Global City Economic Watch Tuesday 23rd June

As large-scale quarantine measures continue to be lifted globally, we are providing a weekly glance at different real-time indicators to assess the level of economic activity in cities and to understand how much closer to ‘normality’ they are.

3 minutes to read

Generally, cities are continuing their gradual return to normality as restrictions on movement and businesses are lifted, though concerns over a ‘second wave’ remain.

New York entered the second phase of its easing plan yesterday, Spain reopened its borders to EU and UK citizens on Sunday and Boris Johnson will unveil the next phase for the UK this week. However, the looming threat of second waves and a resurgence of cases in Beijing has seen activity indicators fall. Below we outline the data.

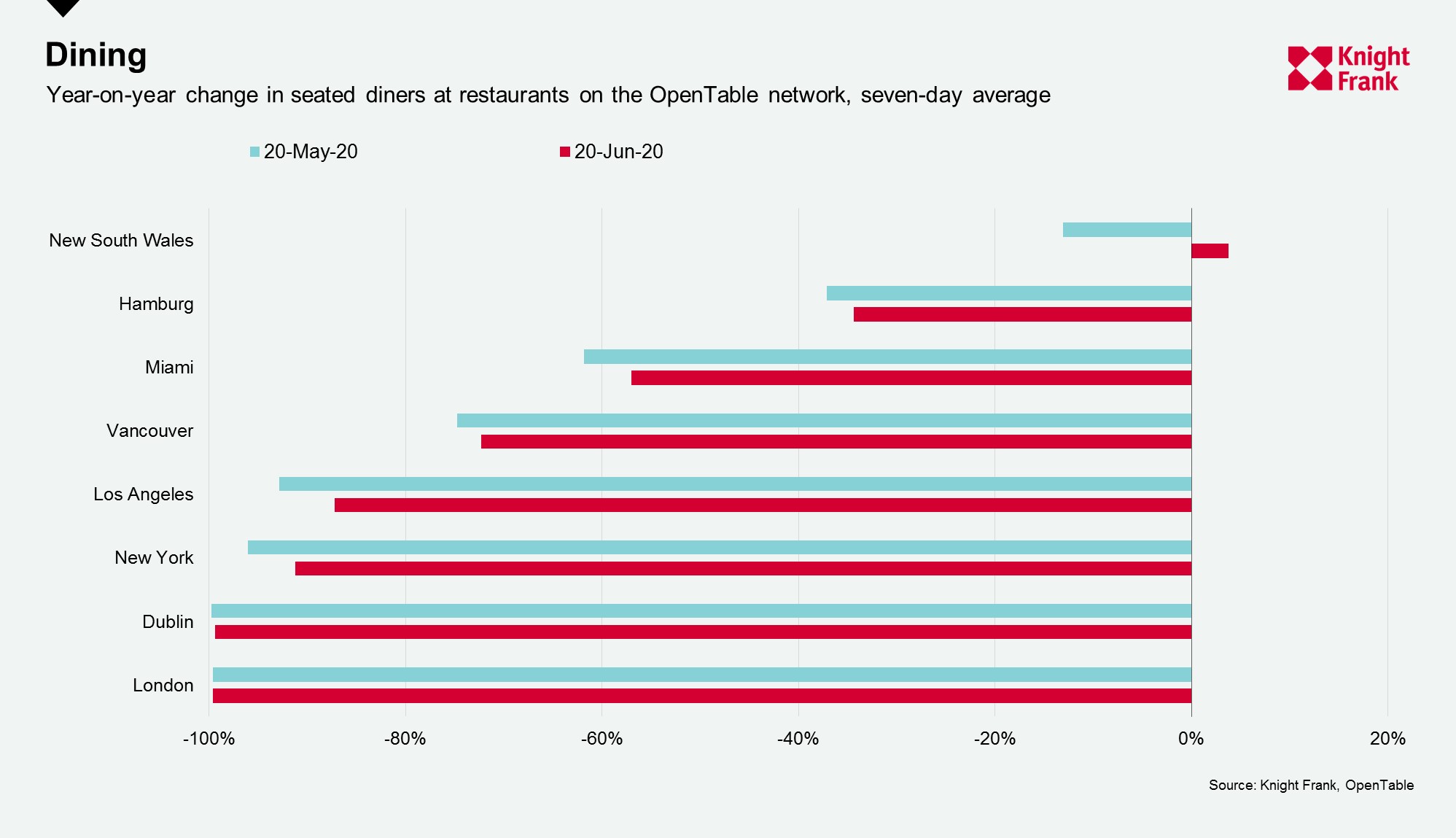

This week we begin with restaurant bookings, as per the OpenTable network. Perhaps the most eye-catching figure comes from New South Wales, where bookings for meals out surpassed levels seen the same week in 2019. Whether this is reflective of an initial release of pent-up demand or an increased willingness among diners to regain ‘normality’ at a faster pace than expected, will be one to watch over the coming weeks and months.

