The drawn out rebalancing of supply and demand

Making sense of the latest trends in property and economics from around the globe.

2 minutes to read

The cooling

Asking prices for UK homes rose 0.3% in the four weeks to June 11th, the smallest rise since January, according to the latest figures from Rightmove.

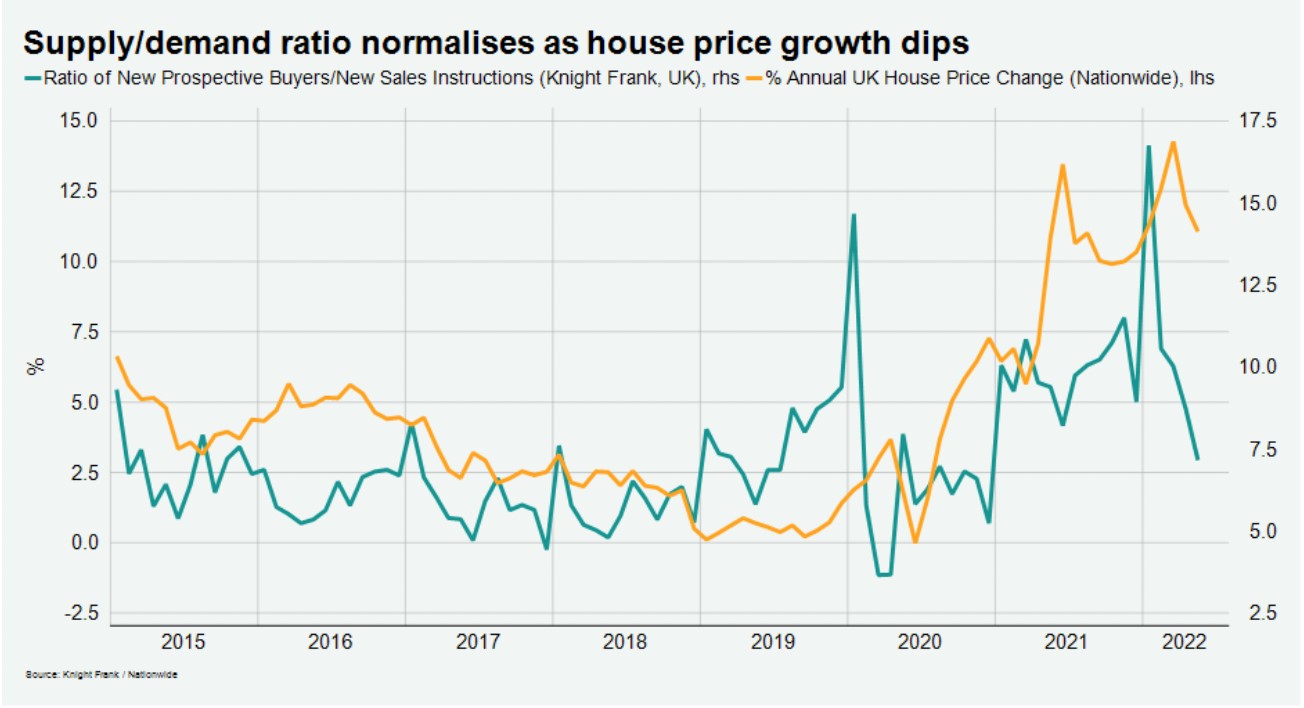

The rebalancing of supply relative to demand continues, but it's going to be a drawn out process. The number of prospective buyers per home dropped by 8% during the period but is still more than double the level at the outset of the pandemic, according to Rightmove. New instructions, a leading indicator of supply, were largely flat in the latest RICS Residential Market Survey.

We shared our own gauge of supply relative to demand on Friday. The long run average ratio of new prospective buyers to sales instructions sits somewhere between six and seven, and we are approaching 7.5, though the data is fairly volatile (see chart).

London offices

Total take up in the London office market during Q1 came in at 2.65 million square feet, a slight decrease on levels recorded in the previous quarter and below the long-term average of 3.02m sq ft, according to the latest figures from Shabab Qadar.

Take up was dominated by professional services and finance & banking occupiers, with both accounting for 30.0% and 23.6% of take up respectively. Legal services firms continue to be a great source of demand in the London office market – see this piece by Jennifer Townsend for more on that.

The pre-let market continues to show resilience with approximately 30% of space under construction already transacted. The ending of all Covid-19 restrictions and the easing of limitations on travel enabled more investors to view assets, which prompted investment into London offices to hit £5.86bn, the highest quarterly level since 2015 Q4. Investors from Asia Pacific were the most active during the quarter, accounting for 40% of investment into London, followed by North American investors with 32%.

Manhattan rents

Earlier this month, Manhattan's median residential rent hit $4,000 for the first time.

The breaking of the symbolic threshold, reported by colleagues at Douglas Elliman, means rents have climbed by more than a fifth since May 2021. Jonathan Miller, who compiles the data, suggests that the growth in wages we've seen in recent years would support more gains.

Manhattan is by no means an isolated case and we'll be taking a deeper dive into the drivers of city rental markets over the coming weeks. In some cases large gains are down to a reversal of declines we saw during the pandemic, but deep set supply shortages that have been exacerbated by landlords selling up amid soaring house prices. Stay tuned for more.

In other news...

Goldman-backed housebuilder to build Europe’s largest home factory in the UK (FT), and finally, millions plan to quit jobs in search for better pay, CIPD’s good work index finds (Times).