Global Residential Outlook - 18 June 2020

A roundup of the latest data and insight on key global residential markets

7 minutes to read

Residential digest

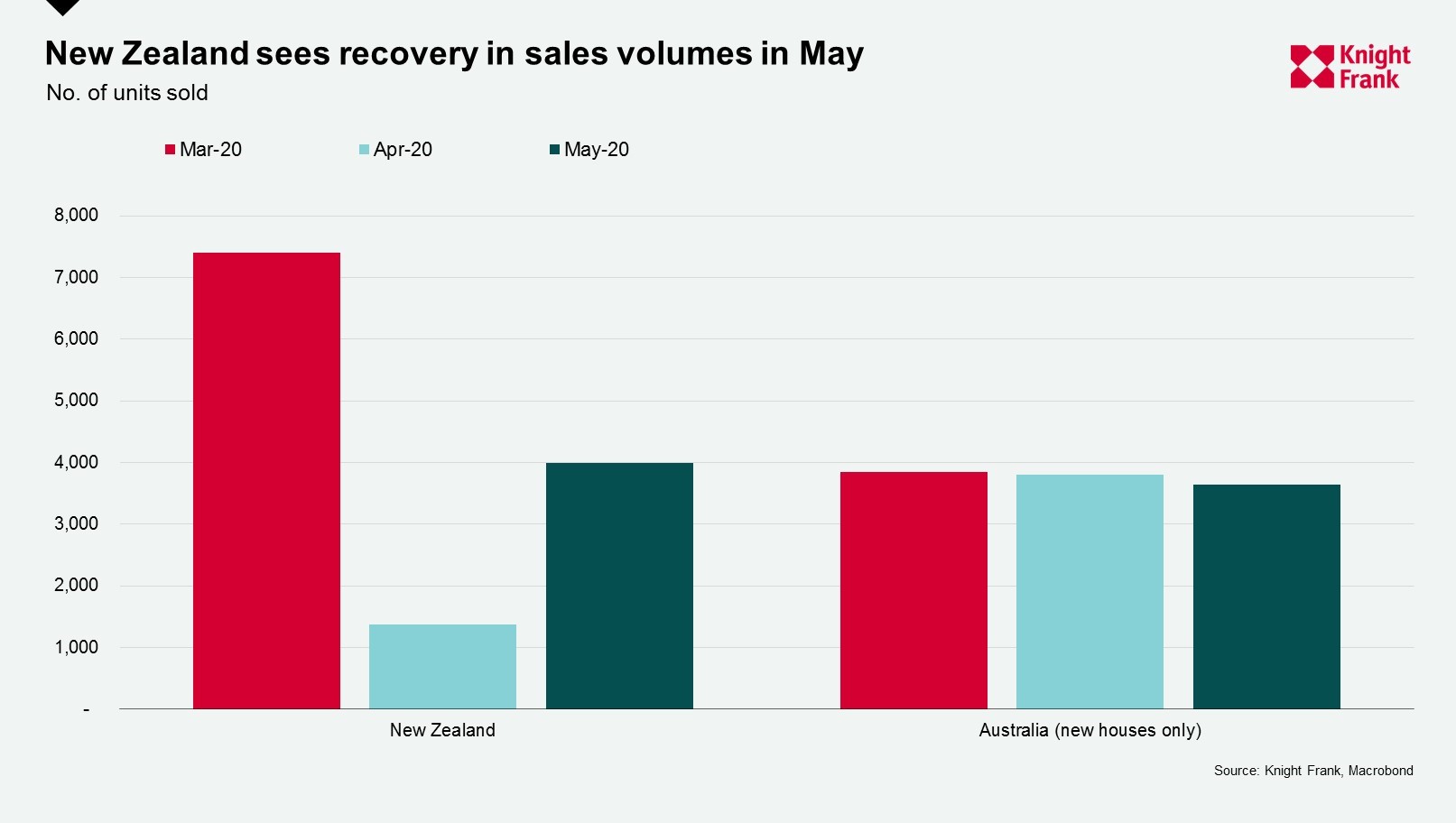

Several markets have now reported sales data for May. Alongside the figures we shared last week for Vancouver, Toronto and Hong Kong, new data has been published for New Zealand and Australia. New Zealand saw sales numbers rebound from 1,371 sales in April to 3,990 in May, a rise of 191%, whilst data from the Australian Housing Industry Association (HIA) shows new house sales in Australia were resilient over the three-month period.

