Is the US soft landing morphing into a hard landing?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Global governments were arguably too slow to raise interest rates as inflation spiked, have they also been too slow in cutting?

That question is key to a deepening rout in global stock markets. Very weak jobs numbers from the US on Friday rattled markets that were already skittish. Reports from companies including McDonalds, Hershey and Colgate that have contained hints that the US consumer might be in worse shape than previously thought. Is the soft landing morphing into a hard landing?

Perhaps, but deeper analyses of the jobs figures by various commentators have suggested that the slowdown might be a continued normalisation of distortions that arose during the pandemic rather than anything more worrying. Still, Goldman Sachs economists on Sunday increased their probability of a US recession in the next year to 25% from 15%.

Knock on effects

Mortgage rates hovering below 7% have throttled activity in the US housing market. Inventory levels were a third below the five-year average nationally and down by more than 50% in markets like New York when we went to print with our US Residential Market Insight report last month.

The combination of economic growth, rising wages and tight stock levels left room for a further uptick in house prices, but any cracks in the economy that prompts a faster cutting cycle does change the picture.

It's possible that the more rates fall, the more buyers will be coaxed into moving, and a corresponding swelling of stock levels could release some of that upwards pressure on values. An alternative view would be that mortgage rates will fall, but remain too high to coax meaningful numbers into parting ways with their lower rate. Then we're left with a larger injection of demand from lower mortgage rates without a significant rise in inventory. The scenario we see will depend on how the Federal Reserve responds to the next rounds of labor market figures.

As Bloomberg notes, futures traders are pricing in roughly the equivalent of five quarter-point cuts through the end of the year, indicating expectations for unusually large half-point moves over the course of its last three meetings. Downward moves of that scale haven’t been enacted since the pandemic or the credit crisis.

UK mortgage rates

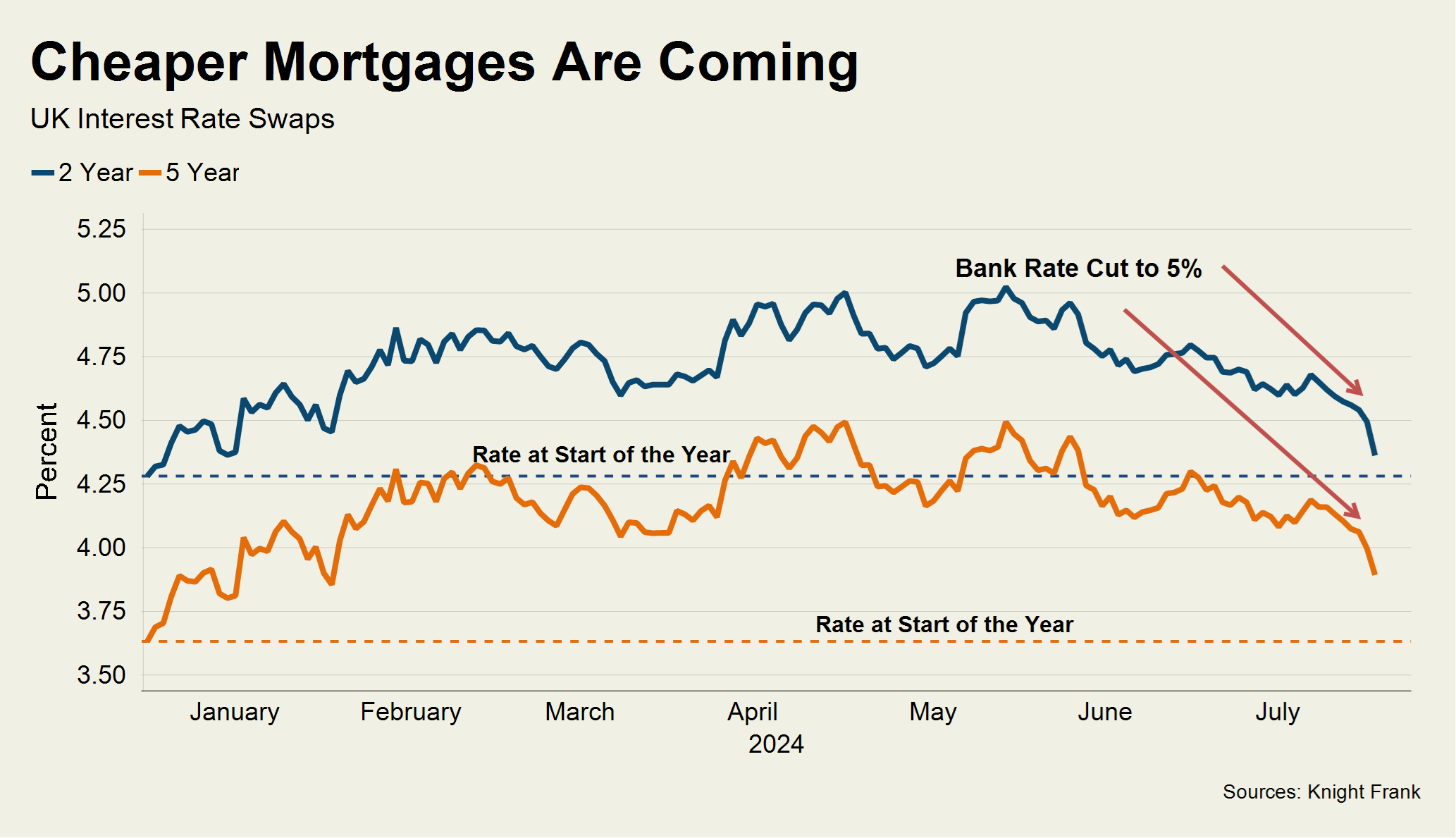

Five-year interest rate swaps fell convincingly below 4% when the Bank of England's cut was announced on Thursday (see chart), meaning more fixed-rate mortgages starting with a ‘3’ are on the horizon - see this morning's update from Tom Bill for more.

'When' remains the key question. The lenders will at some point opt to rebuild margins that have been cut thin during a two-year battle for market share. It's possible they begin that process now the Bank of England's cutting cycle has started, but recent behaviour suggests it's unlikely. The banks are well behind on their mortgage lending targets and will likely race to make up for lost ground.

It's been a quiet summer so far. The amount of offers made across the UK in June and July was the lowest in a decade, Knight Frank data shows. That includes 2020, as the market was re-opening after Covid, and 2016, the summer of the Brexit referendum.

M25 offices

Activity in the first half of 2024 has demonstrated that occupiers in the M25 & South East office market are bringing requirements to market with a growing certainty of their future space needs. Seven transactions above 50,000 sq ft have been completed in the first half, compared to zero in 2023 and a long-run average of four, according to a new Knight Frank market report.

Significantly, two additional deals above this threshold were under offer at the close of Q2, and 30 requirements were active. The upturn in larger requirements indicates an occupier's stance moving from 'just enough' to one that includes expansionary space.

Prime yields were unchanged at 7% at the half year mark. Investment volumes hit £758 million, 19% below the same period a year earlier. However, that figure isn't indicative of the improving

sentiment and uptick in activity that the teams are seeing. H1 2024 investment volumes marked a significant increase of 108% from H2 2023. In terms of deal numbers, 50 transactions were

completed during the period, well above the 10-year average of 44. Private investors and Property Companies accounted for two-thirds of investment volumes.