Retail Renaissance: The Price of Change 2.0

This week’s Retail Note showcases our latest Thought Leadership Retail Report, a deep-dive into current and future structural change in UK retail markets. The ultimate temperature check of what, against all the odds, is likely to be the best performing CRE sector in 2023.

11 minutes to read

To receive this regular update straight to your inbox every Friday, subscribe here.

Key Messages

- Retail’s unlikely ascent to become the top performing CRE class in 2023

- Only achieved through proactively addressing its ‘Structural Failings’

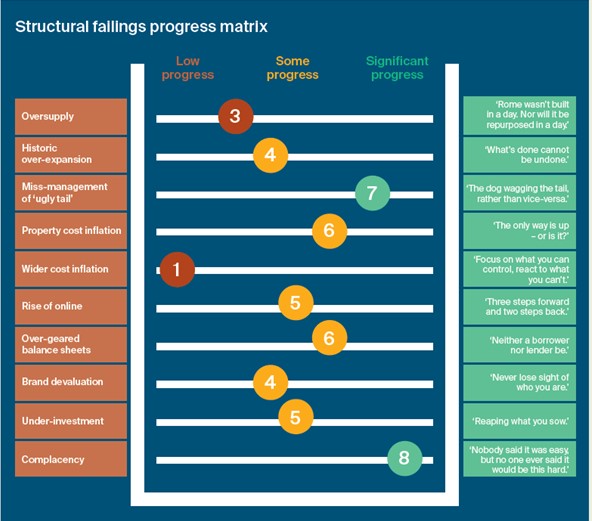

- Progress has been made against all 10 identified ‘Failings’

- Greatest progress made in some of the less tangible ‘Failings’ e.g. #10 Complacency

- Property cost inflation has been redressed

- Retail rents have declined by an average of -4.5% over last 5 years

- Rental declines have now largely bottomed out

- Progress against ‘Failing’ #1 Over-supply is very gradual

- Much more stabilised occupational markets than five years ago

- ‘Failing’ #5 Wider Cost Inflation remains a bugbear for retail operators

- A ‘Failing’ over which they have limited control

- Responding to existing structural change is ongoing…

- …and new structural challenges will emerge (and have already)

- Online is maturing and entering a new phase in its evolution

- The “S” in ESG will be where retail can generate most value

- The retail sector will be one of the key beneficiaries of advancements in AI.

“A Retail Renaissance” – a sequel to our 2018 Research magnus opus “The Price of Change”. Sequels generally inferior to the originals or just different? Hopefully more “The Empire Strikes Back” or “The Godfather Part 2” than “Jaws The Revenge” or “Grease 2”…

“A Retail Renaissance” – the premise

“The Price of Change” brutally laid bare, in no uncertain terms, the structural failings of the UK retail sector. By way of very cursory summary, too much space, a flaky and flabby occupier base, vastly inflated rents and property values, all compounded by a lack of historic investment and a huge sense of complacency. This even before the UK retail market faced its ultimate stress-test in the shape of the COVID pandemic.

A far-reaching reset, radical rebasing, a massive reality check and a voyage of self-help are key tenets to this Retail Renaissance. Few in 2018 would have wagered that retail would reclaim its crown as the top-performing commercial real estate class by 2023, but this is a reality. At the same time, few within retail would acknowledge this with any sense of triumphalism given the relativities within the real estate market and the fact that the Renaissance in retail has far from run its course.

The first section of “A Retail Renaissance” explores and scores progress against the ’10 Key Structural Failings’ identified in the “Price of Change”. Despite the less-than-helpful backcloth of COVID, massive political, social and macro-economic upheaval, the war in Ukraine and resulting/enduring hyper-inflation, progress has been made on all of these ‘Structural Failings’. The degree of progress varies and, in many respects, reflects the level of control and influence retail stakeholders (occupiers, landlords etc) actually have in that particular sphere. In some ‘Failings’, stakeholders are masters of their own destiny, in others, they remain fully at the mercy of market forces. There is only so much they can do in being proactive.

Similarly, it depends how deep-seated the ‘Structural Failing’ is. As a general rule, the more entrenched it is, the longer it will take to reverse or rectify. Quick wins are few and far between. Some progress can be made within five years, but a full turnaround may take decades.

