Covid-19 Daily Dashboard - 29 September 2020

An overview of key economic and financial metrics.

2 minutes to read

Download an overview of key economic and financial metrics relating to Covid-19 on 29 September 2020.

Equities: In Europe, stocks are lower this morning, with declines recorded by the FTSE 250 (-0.8%), DAX (-0.5%), STOXX 600 and CAC 40 (both -0.3%). In Asia, equities were mixed, with the Kospi (+0.9%) and CSI 300 (+0.2%) both up on close, while the Topix (-0.2%) and the Hang Seng (-0.9%) closed lower. The S&P / ASX 200 was flat on close. In the US, futures for the S&P 500 are down -0.1%.

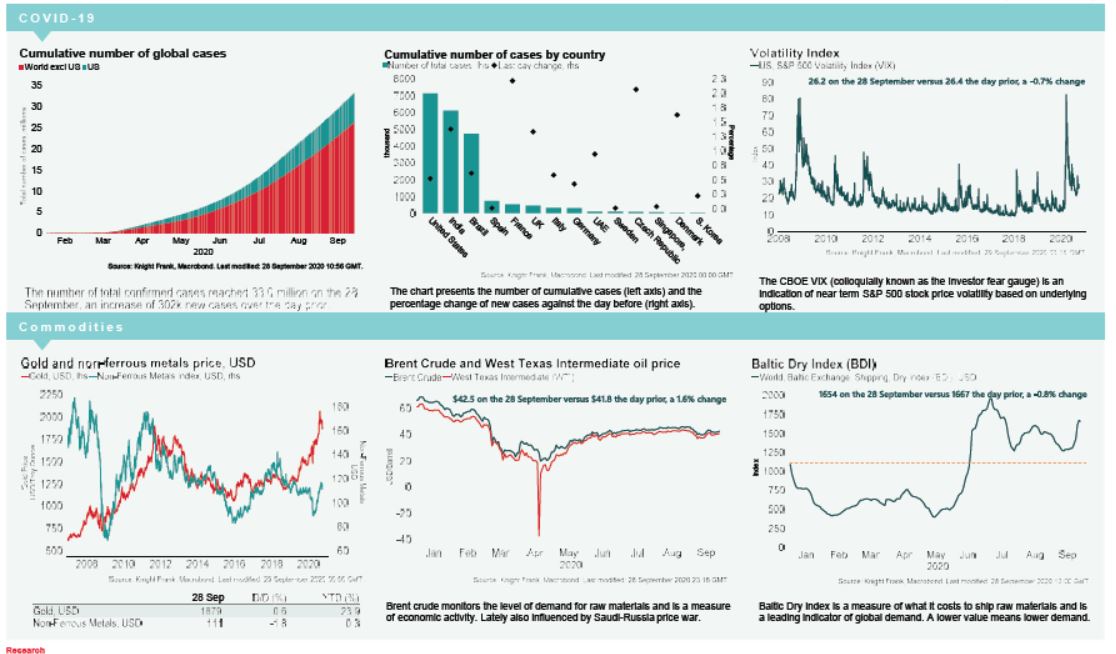

VIX: The CBOE market volatility index and the Euro Stoxx 50 vix are up +2.2% and +1.9% this morning to 26.8 and 26.2, respectively. Both indices remain elevated compared to their long term averages of 19.8 and 23.9.

Bonds: The German 10-year bund yield and the Italian 10-year bond yield have both compressed -2bps to -0.54% and 0.86%, while the US 10-year treasury yield is down -1bp to 0.65%. This is the lowest the Italian 10-year bond has been since October 2019. The UK 10-year gilt yield is flat at 0.20%.

Currency: Both sterling and the euro have appreciated to $1.29 and $1.17, respectively. Hedging benefits for US dollar denominated investors into the UK and the eurozone are at 0.36% and 1.14% per annum on a five-year basis.

Oil: The West Texas Intermediate (WTI) is back above $40 per barrel at $40.29, while Brent Crude is currently $42.59.

Baltic Dry: After increasing +28.6% over the course of last week, the Baltic Dry decreased for the first time in eight sessions yesterday, down -0.8% to 1,654. However, the index remains +52% higher than it was in January.

Gold: The price of Gold increased +1% yesterday to $1,879 per troy ounce. Gold reached a record of $2,063 on 6th August and has since declined -9%, however gold remains +23% higher than it was at the start of January.

Eurozone Inflation: After slipping into deflation for the first time in four years in August at -0.2%, the president of the European Central Bank, Christine Lagarde, announced that eurozone headline annual inflation will likely remain negative in the coming months. Lagarde outlined the stronger euro, earlier declines in energy prices and the temporary reduction to VAT in Germany as the main drivers for the continued decline in prices.