Emerging Demand for Luxury Handbags

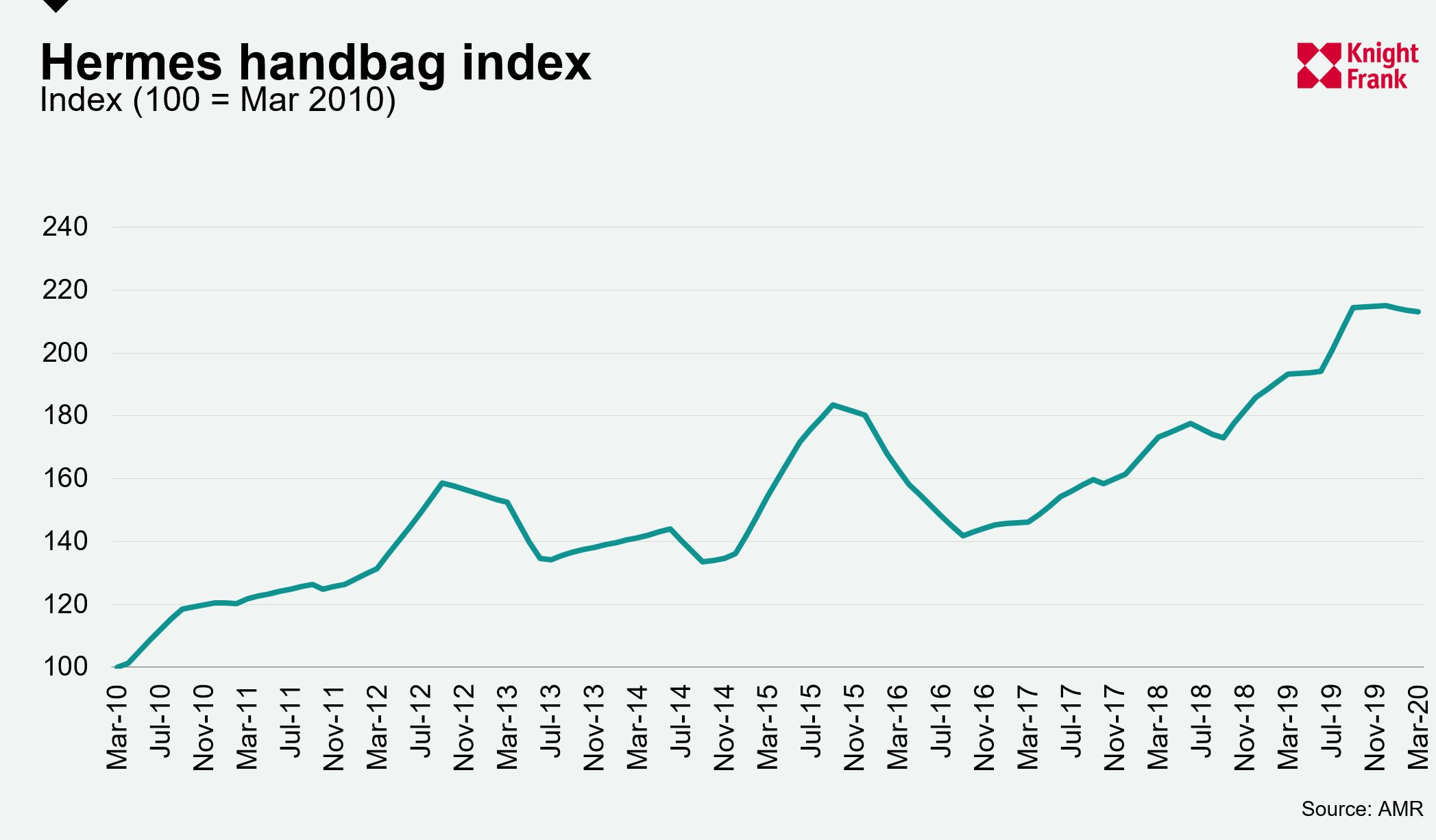

At the end of 2019, we introduced Hermès handbags into our Luxury Investment Index (KFLII) and with 13% annual growth they were the year’s top performing asset class. Our data supplier, AMR’s Sebastian Duthy provides us an update on this glamorous market.

3 minutes to read

What is driving the demand for handbags?

The market for collectable handbags emerged after 2008 and was driven in part by consumers thinking harder about where they were spending their money. Attention was inevitably drawn to high quality bags made by Hermès, which had until then been a well-kept secret by discerning French clients and a few beyond.

By 2011, it was getting harder and harder to get hold of these bags and the rush was on – particularly in the Far East. A few auction houses and resellers were quick to see the opportunity and consigned second-hand bags, many of which had recently been bought in store.

Average values dipped briefly as re-sellers regrouped and by 2015, the market more than doubled in size. In the last three years, the most celebrated Hermès handbags have regularly been breaking price records at auction. Bags such as Hermès ‘So Black’ Birkin and the Hermès Lizard Ombre are just two of a handful of bags whose prices are driven by influencers drawing attention to them.

In the past few years, interest in the collectable market has widened to include many other brands, including Chanel - the second most popular. While records are grabbing news, most won’t be surprised to hear that not all bags are suddenly very valuable. Astronomical prices apply to just a few pieces and while many iconic bags will have been uplifted by recent trends at the top of the market, condition is key.

A considerable size of the resale market is already composed of ‘young’ bags and so there is a high level of expectation among collectors that buying at auction shouldn’t mean settling for anything less than excellent condition.

How has the market been affected by COVID-19?

I would say that around 90% of collectable handbags can be bought online and so the lockdown hasn’t prevented buyers continuing to shop in this way. However, there’s been a definite shift in favour of the buyer who is now increasingly expecting what some in the auction industry are calling a ‘Covid price’.

An Hermès Himalaya Birkin – the world’s most expensive limited-edition handbag with examples regularly fetching over $200,000 at auction – was consigned to a Sotheby’s timed auction on 1 June this year with an estimate of $85,000 to $100,000, but failed to find a buyer.

It’s true also that collectors who are considering spending around $100,000 on a bag generally want to see it in person and so the lockdown is likely to have played a part.

Are there any interesting trends in terms of brands and specific types of bag that you see emerging from your index data at the moment?

In the UK, collectors are gradually shifting in their views. An Hermès bag used to be a one-off investment for life, but now more and more people are finding reasons to have more than one. The greatest demand for luxury bags has, for a long time, come from the Far East. After the lifting of the lockdown in Guangzhou in April, Hermès reported their biggest ever sale in one day at the shop there. Other luxury retailers, such as Chanel, were also confident about the pent-up demand and raised retail prices between 17% and 24% prior to reopening.

With great meaning attached to different colours in China, collectors will refresh their wardrobes with new bags in colours to suit spring and winter. Exotic skins are also high in demand, especially as regulators around the world seek to tighten the trade in endangered species.