Changing channels: the constituent parts of the grocery market continue to shift

Big boxes, supermarkets, c-stores, discount stores, online, foodservice and wholesale – the constituent parts of the grocery market are subject to very different dynamics and growth trajectories.

2 minutes to read

To paraphrase Mark Twain, reports of the death of the grocery superstore have been greatly exaggerated.

Changing consumer patterns and a shift from destination, one-stop shopping towards more frequent, lower basket size convenience shopping prompted many to proclaim c-stores as the channel of the future. Coupled with the inexorable rise of the discounters and growth in the online channel, many predicted the demise of grocery big boxes.

Nothing could be further from the truth. Superstores and supermarkets remain the mainstay of the UK grocery market and while many big boxes have faced major challenges in recent years, the mindset of the major operators has been to fix rather than forego.

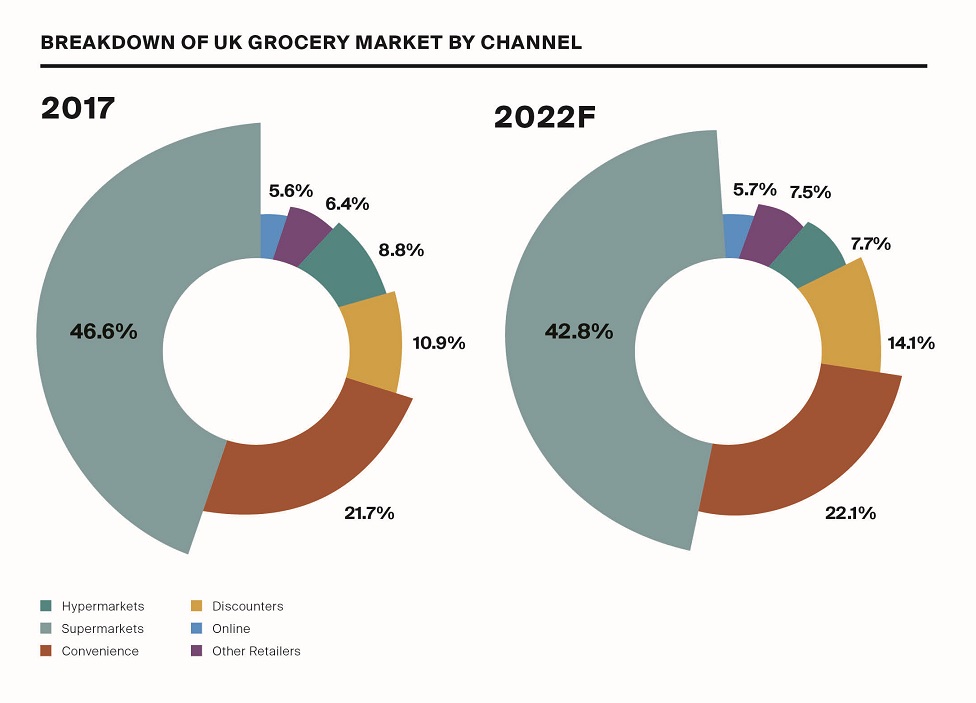

After all, figures from industry body IGD suggest that hypermarkets (8.8%) and supermarkets (46.6%) collectively still make up 55.4% of all grocery sales in the UK.

The corresponding figures for profit are sadly not available, but would unquestionably be much higher – we would tentatively estimate at least 80%+, possibly even 90%+.

Given their more holistic role as the backbone of other retail channels such as online grocery, the enduring importance of big boxes to the Big Four should never be questioned.

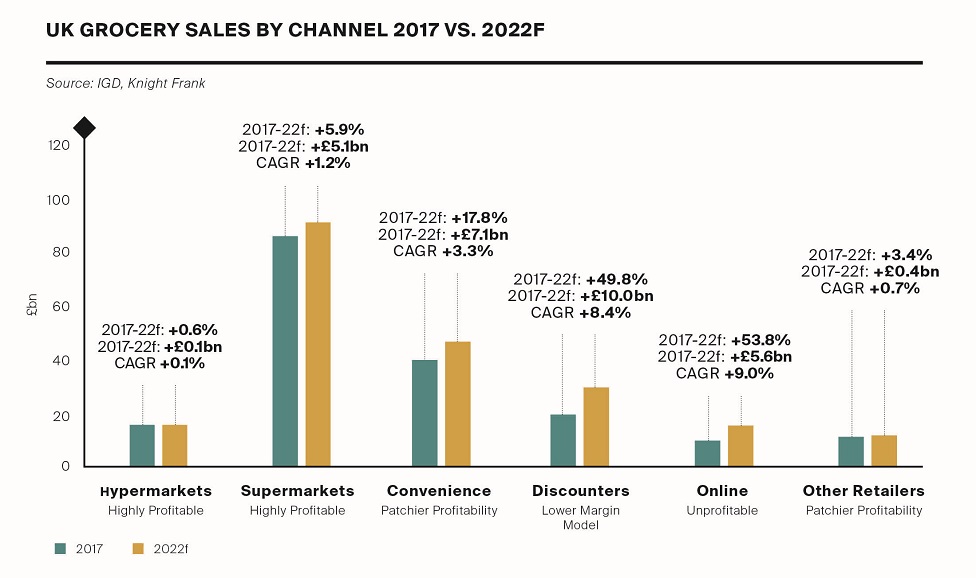

Other grocery channels may promise more seductive top line growth. C-store sales are forecast by IGD to grow by 17.7% over the next five years. The discount channel is forecast to grow by 49.8% over the same period, while online eclipses both at 53.8%.

But these figures need to be put into context. None of these channels come close to big boxes in terms of profitability and each is subject to its own particular headwinds. The c-store market has matured dramatically and is hugely competitive in its own right.

The discounters are increasingly having to contend with the prospect of sales cannibalization. Online is unlikely to be fully profitable until delivery costs are fully recouped from the customer.

The Big Four especially are active across a multitude of these grocery channels. As a result, there is considerable blurring between channels. The challenge is not to be a master of one, but to seamlessly integrate all channels under a wider ecosystem.