UK economy recovering as labour markets tighten and EV sales outpace diesel

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

UK output finally exceeds pre-pandemic levels.

Amongst a slew of important data releases in recent days, news that the UK economy is now 0.7% larger than its pre-pandemic size, robust labour market readings, and fresh inflation data, make a strong case for near-term interest rate rise in the UK.

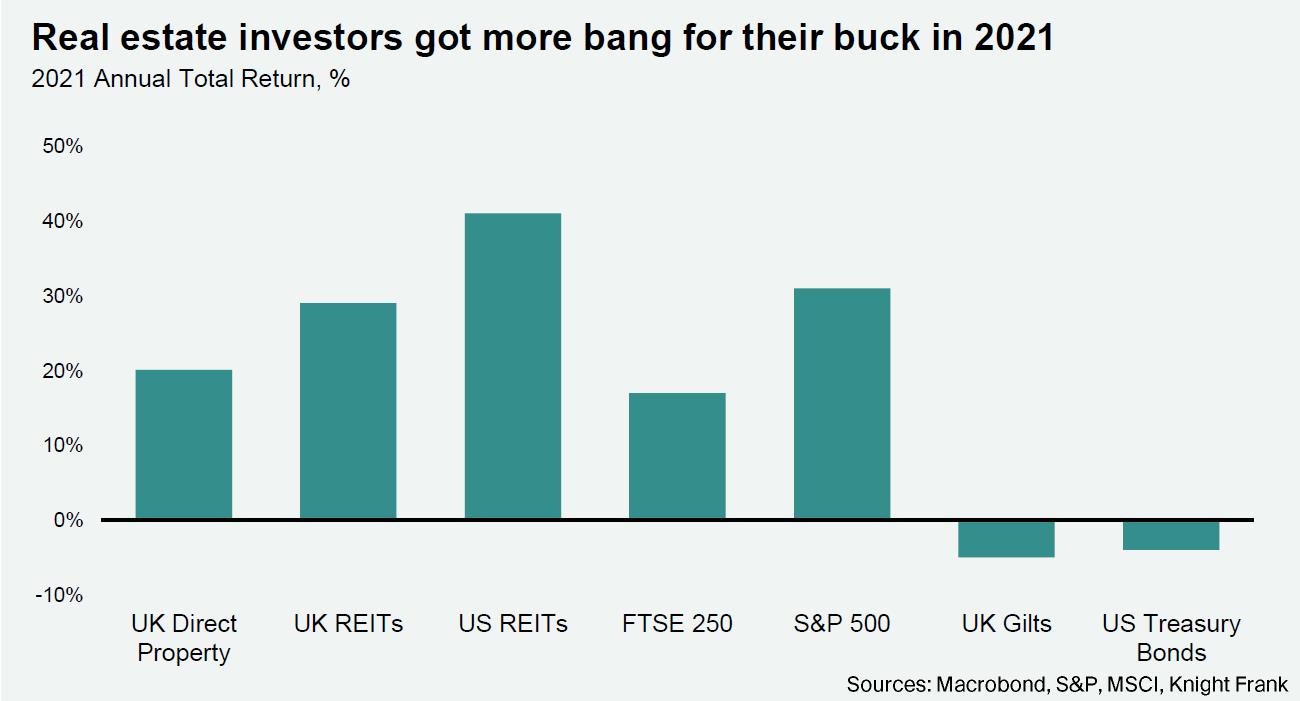

While the impact on bond returns is already being felt, we, along with many forecasters, believe that the anticipated rate hikes will have little discernible effect on real estate yields this year.

UK labour market tightens further

Despite the end of the government furlough scheme and the emergence of the Omicron variant, UK employment increased to 75.5% while unemployment fell to 4.1% over the three months to November. Wages have also been increasing over the same period. However, once adjusted for inflation, only those in relatively higher income brackets are seeing real wage growth.

The cost of household outgoings will be one of many factors under consideration as employees weigh up their desire to return to workplaces, once work-from-home guidance is lifted at the end of the month.

Sales of electric vehicles outpace diesels

In Western Europe, 170,000 electric vehicles were sold in December, overtaking diesel model sales for the first time.

Electric vehicle sales are supported by strict emission regulations, government subsidies and consumers’ changing preferences. With the right mix of regulation, incentives, and scope to save money, consumers are more than willing to embrace sustainable alternatives.

View the latest dashboard here