Covid-19 Daily Dashboard - 14 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 14 September 2020.

Equities: In Europe, the FTSE 250 and the CAC 40 are up +0.2% over the morning, while the DAX and STOXX 600 are both flat. Stocks closed higher in Asia, with the KOSPI adding +1.3% on close and with year to date gains of +10%. The Topix (+0.9%), S&P / ASX (+0.7%), Hang Seng (+0.6%) and CSI 300 (+0.5%) also closed higher. In the US, futures for the S&P 500 are up +0.7%.

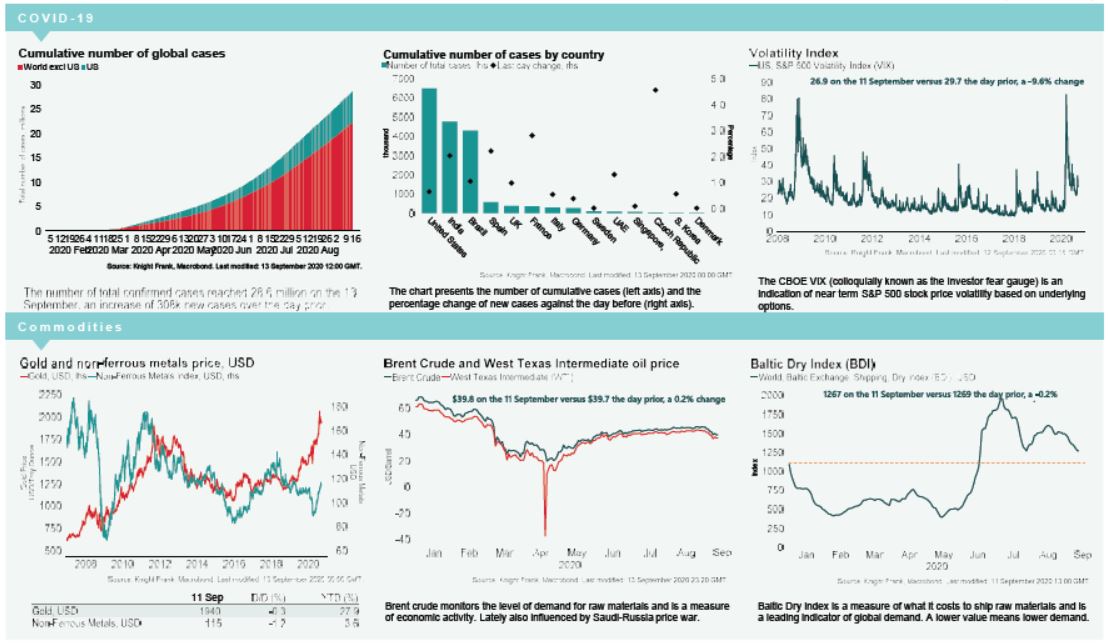

VIX: After decreasing -9.6% on Friday, the CBOE market volatility index is down a further -0.5% this morning to 26.8. However, this remains elevated compared to its long term average (LTA) of 19.8. In Europe, the Euro Stoxx 50 volatility price index is up +0.3% to 23.8, just below its LTA of 23.9.

Bonds: The UK 10-year gilt yield, US 10-year treasury yield and the German 10-year bund yield have all compressed -1bp to 0.18%, 0.66% and -0.50%. The Italian 10-year bond yield is down -3bps to 1.01%.

Currency: Sterling and the euro are currently at $1.28 and $1.19, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.32% and 1.14% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) remain below $40 at $39.46 and $36.97 per barrel. This comes as BP modelled three scenarios for global transition to cleaner fuels in the next 30 years. Its ‘business as usual case’ found that oil demand should rebound from the pandemic before plateauing in the early 2020s.

Baltic Dry: The Baltic Dry declined -0.2% on Friday to 1,267, bringing cumulative declines over the last 13 trading sessions to -16%. The index remains -35% down from the peak in July, albeit +16% higher than it was in January.

Lockdown: Israel is the first country to announce a second nationwide lockdown, which will commence on Friday and will last three weeks. Meanwhile in New Zealand, restrictions will be lifted across the country on 21st September, except for in Auckland.