Pulse on the global economy – 19 June

To help cut through the noise we bring you a roundup of the latest news, emerging trends and forecasts across the global economy and asset classes and how this is impacting residential markets. This week we re-examine the great alphabet debate and take a look at central bank action.

3 minutes to read

Morgan Stanley this week released their mid-year outlook which reignited a call that the global economy would experience a V-shaped recovery “[we] have greater confidence in our call for a V-shaped recovery, given recent upside surprises in growth data and policy action.” Earlier in the year they released a note saying they expected a recession ‘sharper—but shorter—than the Global Financial Crisis (GFC)’.

Whilst their note is optimistic, others point towards a bleaker outlook. The IMF is due to update its World Economic Outlook on 24 June with managing director Kristalina Georgieva saying that the Fund was "very likely" to revise downward its forecast for a 3% contraction in global GDP in 2020.

US Federal Reserve chair Jay Powell struck a cautionary note in his semi-annual monetary policy report testimony before Congress amid a rising number of cases across some states. He has also stated a commitment to not raise interest rates until at least the end of 2022 – meaning that record low borrowing rates are here to remain for the foreseeable.

A raft of data came from the UK over the past week with GDP declining 20.4% in April, worse than expected, following a fall of 5.8% in March. CPI inflation slowed from 0.8% in April to 0.5% in May, its lowest rate since June 2016. The UK’s labour market saw differing data releases with the claimant count measure of unemployment indicating a rate of 7.8% in May, whereas the ILO unemployment rate remains near its 45-year low of 3.9%.

Job numbers around the world seem a little more positive following the surprise in the US figures last week. The ABS and ATO payroll data suggest employment in Australia turned a corner in May, with the number of jobs increasing by 1% over the month.

Another note of positivity is the speed of consumers returning to ‘normality’ in the US with retail sales rising by a record 17.7% in May (-6.1% yoy), the biggest monthly gain on record and more than double economists’ expectations of an 8.2% increase. This follows a pick-up in mobility across European countries in particular as we covered in Tuesdays blog.

Whatever it takes

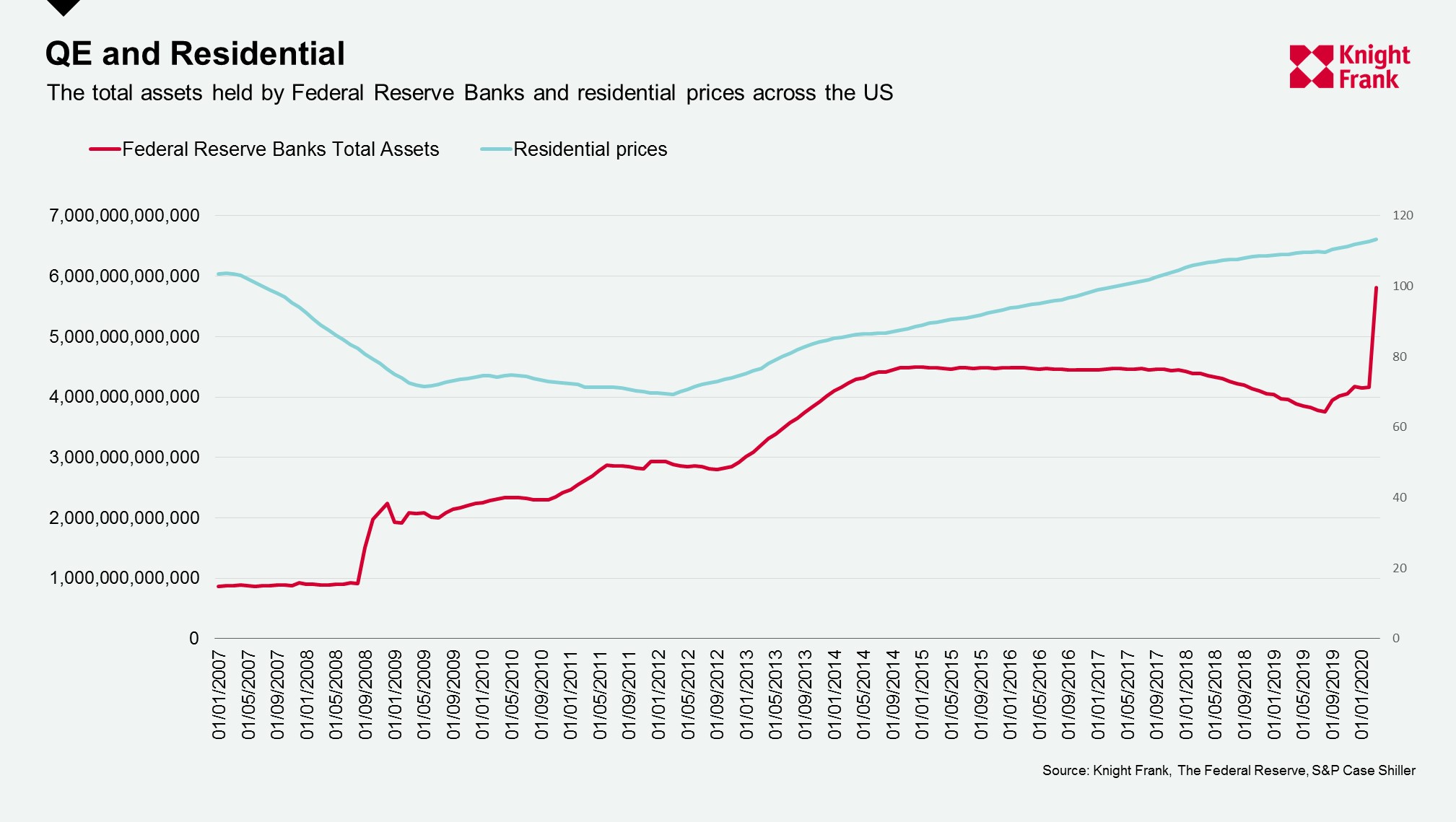

A few months ago I wrote about government and central bank action and how they have pledged to do ‘whatever it takes’ to help prop up the economy. If we look at the assets on central bank’s balance sheets we can see they are firing on all cylinders. In the two months since 23 March the assets at The Federal Reserve have jumped by $1.8 trn, compared to $1.2 trn in the two months after September 2008. The Bank of England, where we look at three weekly measures of Long-Term Operations, Loan to Asset Purchase Facility and Loan to Covid Corporate Financing Facility has pumped in almost £162 bn, they committed yesterday to a further £100bn in bond buying.

Central Banks had never really tapered since the massive rounds of quantitative easing, QE, that came in the wake of the Global Financial Crisis (GFC), the Federal Reserve balance sheet before the pandemic was still almost five-times what it was before the GFC, The European Central Bank‘s (ECB) assets were 2.5 times bigger than pre-GFC.

The rise is unsurprising given the amount of government debt being issued as the fiscal pledges continue. This level of QE, and corresponding lower interest rates, has impacted on residential markets before. The chart below shows The Federal Reserve’s total assets and US residential prices, rebased, which shows a strong correlation. The continuation of this along with the sustained low rates could support residential markets in many economies.

Next week we will check in with the updated forecasts from The IMF and see if there are any more surprises in data released.