The rebound versus the recovery – what’s the difference?

The rebound in economic activity is underway but a recovery may still take a significant amount of time.

2 minutes to read

Remaining realistic throughout market ups and downs and remembering there are opportunities in even the most uncertain times is imperative. Two things have really stuck with me in the past week, the first being the need to remember the important distinction between a rebound and a recovery, and the second is Churchill’s famous dictum "never let a good crisis go to waste."

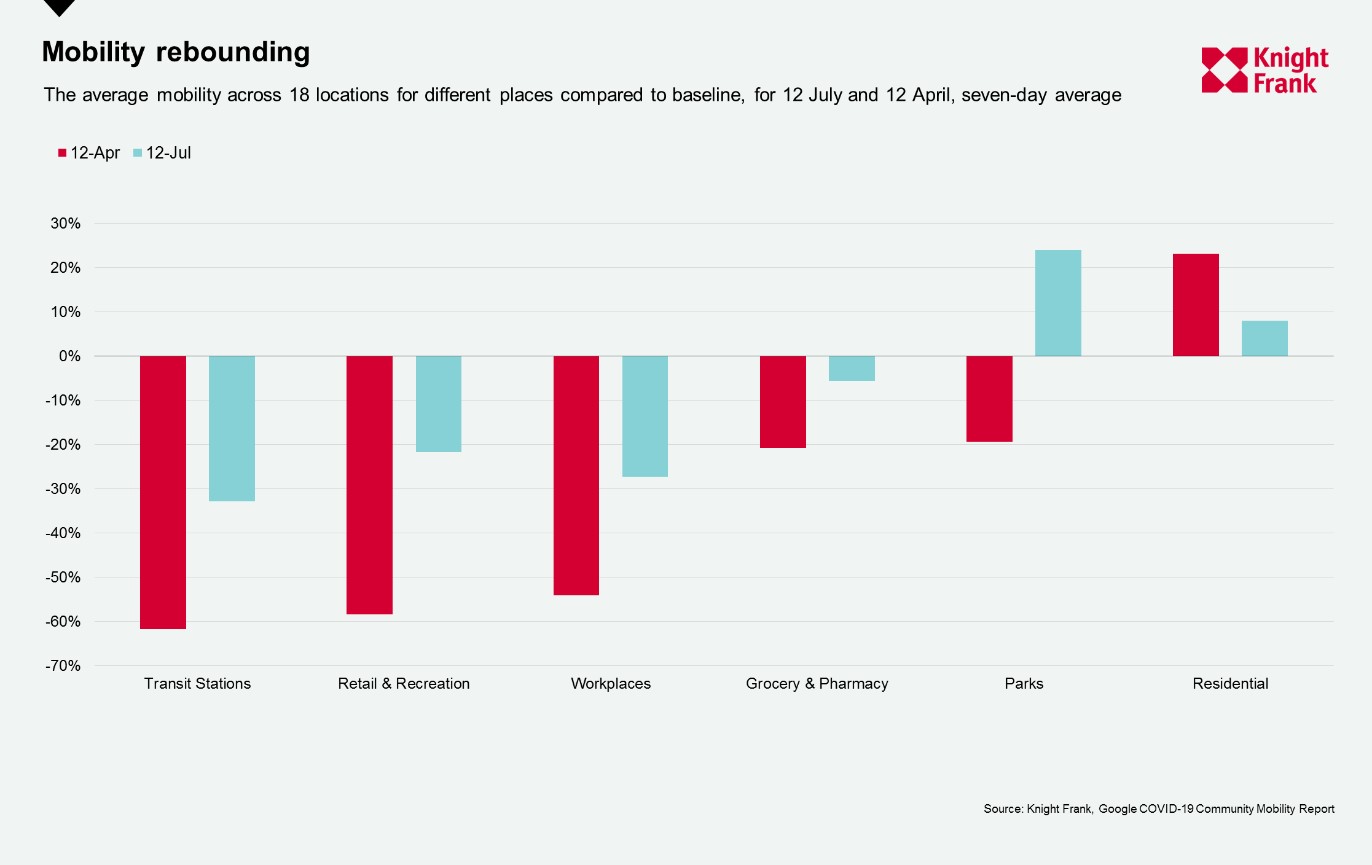

There is no doubt we are seeing a recovery in activity across key global economies. Populations are heading out and spending less time at home. Google’s mobility monitor* provides a window into this trend. Across workplaces in 18 world cities there was 54% less activity, compared to baseline, in the week ending 12 April, by the week ending 12 July this decline had halved to 27%.

However, a full recovery, a return to pre-pandemic levels of activity, may take much longer and indeed may require widespread treatment and/or a vaccine.

The need to monitor economic data closely was shown this week. The release of the UK’s GDP figures for May confirmed a 1.8% monthly rise, short of analysts’ expectations of a rise of around 5%. This result was disappointing, although the direction of travel is positive. We just need to be mindful that many UK retail and business premises outlets did not open until June, with hospitality only beginning to follow in July - June’s data may be more enlightening.

On the upside China's economy grew by an annualised rate of 3.2% in the second quarter of 2020, exceeding expectations. Although looking behind the data and it was driven by the industrial sector’s outperformance following massive government stimulus, whilst consumer spending remained subdued.

Churchill’s quotation was shown to full effect in a survey by UBS, released 13 July 2020, which showed that 79% of investors see volatility as an opportunity. By way of an example UBS said its wealthiest customers took out loans to place billions into stock markets as they slumped at the onset of the pandemic. They are now looking to move their cash out of equities after profiting from an unprecedented sell-off, a possible overreaction, and rapid rebound from March to May.

Acknowledging that some of what we are seeing is just short-term noise, and overreactions to the mixed messages we receive, is critical to developing investment strategies.

*Google’s COVID-19 Community Mobility Report analyses the how visits and time spent at different places change compared to a baseline. The baseline is the median value, for the corresponding day of the week, during the 5- week period Jan 3–Feb 6, 2020

Photo by Kyle Glenn on Unsplash