Housebuilders feel squeeze of rising building costs

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Sentiment weakens

Inflation and the prospect of strikes have had a swift impact on consumer and business confidence.

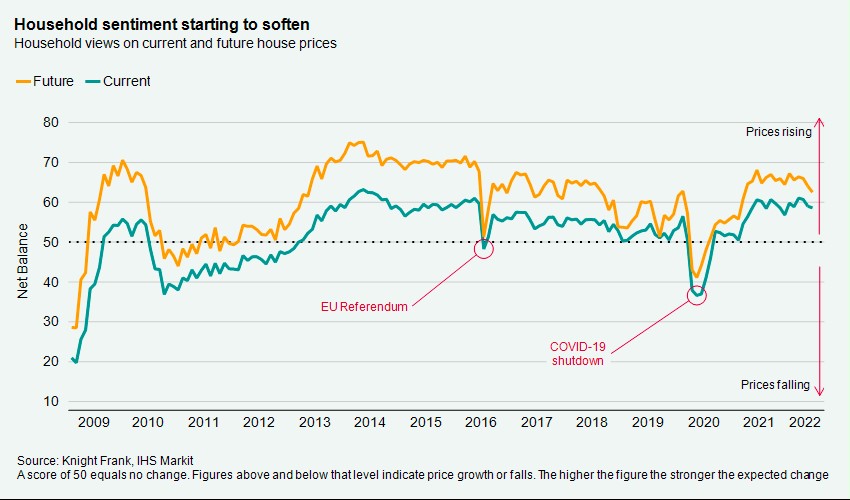

The GfK consumer morale index, launched 48 years ago, fell to an all-time low of -41 in June from -40 in May. That's below levels that have previously preceded recessions. Housing market sentiment is displaying more resilience. Household views on whether house prices are currently rising and will continue to do so remain in positive territory, though both metrics have softened for four consecutive months (see chart).

The S&P Global/CIPS UK composite PMI, a closely-watched measure of business activity, is sending similar signals to the GfK index. The main reading suggests the economy grew at a modest pace through June, though that expansion was supported by orders for goods and services placed in prior months. Inflows of new business posted the weakest reading since February 2021.

Business expectations for output in the coming year fell to lows exceeded only by the onset of the pandemic and the 2016 EU referendum. The latest decline takes business confidence to the lowest since May 2020.

The squeeze

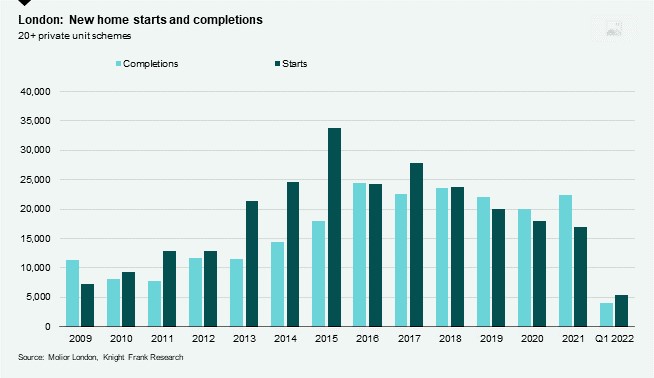

Soaring construction costs and supply chain disruption are key issues for housebuilders all over the country, but are felt most acutely in areas that have seen the weakest growth in house prices since the onset of the pandemic – particularly London.

The squeeze will inevitably impact the viability of some sites. A quarter of respondents to our survey of SME and volume housebuilders said they expected new starts to fall in the second quarter – the first time since we began the survey a year ago that a greater proportion were expecting new starts to fall rather than rise.

Berkeley Group chief executive Rob Perrins takes a longer view. He tells the FT's George Hammond that house price inflation has offset rises in build costs so far, though that's unlikely to be sustained. New starts have already halved since 2015 (see chart) and could halve again, he added.

Construction materials prices climbed more than 25% in the year to April, according to official figures. Wages climbed 6% during the same period.

Canada's housing challenge

London isn't an isolated case and housing supply across several markets is threatened by surging build costs, particularly if it outlives rising house prices for a sustained period.