Retail’s Renaissance can only ever be an ongoing work-in-progress. As well as addressing existing structural challenges, more are on the horizon. We explore but three in the report – structural change within the online / multi-channel space, the rising influence and deployment of AI and the increasing embrace of ESG far beyond mere lip service. All challenges in their own right, but equally also opportunities for those fleetest of foot and smartest of thought.

“The Price of Progress”

A Retail Note bite sized summary of progress against the previously identified ‘Structural Failings’.

1. Oversupply – Progress Rating 3

The issue of retail oversupply sits firmly in the slow-burn turnaround camp. The most significant progress made has probably been the very acknowledgement that the retail market is indeed oversupplied, a fact that was willfully ignored for so long in the past. Very limited new floorspace coming onstream, slow reabsorption of vacant floorspace through renewed (but highly judicious) occupier demand, selective re-purposing of redundant floorspace. All painfully slow processes, but a positive direction of travel nonetheless.

2. Historic Overexpansion – Progress Rating 4

The expansion gold rush in the 2000s is proving difficult to reverse. Those retailers that are still acquiring new space are far more conservative, forensic and selective in their approach. The other moving part in this equation is retailers managing their existing portfolio more proactively – closing under-performing or peripheral stores and channeling investment into the residual core. Overdue housekeeping in many cases, something that would have been better undertaken over a number of years on rolling basis, rather than retrospectively now. But ultimately, better late than never. Fewer, but better stores.

3. Miss-management of the ‘ugly tail’ – Progress Rating 7

Retailers are now far more proactive in churning their store portfolios. Whereas before there was a tendency to ignore the ‘ugly tail’ in favour of the top-performing or new stores, retailers generally are now assessing their entire portfolio and strategising on each individual asset. Retailers now have far fewer qualms about closing an under-performing store or taking the necessary action to improve its performance metrics e.g. negotiating a lease re-gear. A positive, but painful process. And, by its very nature, an ongoing and perpetual process.

4. Rental/property cost inflation – Progress Rating 6

Three moving parts, not necessarily moving in the same direction – rents, rates and service charges. Rents rebased, rates revalued, service charges not doing very much. According to MSCI, all retail rents have declined at an average annual rate of -4.5% over the last five years, a cumulative decline of -20.4%. Shopping centres (-6.9% annual, -30.1% cumulative) have fared worse than standard shops (-5.0%, -22.5%) and retail warehousing (-3.5%, -16.4%). More positive movements in retail business rates, albeit not the full-scale reform the system requires (hope springs eternal). The rent rebasing is increasingly bottoming out. Indeed, MSCI suggests that retail rents actually grew by +0.1% in 2022. A return to rental growth is something of a landmark for the UK retail market, but expect only anemic growth in the coming five years (+0.7% p.a. 2023-27). Having found only just found their feet, don’t expect retail rents to run fast anytime soon.

5. Wider cost inflation – Progress Rating 1

The ‘Structural Failing’ over which retailers have the least control. Yet the one that continues to inflict the most turbulence on retail markets. One key example cost is staff/wages. Over the last decade, the headline minimum wage has increased by £4.23 (+68%), or £2.59 (+33%) since 2018. Very few retailers will have seen their top line grow at anything like this rate over the corresponding period. ‘Unforeseen’ costs are equally manifold, many coming to light during COVID and in the wake of the war in Ukraine. Most are ongoing. Retailers may have limited control over these external cost pressures, but they still have to respond.

6. Rise of online – Progress Rating 5

The online narrative has experienced a rollercoaster ride over the last five years. Prior to COVID, meaningful progress was being made in that the debate was moving on from simplistically trite ‘online vs bricks & mortar’ arguments. Cue a depressing reverse during COVID. All progress was swept away in favour of a renewed obsession with largely meaningless online penetration figures. But this was followed by a massive in-store bounce-back when lockdown was lifted. At the same time, an unforgiving macro-economic environment is laying bare the operational and financial shortcomings of many online pure-players. Painful as it was, many retailers learnt a great deal about online as a by-product of COVID. These lessons are now being put into practice as the voyage of discovery resumes, with a renewed sense of pragmatism.

