What markets are saying about the US election

Joe Biden is within touching distance of the required 270 electoral votes to be declared victorious, however impending lawsuits and a divided Congress means markets are repricing from what was predicted by pollsters to be a ‘Blue wave’.

1 minute to read

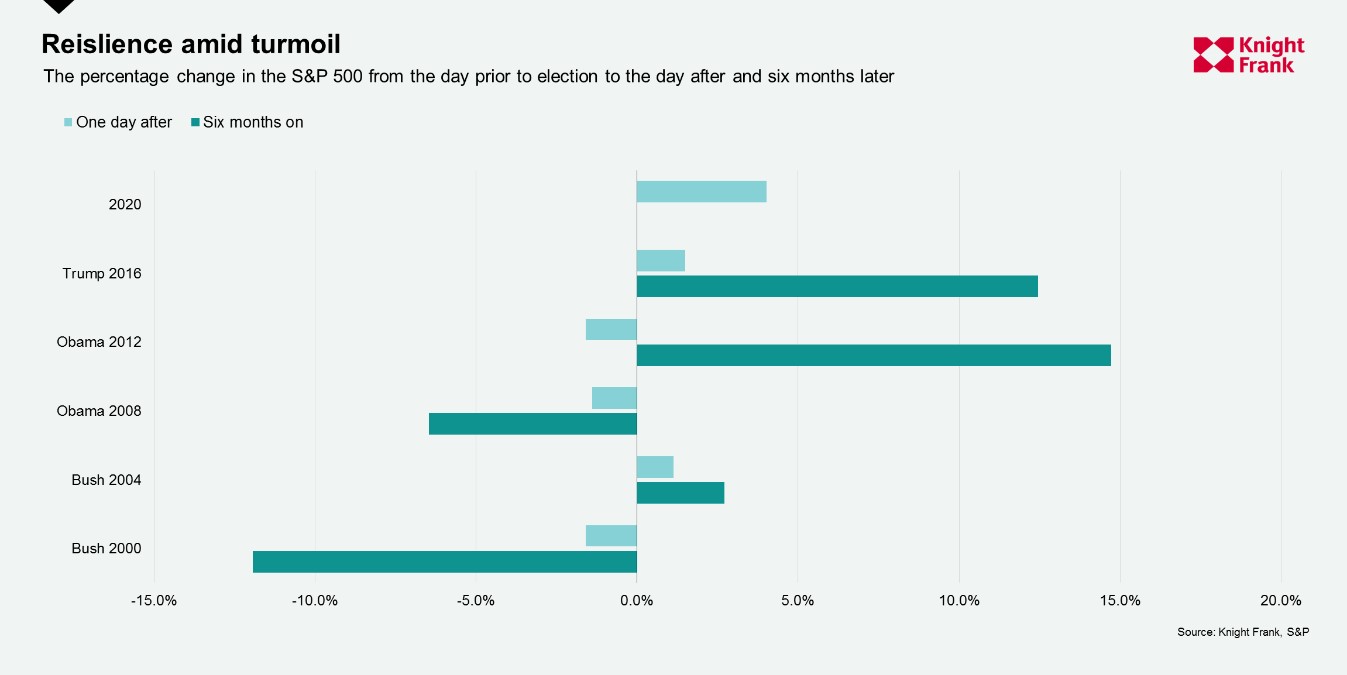

Despite the uncertainty and a divisive outcome, stock markets remain resilient. The S&P 500 climbed 4% between 2nd and 4th November, the most during any election period since the index’s inception. Much of the growth was driven by technology and healthcare firms, given a split Senate reduces the likelihood of major tax hikes or sweeping regulatory changes on these sectors.

The chart below shows how the S&P 500 performed between a day prior and a day after each of the last five elections, as well as a look at their performance six months on from the respective votes. The election in 2000 is of interest given the Florida recount that was ultimately brought before the Supreme Court. It’s now possible that scenario could be replicated in multiple states.