Need to know

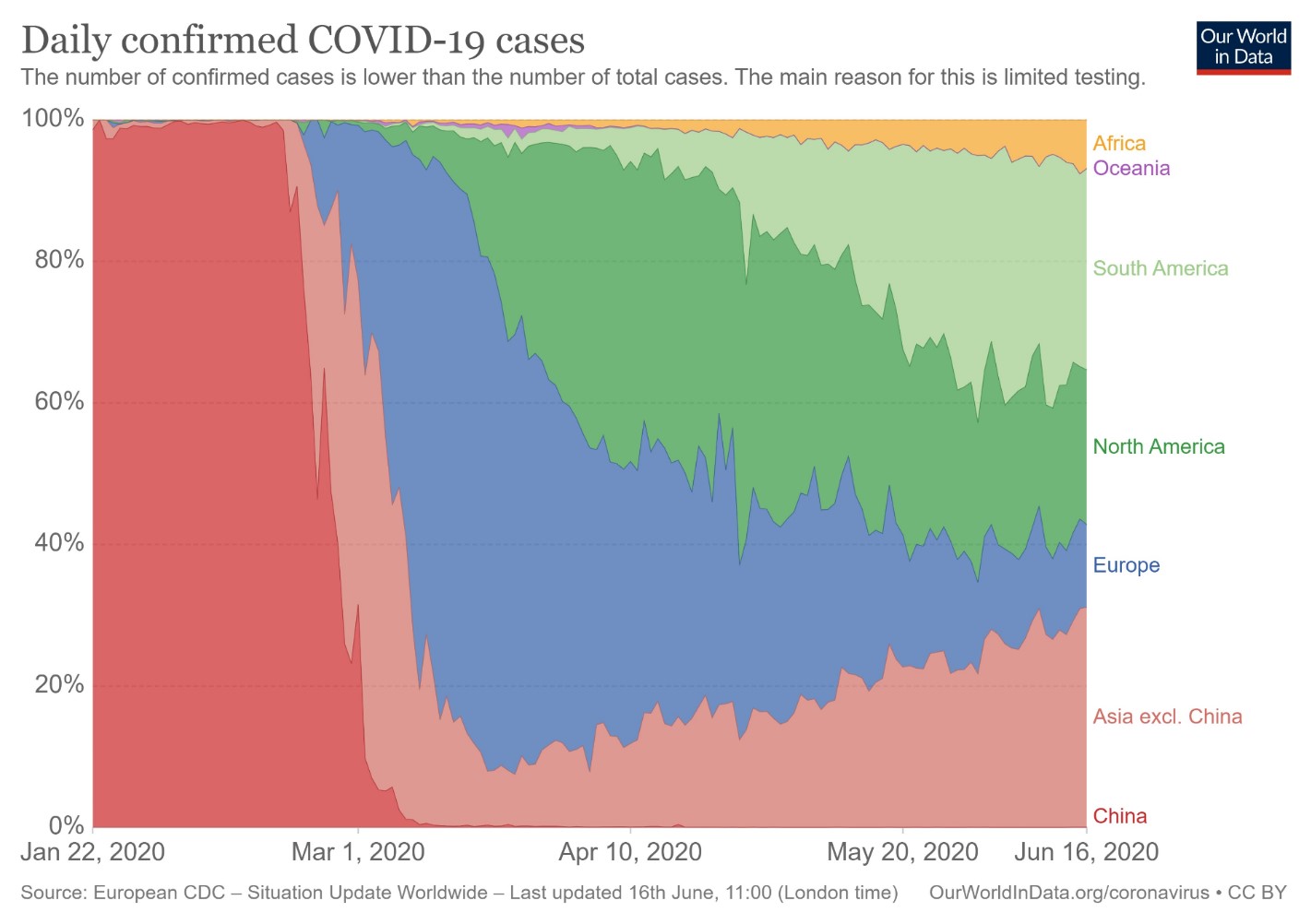

In the last week the number of global Covid-19 cases jumped from 7 million to 8 million. Asia now represents approximately 30% of the global daily incidence, up from 15% in early May. South America accounts for 28% of the global incidence and Europe 12%. Beijing and southern and western states in the US have seen a resurgent number of cases in the last week.