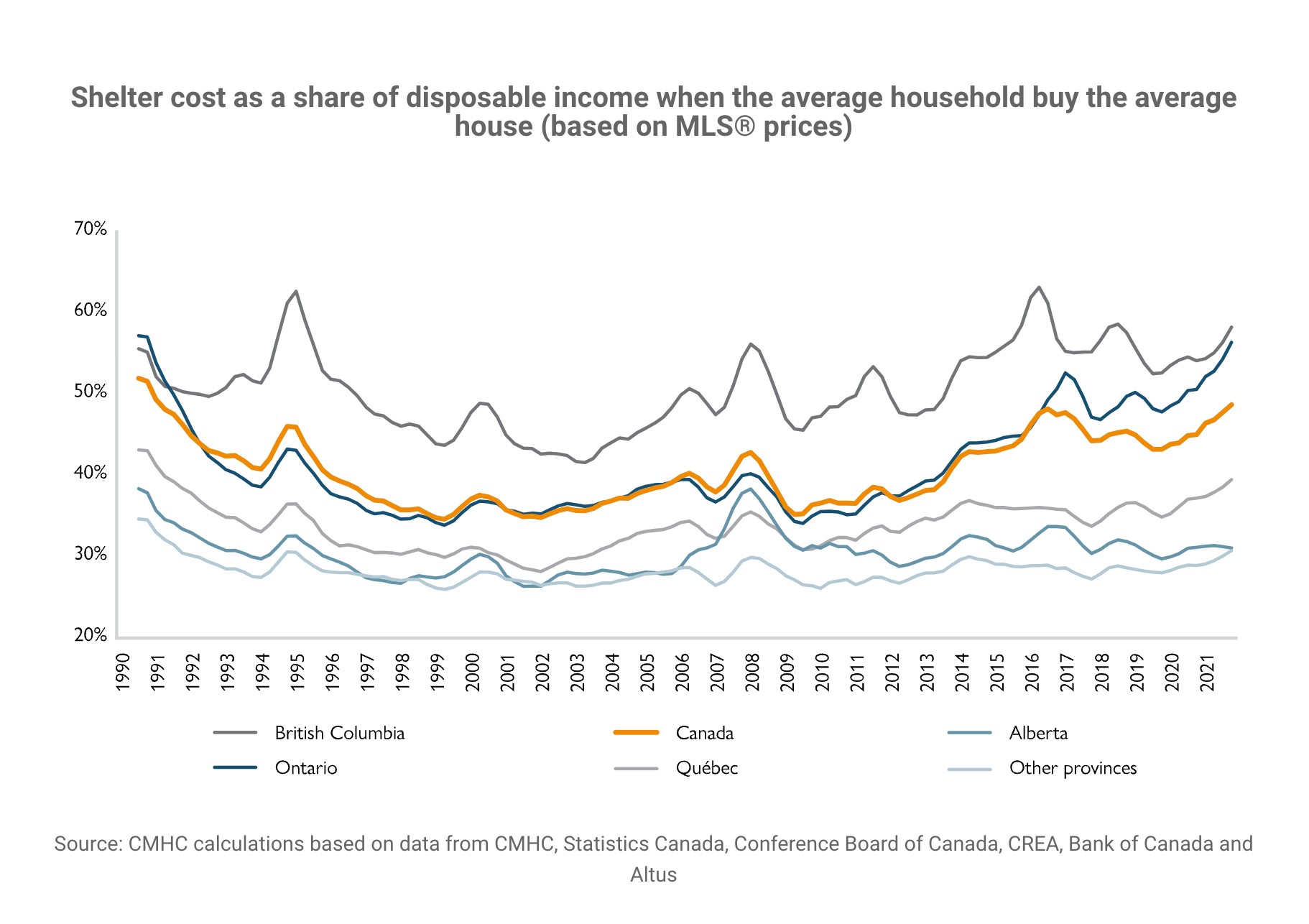

House prices in Canada have fallen for two consecutive months. Sales fell 8.6% in May compared to the previous month. The country faces an acute housing shortage, quantified yesterday by Canada Mortgage and Housing Corporation.

If the current rates of new construction continue, the group projects that the housing stock will increase by 2.3 million units between 2021 and 2030, which amounts to almost 19 million housing units by 2030. To improve affordability, an additional 3.5 million units would be required by 2030, a quantum that would require an overhaul of housing policy. Increasing housing supply in both the rental and homeownership markets is critical, the group argues:

"More and diverse supply across the housing system enables households to better match with housing they want and can afford. This keeps households from stretching their budgets to bid for living spaces in limited supply and that are highly priced."

Brexit

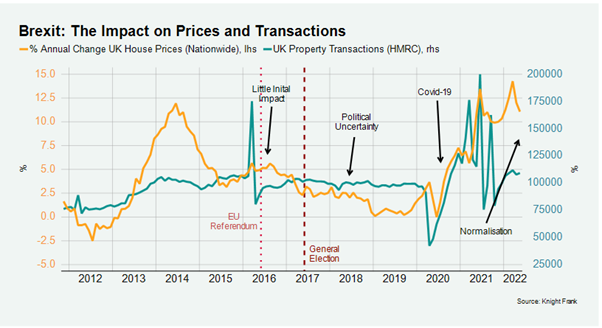

Yesterday marked the sixth anniversary of the Brexit referendum. Earlier this week, Kate Everett-Allen tallied the data to see how the UK and Europe’s housing markets have fared in the intervening period.

This morning Tom Bill takes a deeper dive in the UK housing market's performance. In the heat of a divisive campaign, the government said house prices could fall by 18%, half a million jobs may be lost, and foreign buyers would turn away from the UK if the country voted to leave.

The reality proved to be far more prosaic. Prices defied the negative predictions and did so again four years later when economists warned of a 20% decline as the pandemic took hold. See the piece for more.

Lake Como

Of all Knight Frank’s destinations across Italy, the villages on the banks of Lake Como attract the most diverse mix of buyers – from Europe, the US, Middle East and even Australasia.

Enquiries to purchase property leapt 144% in 2021 year-on-year as lake and mountain views tapped into the renewed desire among buyers to acquire property outside of cities. The average price of prime properties along Lake Como increased 4% in 2021 with most enquiries looking within the €2-€4m price bracket. Over the five years to 2021 prices have increased by around 10%.

On a square metre basis prime prices sit at around €12,000 per sq m in the best villages, including perennial favourites such as Bellagio and Menaggio.

In other news...

LA property investors prepare to fight new megamansion tax (Bloomberg).