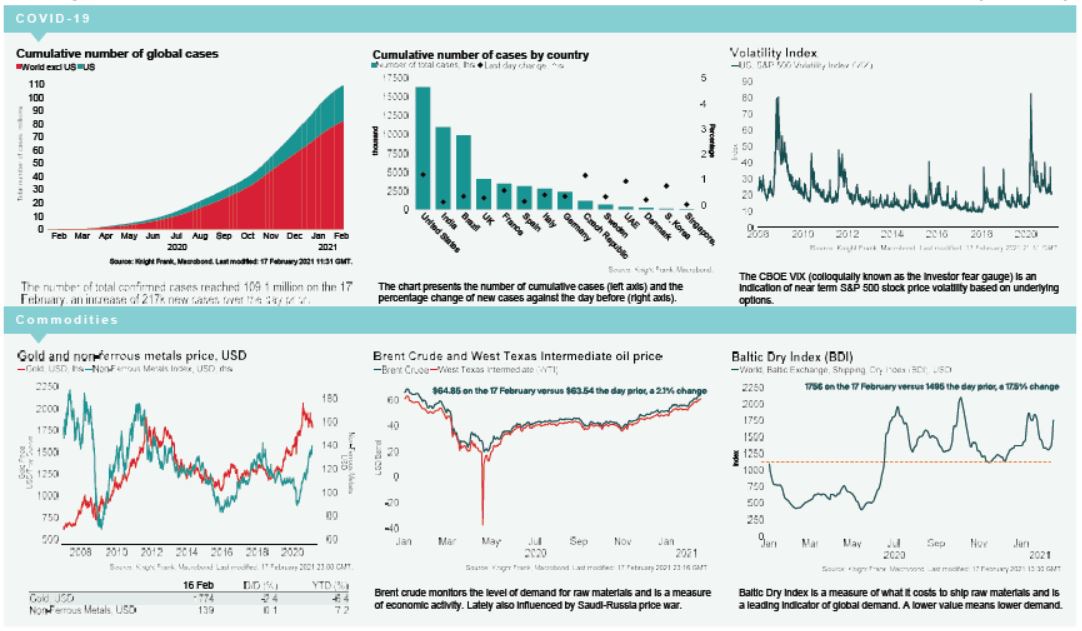

VIX: While the CBOE market volatility index was broadly stable over yesterday, this morning it is up +3.8% to 22.3, above its long term average (LTA) of 19.9. Meanwhile, the Euro Stoxx 50 volatility index is lower over the morning, down -0.9% to 21.6, remaining below its LTA of 23.9.

Bonds: The UK 10-year gilt yield has softened +3bps to 0.60%, while the US 10-year treasury yield and the German 10-year bund yield are stable at 1.28% and -0.36%, respectively.

Currency: Sterling and the euro are currently $1.39 and $1.21, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.53% and 1.47% per annum on a five-year basis.

Baltic Dry: The Baltic Dry increased for the fifth consecutive session on Wednesday, up +17.5% to 1756, the highest it has been since 25th January 2021 and its largest daily increase since June 2020. The index is now just -5% below the four-month high seen in mid January 2021. Gains in the index have been buoyed by demand for both the panamax and capesize vessels, after the Chinese New Year. Yesterday, capsize rates increased +28.8% to a near three-week high, while Panamax rates were up +15.9% to their highest level in over ten years.

Oil: Both Brent Crude and the West Texas Intermediate (WTI) remain above $60 per barrel this morning, despite decreasing -0.1% and -0.2% to $64.30 and $61.02, respectively.

Loan Loss Provisions: In Q4 2020, Barclay’s loan loss provisions declined by nearly one fifth to £492 million over the quarter, lower than analyst expectations of £689 million and marking the second consecutive quarter of declines. Meanwhile, Santander’s loan loss provisions increased +3% to €2.6 billion over the quarter to Q4. For the full year, Santander’s loan loss provisions totalled €12.6 billion, while Barclay’s reached £4.8 billion.