Global Residential Outlook 11 June 2020

A roundup of the latest data and insight on key global residential markets

7 minutes to read

Residential digest

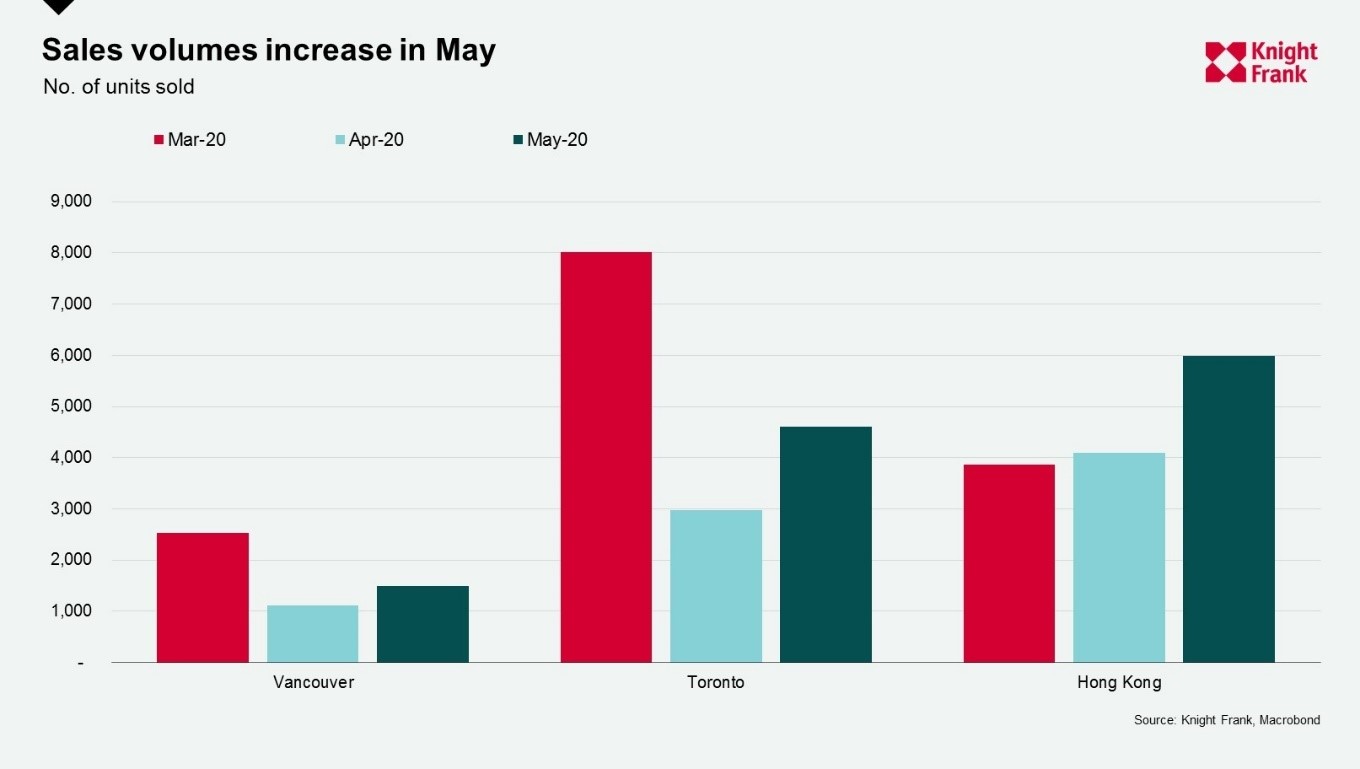

Eleven days into June and sales data for May has already been reported for three cities; Vancouver, Toronto and Hong Kong.

Interestingly, in May, all three cities saw sales volumes increase month-on-month, what’s unclear is whether April’s downturn will be the only dip this year, or if future outbreaks of the pandemic could see sales volumes weaken again.