This week marks a milestone in Europe with nine countries, including Germany, France, Greece, Belgium, Switzerland and the Netherlands, opening their borders to other EU nations. Italy and France look to be moving quicker than their European neighbours. President Macron announced in a televised speech to the nation on Sunday the lifting of most of France’s remaining coronavirus lockdown restriction with bars and restaurants now able to serve diners indoors,in line with social distancing rules.

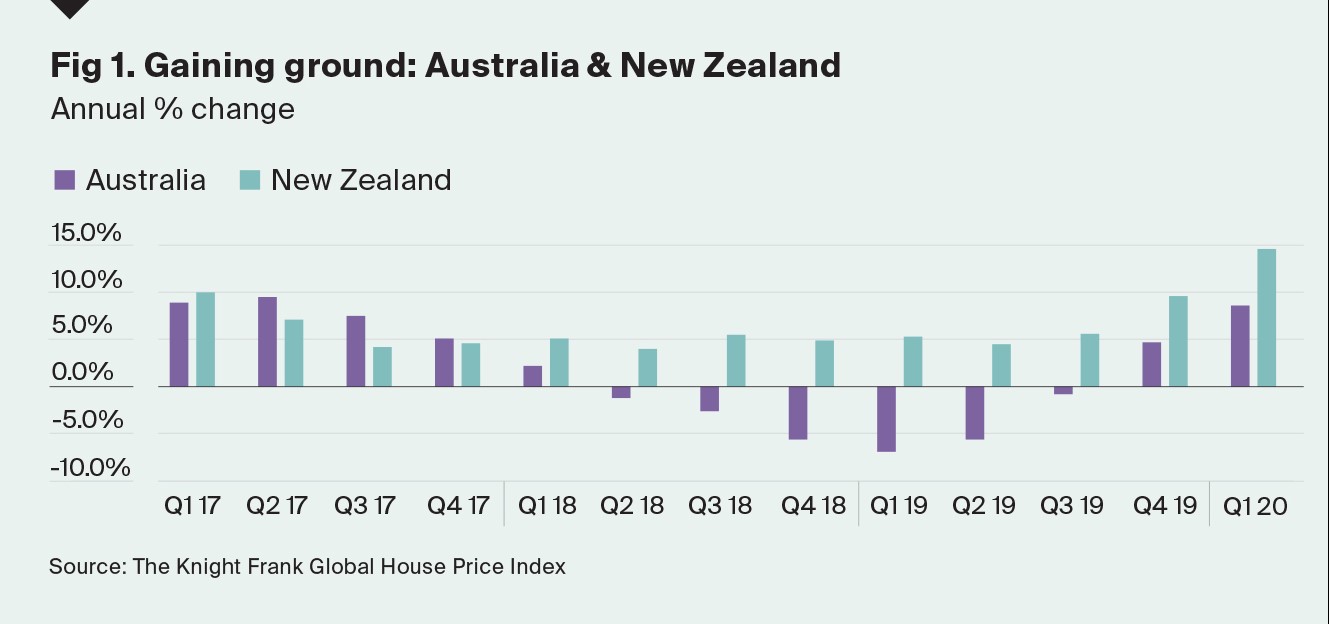

Knight Frank’s Global House Price Index, which tracks the movement in mainstream residential prices, confirms that prior to Covid-19 housing markets were in rude health with only one of the 56 countries and territories tracked (Finland) seeing an annual decline in prices. We expect the pandemic to hit sales volumes harder than prices, but it is likely to be Q2 or Q3 before the true impact on prices is known. That said, it is unlikely that sellers will lower asking prices significantly given low interest rates and the introduction of mortgage holidays across most advanced economies which will help prevent widespread distressed selling.

My colleague Flora Harley’s weekly look at global real-time economic indicators reveals European cities are seeing the largest improvements with Paris, Prague, Vienna, Milan and Madrid representing the top five performers - although lockdowns here were some of the strictest. Seoul and Hong Kong are the cities closest to “normal” levels of activity, but they are now joined by Prague, Stockholm and Sydney where restrictions continue to be relaxed.

