Office market turning point, record country house sales and will base rate rise again?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The clamour for the best offices

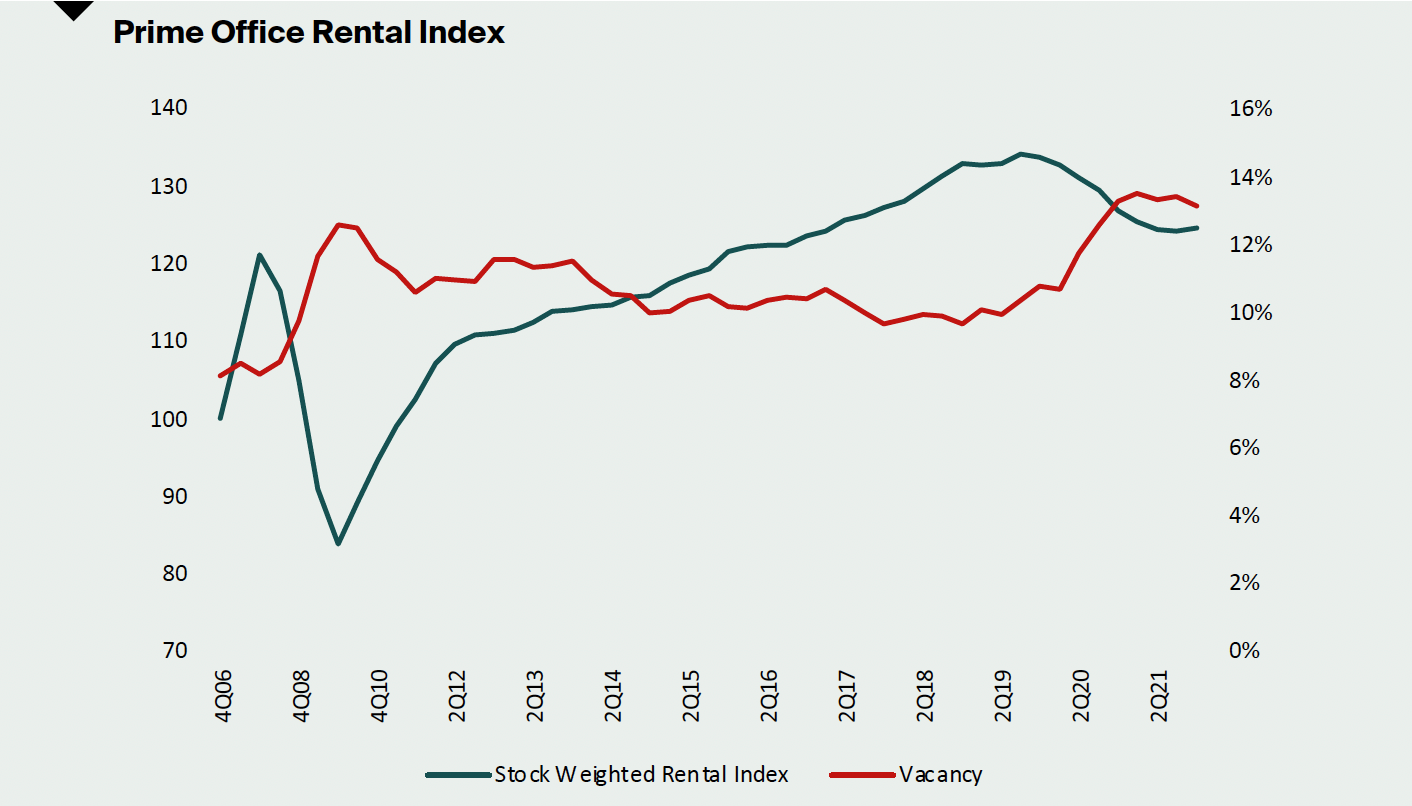

Prime office rents in Asia Pacific rose 0.3% in the final quarter, the first increase since the onset of the pandemic.

There's a lot going on. Occupiers are hanging onto space while they reassess which new working habits stick. Supply chain disruption has exacerbated construction delays, hampering the delivery of new buildings. A gradual return to the workplace is underway, leading to a reduction in incentives and an increase in asking rents.

The key factor, however, is the flight to quality. As we're now seeing in office markets globally, occupiers want high quality, sustainable space. As Lee Elliott has noted, there is a far greater spectrum of occupier demands emerging, and a clear desire to move away from generic space towards something more bespoke. The largest leasing deals in London at the moment are for pre-lets or recently completed developments, revealing the degree to which large occupiers are prepared to pay a premium to secure space for future occupation significantly ahead of lease expiry.