Need to Know

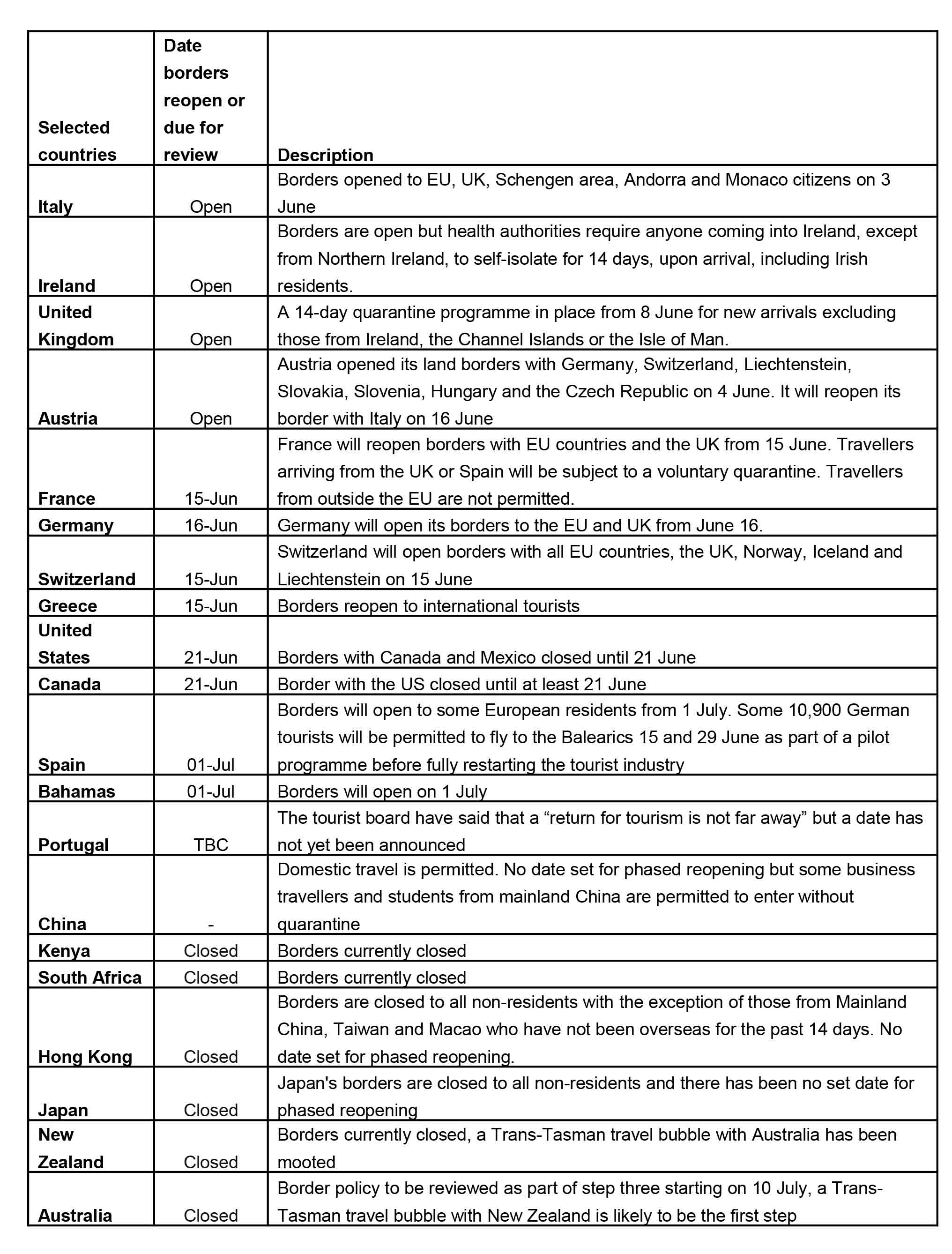

- Coronavirus restrictions continue to lift around the world. New York City entered the first of four reopening phases on Monday, beaches are open in France and cinemas are expected to reopen on 22 June. Denmark has lifted its limit on public gatherings from 10 to 50 people, whilst in New Zealand the government has lifted restrictions except tight border controls after health officials declared that there were no active cases. For an update on which borders are opening and when please see the Data Digest below.

- Since Monday, travellers arriving in Britain have had to self-isolate for 14 days under quarantine plans. However, such rules face a legal challenge from EasyJet, Ryanair and IAG with a ruling expected as early as Friday this week.

- Exclusive research by Knight Frank highlights the impact of Covid-19 on expats, with many now seeking a foothold back home. The survey confirms that 29% of expats are considering a permanent move, 14% are buying a property purely as a second home but the majority (57%) are seeking a 50/50 home, a base when they visit that could potentially be a permanent base long term.

- An announcement by American Airlines this week that it plans to fly more than half of its domestic flight schedule in July prompted US shares to surge. Flights to Florida, Montana and Colorado will resume in response to pent-up demand for holiday travel.

