Regional retail investment opportunities on the High Street: Knight Frank's top billed towns

The majority of investor requirements are focussed on well-configured units in the top South East towns and top 10 regionally dominant centres. Buyers of prime high street retail are attracted to strong re-let prospects to solid covenants with high residual values and limited (if any) capital expenditure required.

2 minutes to read

However, buying off ca. 4% NIY with limited rental growth prospects (in the short term) is a little uninspiring for some property companies and funds.

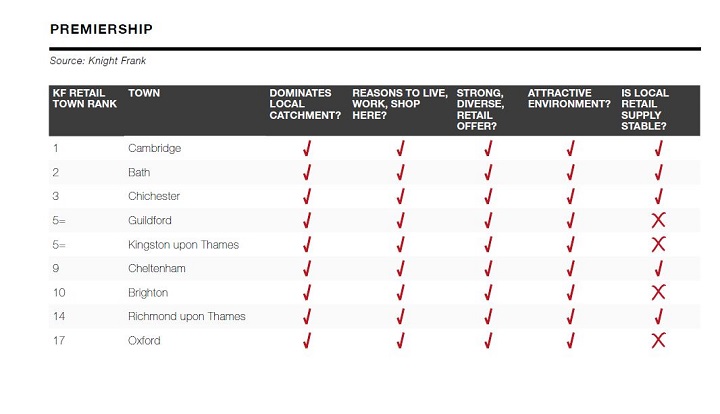

We currently see value in a small but select group of “Good Secondary” towns, which perhaps fly under the radar of a number of active buyers, but offer a very attractive discount to prime of circa 200 basis points at 6% NIY. Our Retail Ranking table highlights a number of these towns, which we view as highly investable for the right asset.

Knight Frank Top Picks – Premiership:

Cheltenham – The John Lewis factor should increase spend in the town and a slight yield discount compared to other highlighted towns.

Brighton – Improving town with anticipated growth.

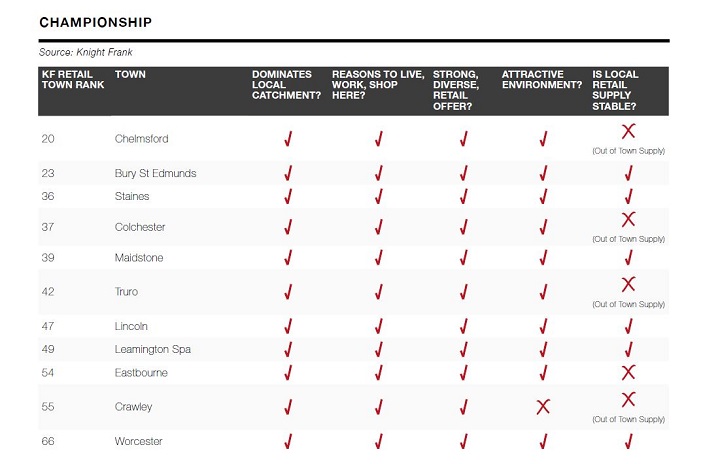

Knight Frank Top Picks – Championship:

Eastbourne – New shopping centre extension and improved A3 offer will improve town’s standing.

Worcester – Refusal of consent for Worcester Woods Retail Park will give occupiers and investors greater confidence in the town.

Staines – May be a surprising choice, but we are fans of a number of London suburbs which we will explore further in further posts.

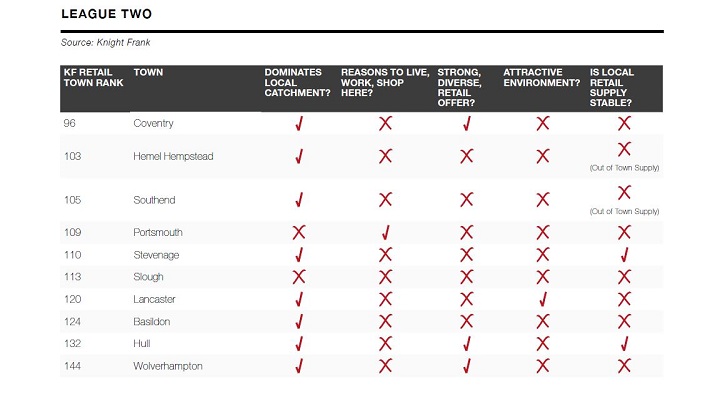

The League Two towns are some examples of historically “institutional” locations which now underwhelm on most measures. Can an investor be confident of maintaining income levels in these towns? Are these high streets ever going to attract institutional demand again? Our experience of selling assets in these towns has shown that there is still investor appetite for these locations if sensibly priced, but perhaps an early exit is the safest policy.

Conclusion

The high street is not dead, but it is challenged. We have seen that high street retail has plenty of merits for a variety of investors, particularly due to its liquid nature.

However, town selection will become increasingly important going forward as shopping habits evolve and dominant popular centres continue to strengthen, to the detriment of nearby weaker towns.

Some high streets are rising to the challenges better than others – the art is separating the wheat from the chaff.