However, NSW appears to be an outlier, with restaurant bookings in many locations still remaining significantly down on 2019 levels. In some locations, such as the UK, this reflects the fact that much of the hospitality sector remains closed.

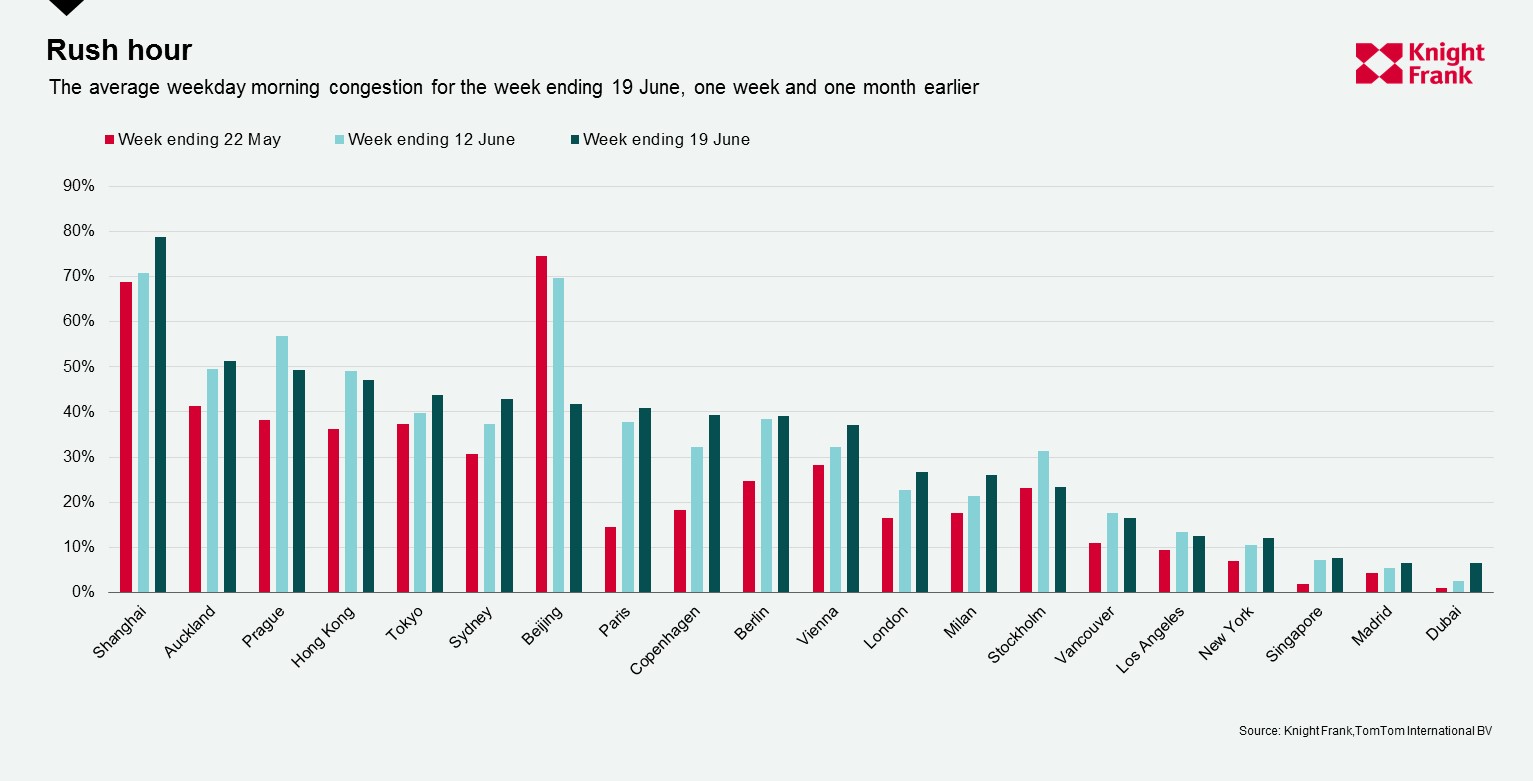

One area that has seen a consistent tick-up in activity, is transport, with data from TomTom**, suggesting that traffic congestion is edging closer to normality. Across the 20 cities we track, the morning rush hour traffic was just 25% below 2019 averages last week, compared to 32% below four weeks ago.

Three-quarters of the locations we track saw their congestion increase week-on-week led by Shanghai (+8%), Copenhagen (+7%) and Sydney (+6%). Four locations sit within 10% of their 2019 average: Vienna, Prague, Copenhagen and Hong Kong.

The fragility of the recovery was highlighted in Beijing, where average congestion dropped to just 42% of the 2019 average from 70% a week earlier as some regionalised lockdowns were reinstated following a rise in cases. Stockholm and Prague also saw their average decline but by a more modest 8% and 7% respectively.