That's not to say office markets are without challenges. The vacancy rate across Asia Pacific stands stubbornly high at 12.8% (see chart) and how to reposition assets that don't meet changing occupier demands will be among the most important questions of this cycle.

The allure of country living

Back in 1995, Blur released a number one single about a city dweller who fled the "rat race" so he could take herbal baths in a very big house in the country. Little did they know that, more than a quarter of a century later, large numbers of homebuyers would do the same thing.

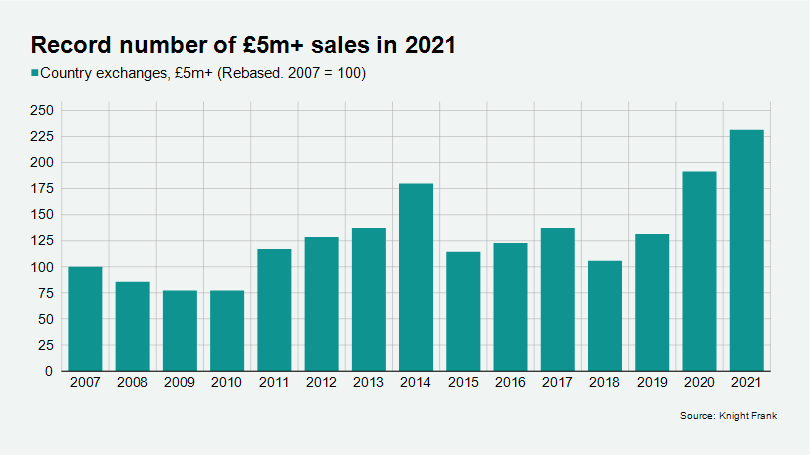

New Knight Frank data reveals that 2021 saw the most £5m+ sales of country houses in 15 years, beating the previous record set in 2020 by 21%. With such high demand, supply struggled to keep up and the total amount of £5m+ properties available for sale in December 2021 was 30% down on December 2019.

However, prospective sellers appear to be active ahead of the spring market. The number of £5m+ market appraisals for sale, a leading indicator of supply, in December 2021 was the highest for that month in eight years. That trend isn't constrained to the £5m+ market either - the number of market valuation appraisals in the wider country market was also at its highest for a decade.

The Bundesbank is worried

The German regulator BaFin last week told banks to build up capital buffers of around €22 billion next year amid what it believes could be a property bubble that threatens the stability of the financial sector.

German house prices climbed 13% during the year to September and have now risen almost 60% since 2015. The Bundesbank has previously estimated the market is somewhere between 15% and 30% overvalued.

In an interview with the FT this morning, Claudia Buch, vice-president of the Bundesbank fleshed out the central bank's concerns, which centre on banks' exposure to higher rates resulting from the surge in long-term fixed products, plus the increase in high LTV lending.

Buchs said she hoped the new rules would provide “a bit of an incentive” for lenders to “think twice” about the recent trend for some to provide mortgages for the entire value of a property with little or no deposit. “The intention is not really to tame the property price cycle but to make sure that whatever financing there is sound and the borrowers can actually afford it,” she added.

Another Bank of England rate hike?

UK employers hired record numbers of staff last month and labour shortages worsened. Job vacancies in the final quarter hit a record high of 1.247 million, more than double their level a year before.

Pay is rising but, due to inflation, consumers aren't seeing the benefits. Average earnings excluding bonuses in the three months to November were largely flat and will likely fall behind inflation in the months ahead. Consumer confidence is starting to ebb. The latest reading from the YouGov/Cebr consumer confidence index dipped slightly, though remains elevated compared to last year. Incidentally, the same survey shows consumers have the strongest expectations for rising house prices since May 2017.

That reading may temper if the Bank of England hikes the base rate again in February. Financial markets pegged the probability of that at about 85%, and that was before this morning's release of the Consumer Price Index, which has inflation running at 5.4%, a thirty year high.

In other news...

Monday we covered Knight Frank data indicating that a shortage of supply of residential rental properties across London and the Home Counties is set to tighten further in the Spring. We didn't include the link, so here it is.

Taylor Wimpey is bullish (Trading update), Wakin Jones on the buoyant BTR market (Results), Microsoft makes a big bet on the Metaverse (Times), Goldman Sachs’ David Solomon warns of ‘wage inflation everywhere’ (FT), Blackstone bets on the rent-to-buy market (FT), Lloyd’s of London considers exit from landmark City building (FT), and finally, China's property tax isn't going anywhere (Bloomberg).