Covid-19 Daily Dashboard – 2 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 2 September 2020.

Equities: Global equity markets are currently trading higher today. In Europe, the STOXX 600 is up +2.7%, followed by the CAC 40 (+2.4%), the DAX (+2.3%) and the FTSE 250 (+1.2%). In the US, the S&P 500 is up +0.7% this morning to 3,550 points. In Asia, the S&P / ASX 200 was the best performing index (+1.8%), followed by the KOSPI (+0.6%) and the TOPIX (+0.5%). On the other hand, the CSI 300 remained stable and the Hang Seng declined by -0.3%.

VIX: The CBOE market volatility index, also known as the ‘investor fear gauge’, is down -0.8% to 25.9. In Europe, the Euro Stoxx 50 volatility price index is currently down by -6.3% to 25.4 but above the long term average of 23.3.

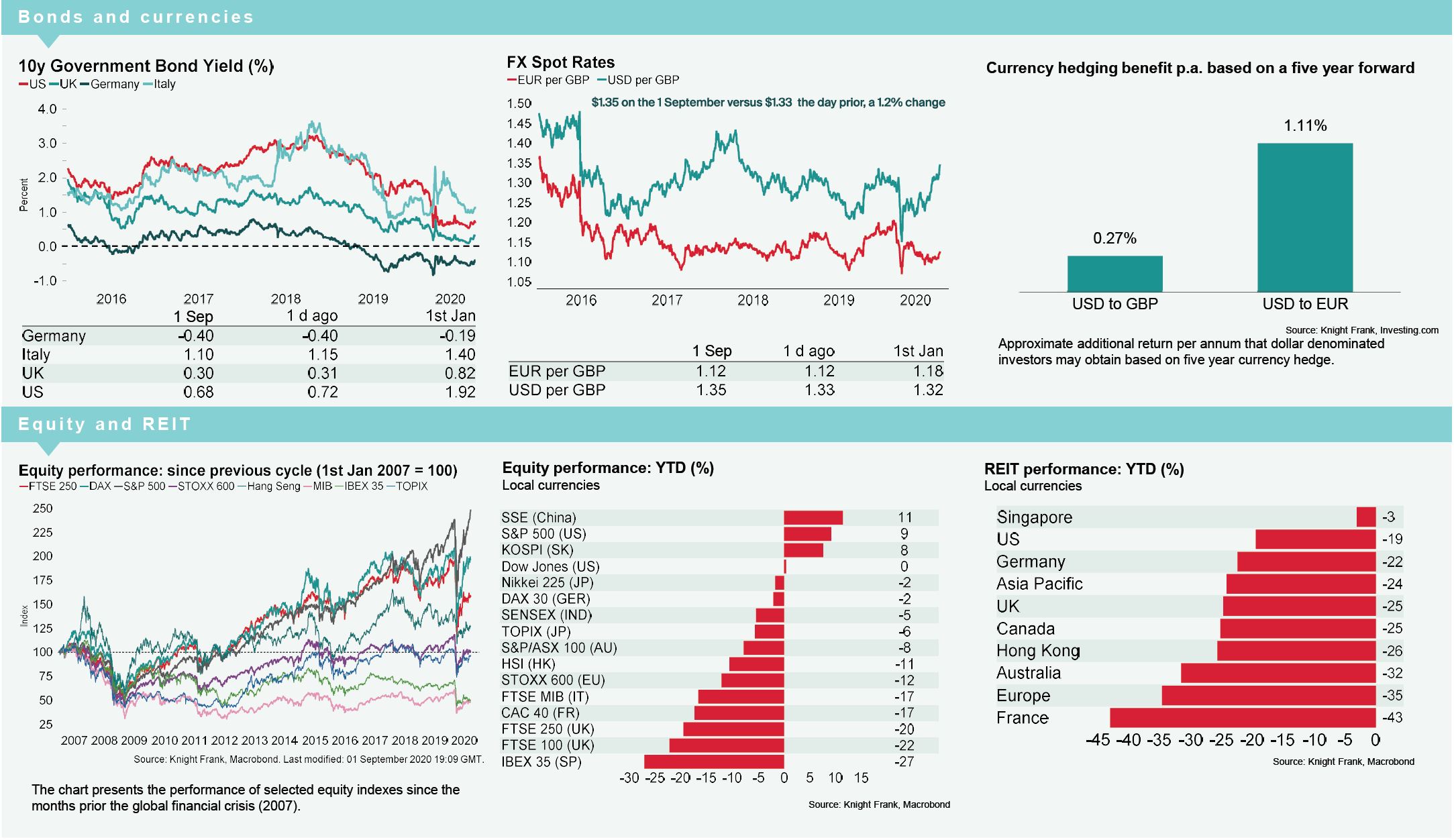

Bonds: The UK 10-year gilt yield and the German 10-year bund yield have both compressed -3bps to 0.27% and -0.45% respectively. The US 10-year treasury yield has softened +2bps to 0.69%. The Italian 10-year government bond yield has declined -5bps to 1.04%, narrowing the spread versus the German bond to 149bps.

Currency: Sterling and the euro are currently $1.34 and $1.19. Hedging benefits for US dollar denominated investors into the UK and the eurozone are 0.27% and 1.11% per annum on a five-year basis.

Oil: Brent Crude and the West Texas Intermediate (WTI) are both trading up +0.4% this morning to $45.75 and $42.95 per barrel respectively.

Baltic Dry: The Baltic Dry lost -1.1% yesterday, declining to 1,471, albeit +35% above where it was in January.

Eurozone inflation: The eurozone CPI preliminary figure pointed to a decline of -0.2% year-on-year in August 2020, down from +0.4% the month prior and below market expectations of +0.2%. If the data is confirmed, it indicates the eurozone has moved to deflation for the first time since March 2016.

Australia GDP: The Australia GDP contracted -7% in Q2 2020 over the previous quarter, following a decline of -0.3% in Q1 and below market expectations of a -5.9%. It was the second consecutive quarterly contraction and the sharpest on record.