7. Overgeared balance sheets – Progress Rating 6

Retail occupiers are probably less debt-ridden now than they were a generation ago. It would be reassuring to think that this has been the result of self-help on the part of operators and more stringent management of cash flow, but the reality probably lies closer to the fact that many of the most indebted operators are no longer with us and private equity generally sees less opportunity in UK retail than it did previously. basically because the pickings are relatively slim. Interestingly, PE within UK retail has migrated from the high street to the foodstore arena, with two of the ‘Big 4’ supermarkets (Asda and Morrison’s) now in the hands of private equity (the Issa brothers and CD&R respectively). Manageable debt is part and parcel of sensible retail. Onerous debt is a killer.

8. Brand devaluation – Progress Rating 4

One of the least tangible of the ‘Structural Failings’, responsibility for brand devaluation lies firmly at the door of retailers themselves. Preservation of brand is what they signed up for, it’s what they do. But over the years, the value of brand slipped perilously, sometimes catastrophically, down the order of priorities for many operators. There is growing evidence to suggest that many retailers are slowly, but positively, re-establishing their brand credentials, albeit as much by default as by design. In a new dawn of “honest pricing”, retailers are being forced to trade on a different competitive playing field, one where strength of brand is paramount. There is a slow (but growing) recognition generally that investment is needed not just in restoring brand value, but taking it forward. Capex is needed in refurbishing stores, investing in staff and improving supply chain – and there is much more value and potential return here than in vanity projects.

9. Under-investment – Progress Rating 5

A deep-seated challenge that applies across the spectrum of retail market stakeholders. Retailers need to invest heavily in their brand and all that underpins it. Rather than channel all resource into online capability, capex needs to be deployed more widely across all fundamental areas of the business. A legacy of historic under-investment continues to weigh heavily on retail property markets, particularly shopping centres. Far too many have been treated as ‘cash cows’ for too long, consistently delivering double-digit returns during the good times. But at the same time, many have not been asset managed nearly as proactively as they should have been, nor allocated the rolling levels of investment required to remain fit-for-purpose, let alone relevant. A similar catch-22 situation for councils and local authorities. Some towns have been so neglected and cash-starved for so many years that they are almost beyond redemption – no amount of fresh investment will necessarily restore former glories. The conundrum of allocating the right levels of capital to the right areas of retail and an understandable reluctance not to throw good money after bad.

10. Complacency – Progress Rating 8

The structural failing against which the greatest progress has been made. Any lingering vestiges of complacency in retail were surely swept away in the maelstrom of COVID, proving that nothing focusses the mind as much as an existential crisis. Greater appreciation of the complexities of retailing is a double-edged sword. Only by shedding past complacency can the sector evolve and move forward. But at the same time, the realisation that retail can be a minefield may push some to the opposite extreme – basically putting in the “too difficult to deal with” box. Many investors have had their fingers burnt in retail and won’t be returning anytime soon.

For much more detail (plus some whizzy-ish charts and infographics), please refer to report itself.

Future Structural Change

So much for existing and ongoing structural change. “A Retail Renaissance” also addresses three key areas of future structural change in retail. By way of teasers:

- Online: Bonfire of the Vanities. The online market maturing and entering a new phase in its evolution, one where a lot of the artificial elements are removed, there is a renewed push for profitability, online penetration statistics are increasingly subordinated to market realities, many ‘disruptors’ fall by the wayside and the retail market increasingly dances to a multi-channel tune.

- ESG and Retail: Challenge and Opportunity. Greater disaggregration and understanding of the three component parts and rising recognition that the “S” represents the biggest opportunity for retail, given its position at the heart of communities and role as a major employer. Greater measuring and reporting social value in financial terms, allowing investors to understand the social benefits in a currency they understand – return on investment (ROI). Not all regulation necessarily being red tape, but compliance actually being of benefit to the retail market.

- Retail & the rise of AI: an investment worth making?. Creating new Beatles records, but wiping out humankind at the same time so they don’t get to hear them, AI will undoubtedly have a huge influence on retail markets. Although the narrative will focus more on AI vanity projects, AI stands to significantly enhance retail through solving routine inefficiencies across the business, from supply chains to customer service.

“A Retail Renaissance: The Price of Change 2.0”. Maybe not quite as good as “The Empire Strikes Back.” But streets ahead of “The Phantom Menace”…