Covid-19 Daily Dashboard – 3 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 3 September 2020.

Equities: Equity markets performance in Europe was positive this morning. The CAC 40 was the best performing index (+1.8%), followed by the DAX (+1.5%), the STOXX 600 (+1.1%) and the FTSE 250 (+0.9%). In the US, the S&P 500 remained stable at the new record high reached yesterday, equal to 3,576 points. In Asia, the KOSPI was the best performing index (+1.3%), followed by the S&P / ASX 200 (+0.8%) and the TOPIX (+0.5%). The CSI 300 and the Hang Seng both saw declines over the day of -0.6%.

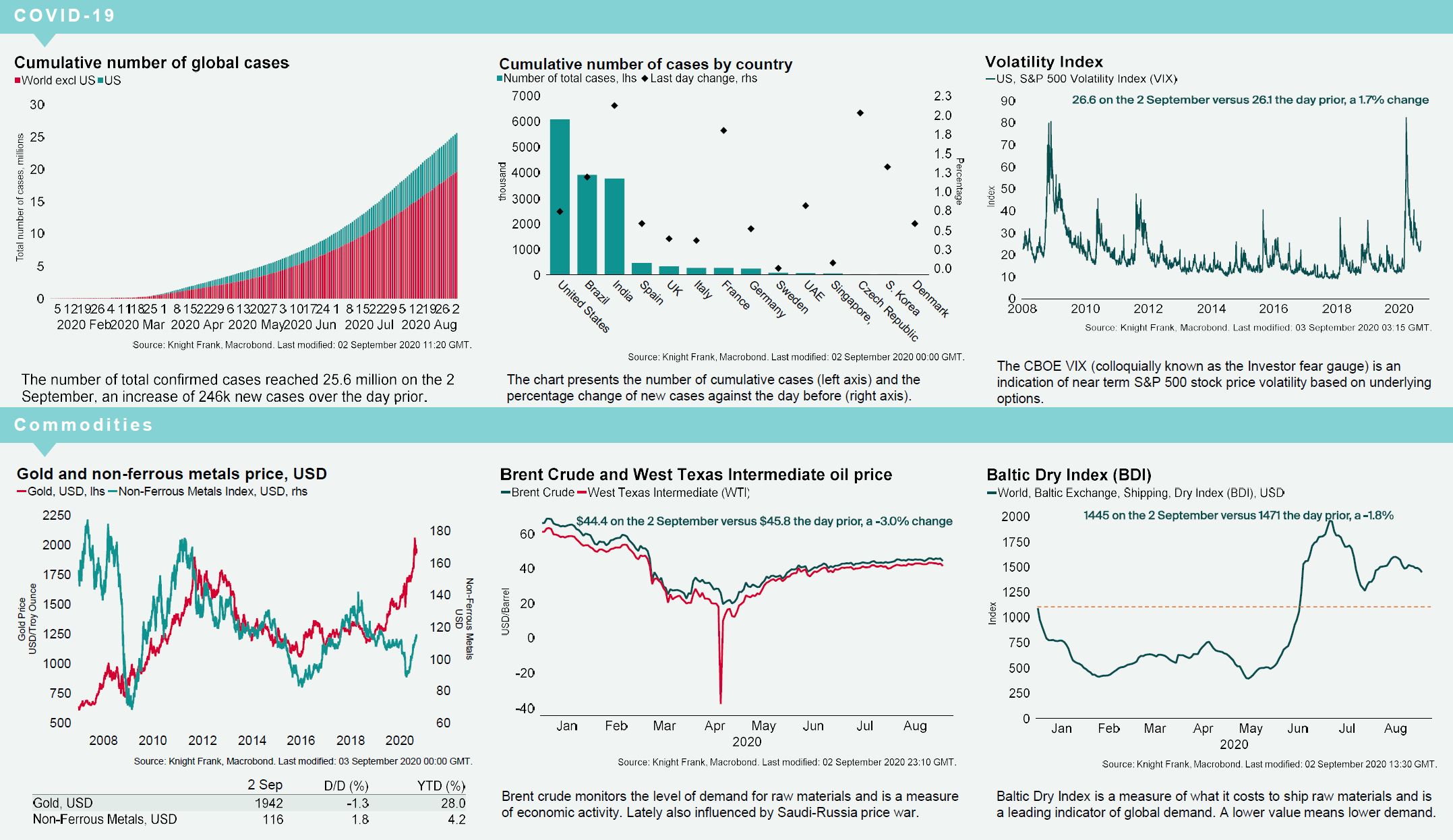

VIX: The CBOE market volatility index is trading at 26.13 and the Euro Stoxx 50 volatility price index at 25.4.

Bonds: The UK 10-year gilt yield and the US 10-year treasury yield have softened +1bp to 0.24% and 0.66% respectively. The German 10-year bund yield and the Italian 10-year government bond yield remained both stable at -0.47% and 1.04%.

Currency: Sterling and the euro are currently $1.33 and $1.18. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.29% and 1.11% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are both trading down this morning by -1.6% and -2.0% to $43.60 and $40.83 per barrel respectively, the lowest levels since the end of July.

Baltic Dry: Following a decline of -3% over the previous five trading sessions, the Baltic Dry lost a further -1.8% yesterday, down to 1,445, the lowest level since the 4 August.

France: The French Prime Minister, Jean Castex, announced this morning a €100bn stimulus package over two years, to help the economy recover from the Covid-19 crisis. Equal to 4% of French GDP, it is the largest stimulus programme against national output of any big European country, and it is also the first announced since the EU leaders agreed on a €750bn recovery fund in July. The package includes €35bn for the corporate sector (of which €20bn of tax cut), €30bn for green policies and building renovation, and €11bn for the transport sector.

UK PMI: The UK Services PMI was revised lower to 58.8 in August 2020 from a preliminary estimate of 60.1 and compared to July's final 56.5. However, it remains the largest expansion since April 2015.