Prime London Sales Report: October 2020

Prime central London sales index: 5295.2Prime outer London sales index: 256.4

2 minutes to read

A second national lockdown in England is unlikely to impact the prime London property market as the first one did.

The property market will remain open during the month-long lockdown and momentum generated since the market re-opened in May will drive deal activity into Q1 next year.

Indeed, an analysis of exchanges that took place in October in London shows that only 36% arose from initial valuation appraisals that took place between June and September 2020. The equivalent figure was 32% in prime central London.

In other words, the majority of exchanges taking place are transactions that originated before the lockdown.

However, the large number of properties that have gone under offer since May is starting to translate into exchanges.

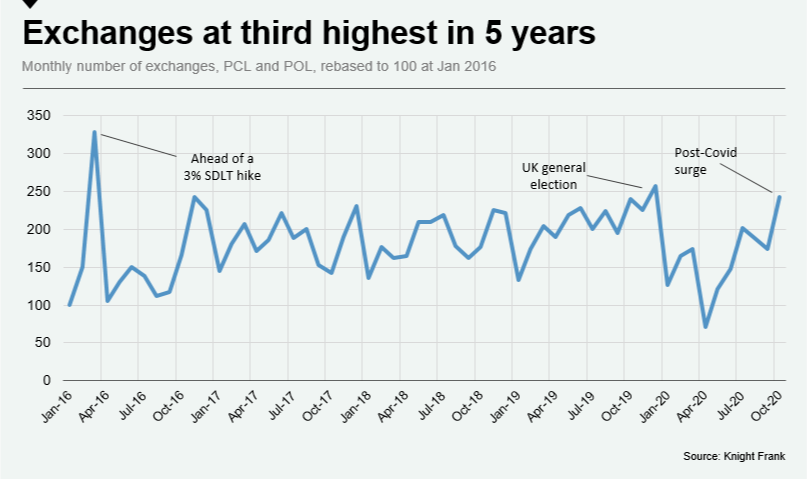

The extent of the post-lockdown surge means October was the third highest month in five years for exchanges in London. The highest number was recorded in March 2016 ahead of a stamp duty hike in April and the second highest figure was registered in December 2019, the month of the decisive UK general election result.

However, this surge should be seen in the context of a market that has behaved erratically over the course of this year. The overall number of exchanges was 19% down in the first ten months of the year compared to 2019, see chart below.

Meanwhile, prices have continued their upwards trajectory of recent months.

Quarterly growth remained at 0.2% in prime central London for the second consecutive month, meaning the annual decline held at -4.5% in October.

In prime outer London, prices rose 0.9% in the three months to October, which was the highest such rise in five years, as more buyers seek outdoor space and greenery.

For this reason, the largest quarterly rises in London took place in Belsize Park (3.2%), Dulwich (2.3%), Wandsworth (2.1%) and Wimbledon (1.8%).