Asia-Pacific Dominated the Luxury Residential Market in 2023

Uncover the key elements behind the remarkable demonstration of resilience in the Asia-Pacific real estate landscape

2 minutes to read

In the ever-evolving landscape of luxury residential real estate, 2023 emerged as a year of surprising resilience and growth, with the Asia-Pacific region taking centre stage. According to the latest edition of The Wealth Report by Knight Frank, prime residential prices surpassed expectations, showcasing the enduring strength of luxury markets despite global economic fluctuations.

Out of the 100 markets tracked in Knight Frank’s Prime International Residential Index (PIRI), an impressive 80 recorded either flat or positive annual price growth. This robust performance is particularly notable considering the backdrop of successive interest rate hikes. On average, luxury prices climbed a solid 3.1% in 2023, signalling healthy gain across the board.

Leading the charge in this impressive display of resilience is the Asia-Pacific region, which outperformed other world regions with the highest growth rate of 3.8%. This achievement edged out the Americas, which posted a commendable 3.6% growth. Within the Asia-Pacific region, Manila emerged as the top-performing city, boasting an impressive 26.3% growth rate.

The success story of luxury residential markets in Asia-Pacific can be attributed to several factors, such as strong economies, favourable government policies, and a fast-growing pool of affluent population pivoting towards opulent living. Further, various markets, like Singapore and Australia, have long touted as ‘safe havens’, consistently attracting the wealthy to their shores.

While luxury prices remained resilient, sales experienced a notable decline in key markets such as London, New York, and Hong Kong, among others. Nevertheless, certain cities saw corrections after rapid rate hikes, while others benefited from supply shortages or policy shifts.

Amongst all the policy adjustments implemented so far, the most prominent one took place in Hong Kong SAR. Effective February 28, 2024, stamp duty rates for all homebuyers, including first-time and subsequent purchasers, have been reduced. This change aims to invigorate the housing market by improving affordability and accessibility for prospective homeowners, particularly for new entrants to the market. Consequently, this adjustment is expected to stimulate demand for residential properties, potentially increasing sales volume and bolstering the overall vitality of the sector.

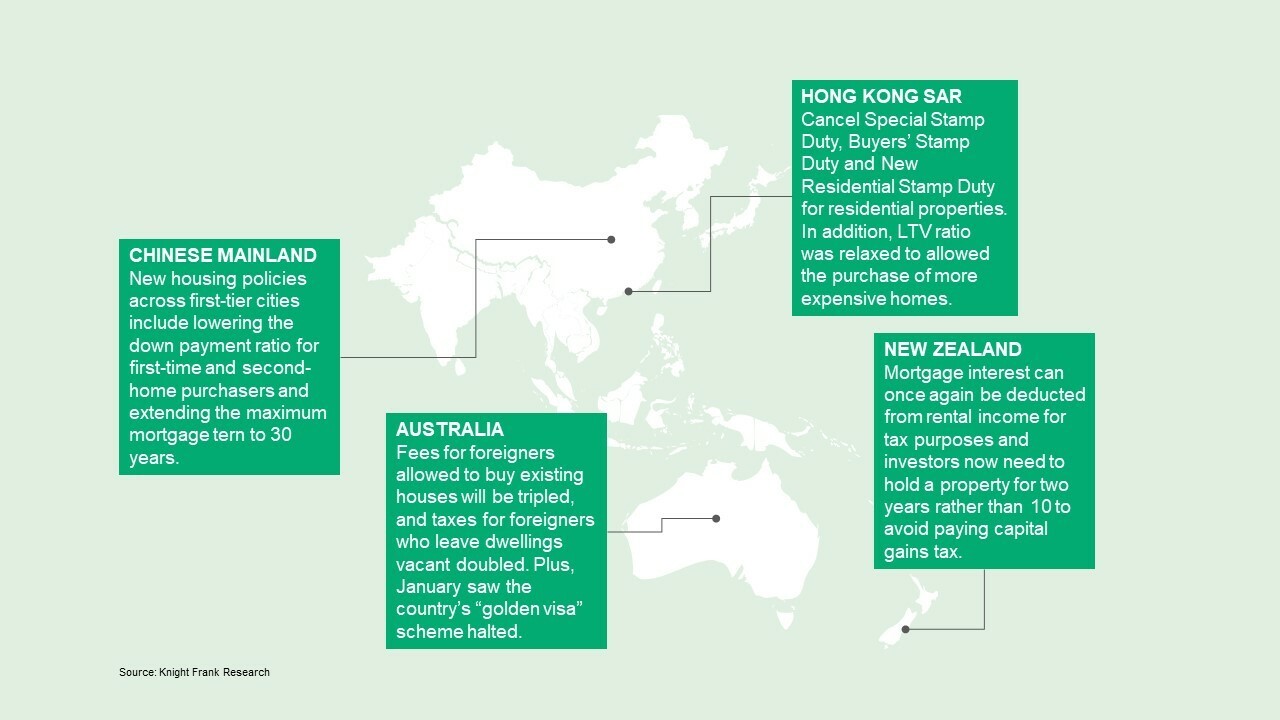

Other major policy shifts in Asia-Pacific can be found in the figure below.

Figure 1: Latest developments in rules and regulations governing the property landscape across Asia-Pacific

As we move further into 2024, the luxury residential market in the Asia-Pacific region is poised for further growth, driven by a combination of factors including economic trends, policy changes, and evolving buyer preferences. The region's ability to adapt and thrive in the face of challenges underscores its position as a key player in the global luxury real estate market.

For more insights on our latest edition of The Wealth Report, please click here: https://www.knightfrank.com/wealthreport.