- Our weekly look at global real-time economic indicators reveals morning congestion levels across Shanghai, Sydney, Paris, Tokyo and Auckland increased by more than 20% over the last month. In terms of population mobility, Paris leads with 45% of the population mobile compared to normal, with Tokyo, New York and Los Angeles amongst the least mobile.

Europe

News last week from the European Central Bank that it plans to buy an extra €600bn of bonds in a bid to revive the eurozone’s anaemic economy, provides further evidence of the “whatever it takes” stance amongst senior policymakers but also suggests that interest rates will stay at their record lows for some time.

The Eurozone’s biggest economy, Germany, followed this with its own €130 fiscal stimulus and a reduction in VAT from 19% to 16% up until the end of 2020.

In Spain, news that 17% of the companies dissolved during April belonged to the construction sector was softened by new data from Brains-RE which reports that developers are finding a strong appetite amongst institutional investors for build-to-rent product in Madrid and Barcelona. AXA IM-Real Assets purchased a portfolio of 919 homes in Madrid for €150 million.

Barcelona rental data is out for the year to March 2020, with average rents reaching €17.6 per sq m, well above the Spanish average of €10.2 euros per sq m.

In Switzerland, a study by Credit Suisse confirms that high real estate prices in urban centres are causing many home buyers to take a close look at rural municipalities. Costing 7.6 years’ worth of annual salary, the price of a single family dwelling in Switzerland has reached a new high prompting residents to embrace longer commutes.

Meanwhile, residential prices in Ireland increased by an average of 3.7% in May 2020, having fallen by 5.5% in April 2020, according to a Daft.ie Housing Market Report. The report also shows a 0.6% rise in average rents in May 2020, compared to April.

In England, non-essential shops will reopen next week, but plans to fully reopen primary schools before the summer holidays have been dropped. In London, The lettings market has rebounded more quickly than the sales market since restrictions were lifted. The number of valuation appraisals for lettings properties in the week ending 6 June was the highest number on record and 19% above the five-year average.

Asia Pacific

With economic data lagging, the Purchasing Managers Index (PMI) can be one of the most useful leading indicators of economic conditions. My colleague Nick Holt's analysis of Asia-Pacific property markets finds PMI readings ticked upwards across the region in May as economies reopened.

In Hong Kong as shown in the chart above, residential sales volumes increased from 4,102 in April to 5,984 in May despite challenging headwinds. A survey of our APAC teams found Hong Kong was amongst a growing number of APAC residential markets to see asking prices, listings and sales either stabilise or creep upwards. The new Secretary for Financial Services and the Treasury this week announced plans to relax its 14-day quarantine for executives of 480 of the largest companies listed in the city this week to enable them to travel freely to mainland China for meetings and the signing of deals.