Europe

Despite the opening up of key borders across Europe and the partial resumption of flights by operators such as Easyjet, there remain some anomalies. At present, Portugal is accepting arrivals from most of the EU, but not Spain — and some countries, such as Malta, are still closed. The land border between Portugal and Spain remains closed until 1 July, but air travel is permitted from 15 June. A full country-by-country breakdown is available here.

In Portugal, the investment landscape is shifting with changes to both the Golden Visa and Non-Habitual Residents (NHR) tax announced this year. For non-EU investors seeking residency and a foothold in Lisbon there is a window of opportunity before new legislation takes effect, however, Covid-19 may delay matters.

In Spain, online viewings increased 8% between April and May, confirming the trends outlined in our joint release with Rightmove. The Private Rented Sector (PRS) in Madrid and Barcelona continues to attract private and institutional investors with rents registering a 3% increase in the year to March 2020 according to our latest Spain PRS Snapshot.

In the UK, non-essential shops reopened on Monday and the government is reviewing the 2-metre social distancing rule with an announcement expected on or before 4 July. The Prime Minister has announced a Brexit deal could be done in July. Formal discussions will resume on June 29 in what has been described as a more concentrated format than the previous series of talks.

Data for the first week of June shows offers accepted by Knight Frank’s country homes team reached a record high whilst the number of new applicants in London was 54% ahead of the five-year average. Tom Bill looks at why buyers and sellers will need their wits about them when navigating the UK economic and housing market data that is emerging. Whilst the backward-looking data paints a bleak picture, the real-time figures provide a dose of positivity.

Asia Pacific

This week Justin Eng analyses population mobility across Asia to establish which markets are recovering fastest with the data revealing that New Zealand, Malaysia, India and the Philippines are closest to normal levels.

In Singapore, with the strict circuit breaker having ended on 1 June, the city-state is moving to phase two this weekend, allowing businesses and social activities to resume. Shops and restaurants can reopen with social gatherings of up to five people also permitted. The latest data on new homes sales suggests the market is starting to recover with 484 new homes sales agreed in May, up 81% from April’s figure of 267.

Australia and New Zealand continue to ease restrictions. In Australia, outdoor venues such as sports arenas are now open and allowed to sell 25% of seats. Most intra-state borders are due to open in July. Plus, Prime Minister Scott Morrison has announced a joint federal and state government effort to fast track the approval process for 15 major infrastructure projects, including the Brisbane-Melbourne inland rail project. The 15 projects will require AU$72 billion in public and private sector investment and will create an estimated 66,000 jobs.

A chart taken from our Global House Price Index highlights the extent to which both markets were seeing prices accelerate prior to the pandemic with mainstream prices up 9% Australia year-on-year and by 15% in New Zealand over the same period.

The states of New South Wales (NSW) and Victoria are reportedly considering an ‘‘opt in’’ land tax model, where future home buyers would be given the choice to pay a large one-off stamp duty (currently AU$40,000 in NSW and AU$55,000 in Victoria for a AU$1 million home), or opt to pay land tax of a few thousand dollars each year based on the value of the property’s unimproved land.

US & Canada

Brokers in the US are hoping that the confidence displayed by consumers in the US retail sector last week is mirrored in house buying sentiment. Retail sales rose by 18% month-on-month in May, the best rate since records began in 1992, suggesting that in some respects the world’s largest economy is recovering faster than expected.

However, Federal Reserve Chair Jerome Powell struck a cautionary tone as news emerged that infections hit record highs in six US states as they continued to unlock. Federal Reserve officials predict that interest rates will remain close to zero until at least the end of 2022 and an additional fiscal stimulus package, on top of the $3 trillion already approved is being considered.

US mortgage applications continue to track higher according to the Mortgage Bankers Association. Total mortgage applications rose 8% in the week ending June 12. Purchase applications increased 3.5%, with the index measuring the volume of purchase applications at its highest level since January 2009.