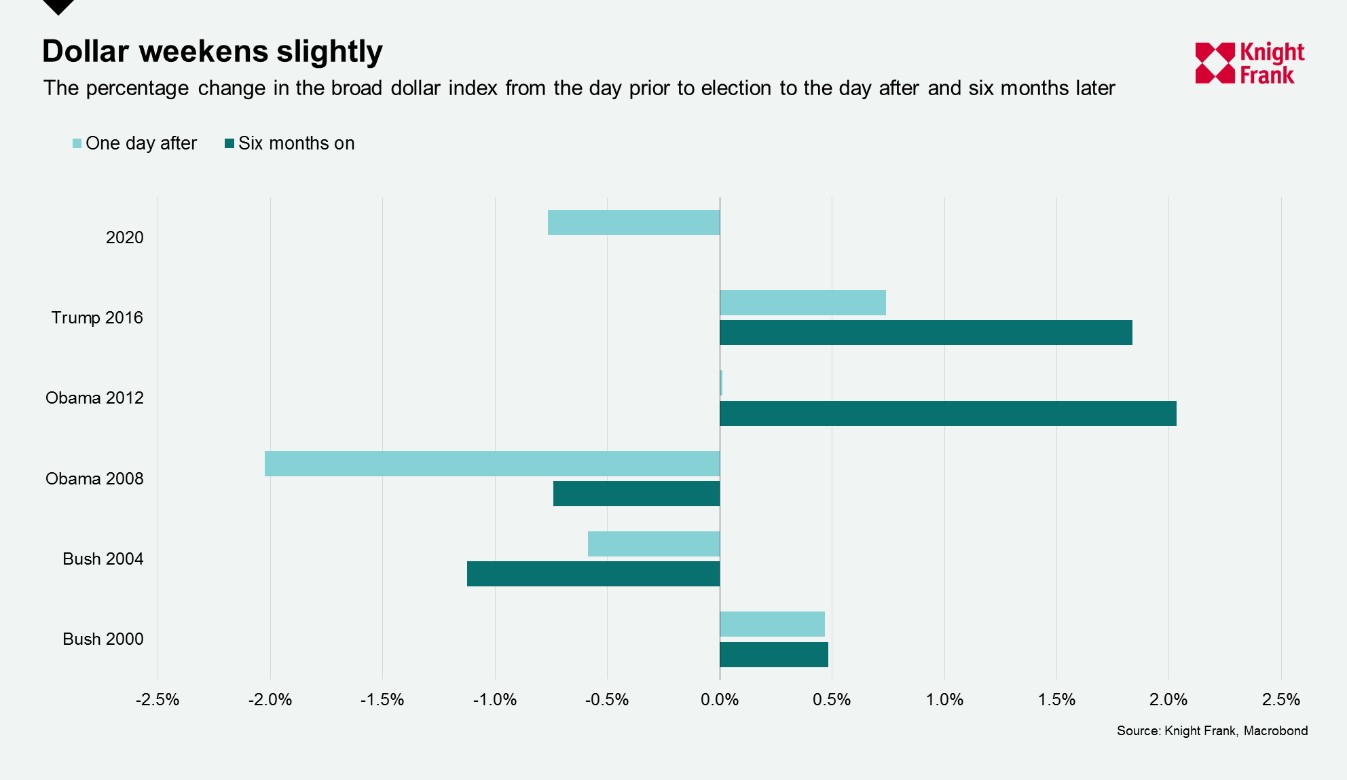

With an incoming divided Congress, hopes of a new multi-trillion-dollar stimulus package fell, which helped push Treasuries higher while weighing on the dollar. Between 2nd and 4th November, the dollar fell 0.8% against a basket of currencies, holding at around $1.30 against sterling and $1.17 against the euro. This comes on the back of around a 1% rise in recent weeks amid growing concern over rising Covid-19 cases and fresh round of lockdowns across Europe.

The reaction of the current President, the Republican Party’s legal pursuits, combined with Covid-19 reaching record high daily counts will likely keep markets volatile in the short term. Once a final result is recognised volatility may reduce, depending on the containment of the pandemic. That could lead to a stronger dollar, which in turn will result in substantial shifts in the buying power of international investors.

Main photo by David Everett Strickler on Unsplash