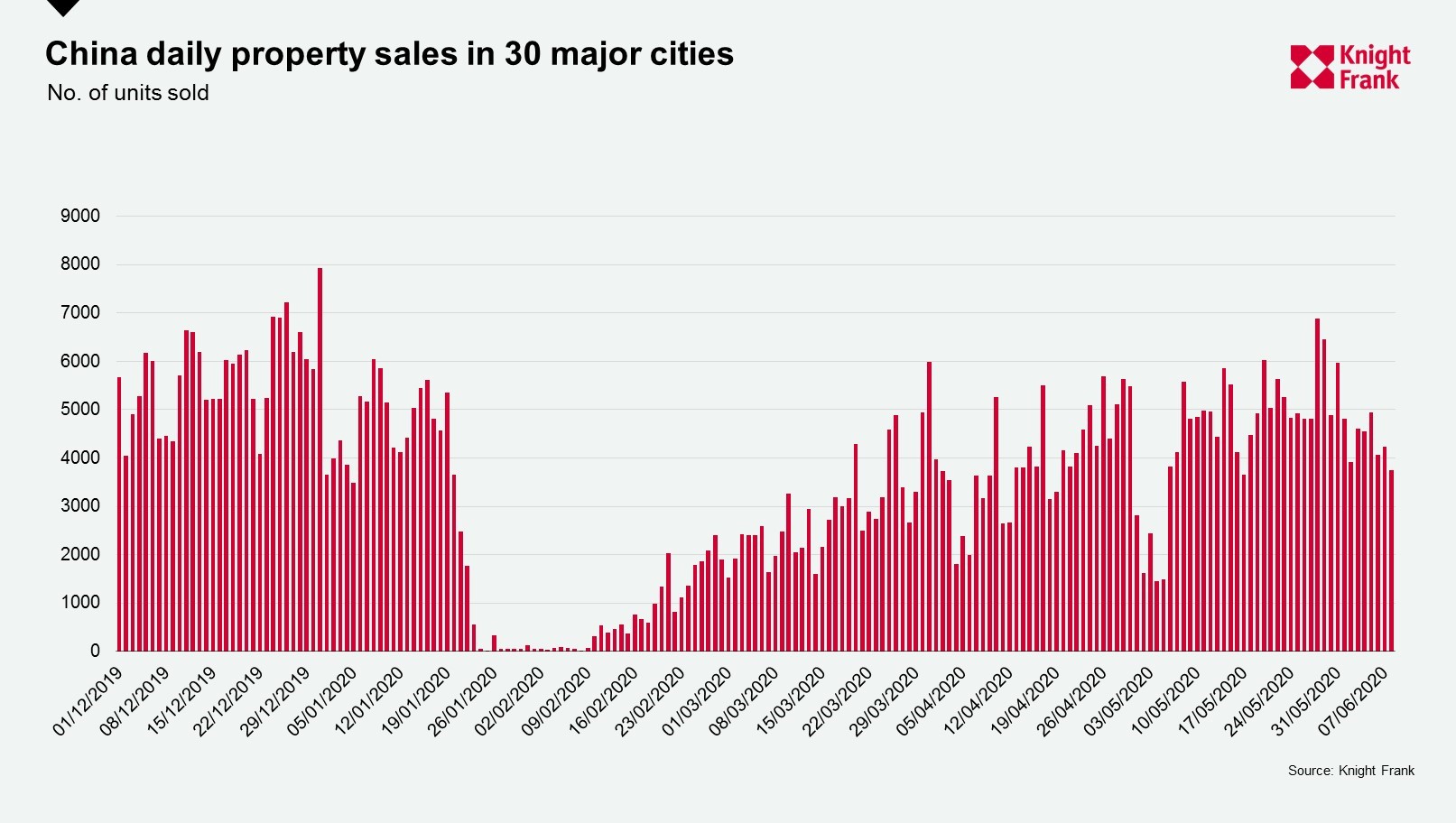

In China, residential sales continue to recover according to data from Capital Economics with sales in 30 major cities exceeding 4,000 per day for all but three days over the last month.

In Australia, Michelle Ciesielski highlights how pent-up demand carried over from the restricted lending phase and a favourable currency play for expats, has seen prices hold up across most cities.

Following the Federal Government’s Homebuilder grants package, policymakers in Western Australia have announced a AU$20,000 grant for owner-occupiers and investors who build a new house. The scheme will run until the end of the year, will not be means tested, and there will be no cap on property values. The government will also extend a 75% stamp duty rebate — a stimulus introduced last year for off-plan apartments to include all apartment projects currently under construction. This rebate — capped at $25,000 — will only be available to owner-occupiers. The total cost of the package is expected to be around $125 million.

The pacific islands of Fiji, Palau and Vanuatu are lobbying to join the proposed Trans-Tasman travel bubble between Australia and New Zealand according to the Financial Times, but the federal approach to the easing of lockdown measures in Australia is reported to be slowing progress.

US & Canada

The US has posted some positive housing market indicators in recent weeks, in particular mortgage applications and new home sales. However, despite news that household incomes in the US may hold up better than those in Europe, analysis from Capital Economics suggests data for existing home sales, is unlikely to look as buoyant given credit conditions are tightening, inventory levels are at record lows and home purchase sentiment is weakening.

In Vancouver, both sales and listings picked up in May, with the provincial government announcing a phased approach to re-open the economy. Greater Vancouver saw 1,506 properties change hands in May, up from 1,119 last month. A look at mortgage deferrals shows British Colombia accounted for less than 6% of Canada’s total. This, combined with mortgage rates at all-time lows and significant government stimulus is supporting transaction volumes.

Data Digest

With next week a key one for a number of European countries which are set to open borders, we summarise below the latest announcements around border openings.

Also, worth exploring is the International Air Transport Association’s new interactive map outlining up-to-the-minute travel regulations around the world.

Border re-openings

This week’s recommended viewing and listening:

- Webinar: In a Fireside chat, Victoria Garrett, Head of Residential, Asia Pacific for Knight Frank speaks to Shayne Harris, Head of Residential, Australia about the Australian market.

- Intelligence Talks podcast: Anna Ward speaks to David Bailin, Chief Investment Officer at Citi Private Bank and Knight Frank's Flora Harley. The discussion covers global politics from Brexit, US-China relations and the impact on property, as well as David's thoughts on best property sectors and markets to invest in right now. To view our full podcast series click here.