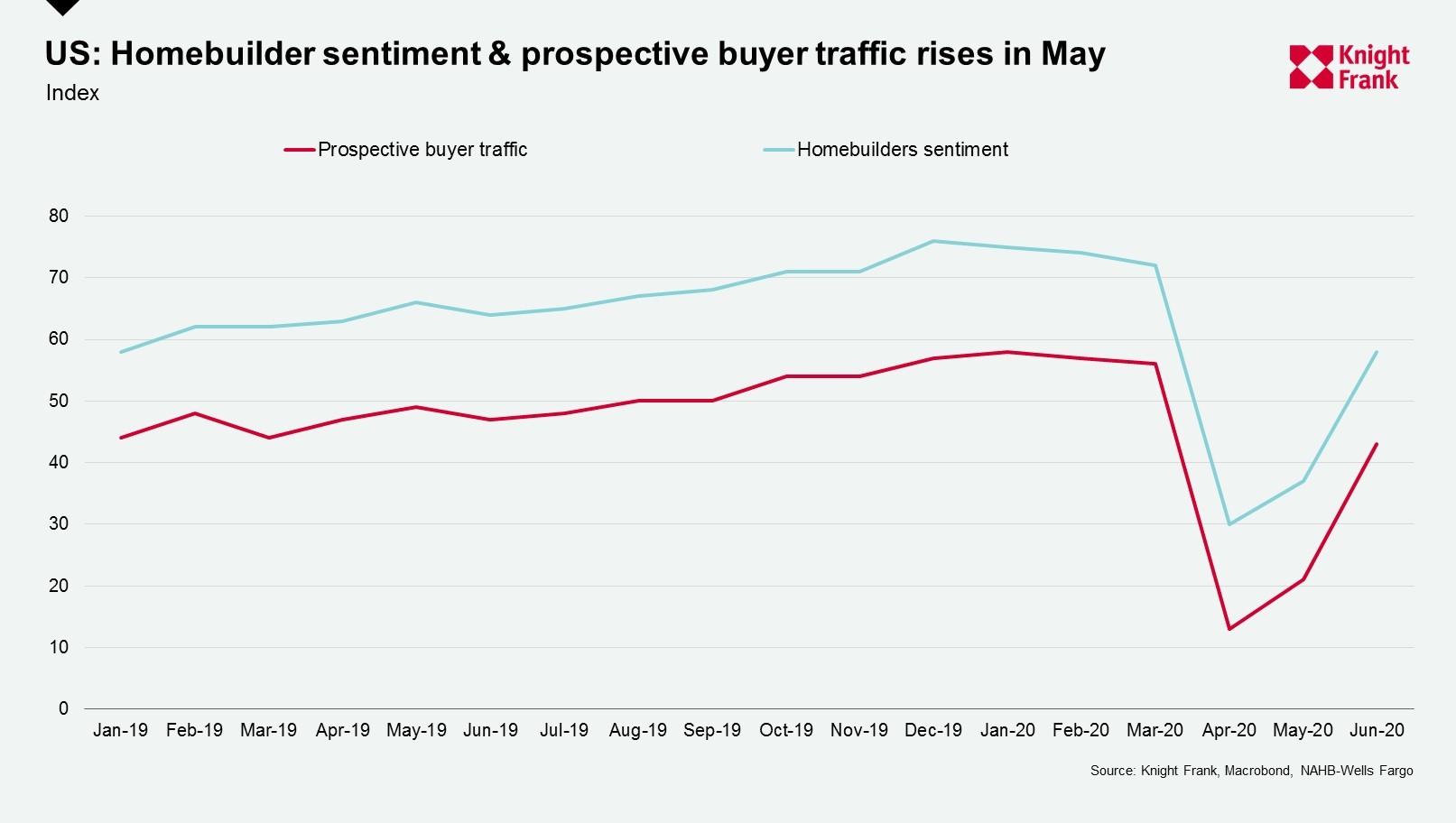

New data from the National Association of Homebuilders in the US shows a continued recovery with activity amongst prospective buyers and homebuilder sentiment increasing in May month-on-month.

In Canada, new price data from the Bank of Canada and Teranet shows prices increased 1.1% on average with Ottawa-Gatineau and Toronto seeing the largest monthly increase. Average prices in Vancouver now sit 4% below their peak in July 2018 whilst those in Toronto are currently at an historic high.

This week’s recommended listening:

Intelligence Talks podcast: In our latest Intelligence Talks global podcast, my colleagues in the Middle East and Africa, Taimur Khan and Tilda Mwai, talk to Anna Ward and discuss inbound/outbound investment, the impact of the postponement of Expo 2020 (due to be held in Dubai) and the long-term trends they think will be important post Covid.

Listen on Spotify, Apple and Acast. To view our full podcast series click here.