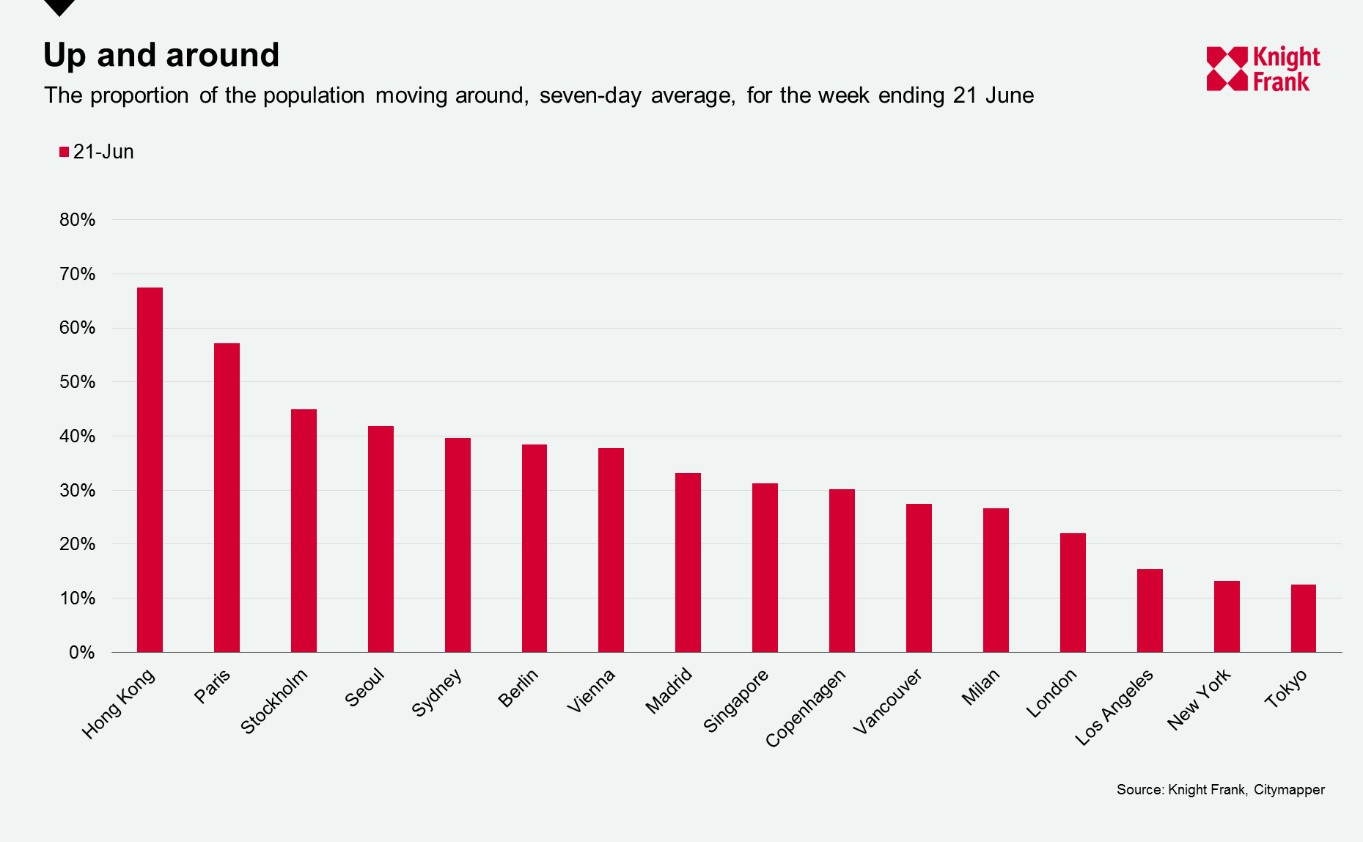

Looking at a broader measure of population mobility, the Citymapper Mobility Index*, which looks at population mobility compared to usual, pointed to an increase in mobility in all locations tracked, with the exception of Stockholm over the past week, although Stockholm is still the third most mobile city.

Singapore saw the biggest increase in mobility as restrictions were lifted over the weekend, with 31% of the population mobile, up from 21% the previous week. Paris, with 57% of the population now mobile compared to normal, was once again near the largest risers and is firmly the second most mobile city – demonstrating the return to normality after President Macron removed most of the remaining measures last week.

Despite still being the three least mobile cities, Tokyo, New York and Los Angeles saw a rise of 5% and 1% for the two US cities over the past week, we would expect to see New York’s mobility increase as they enter phase two this week.

Next week we see what impact the opening up of borders is having on air travel and where the population is spending their time with Google’s COVID-19 Community Mobility Report. We will also continue to monitor other high frequency indicators such as box office takings as these establishments start to reopen.

Notes on methodology

*The Citymapper Mobility Index looks at the percentage of the population moving compared to a recent typical usage period, they do this by comparing trips planned in the Citymapper app to a recent typical usage period as trips planned are correlated to trips taken.

**The congestion level looks at how much longer a trip would take compared to baseline, e.g. a level of 53% means that a 30-minute trip will take 53% more time than it would during baseline uncongested conditions.