Rise in Handbag Opulence

A new category of 'Collectable Handbags' topped the Knight Frank Luxury Index (KFLII), knocking off rare whisky off its prior number one position.

1 minute to read

An analysis of the Attitudes Survey in The Wealth Report 2020 revealed that properties form the largest percentage allocation in investment portfolios. However, data from the Art Market Research (AMR) shows a rising number of ultra-rich increasing their investment into objects of desire and collectibles.

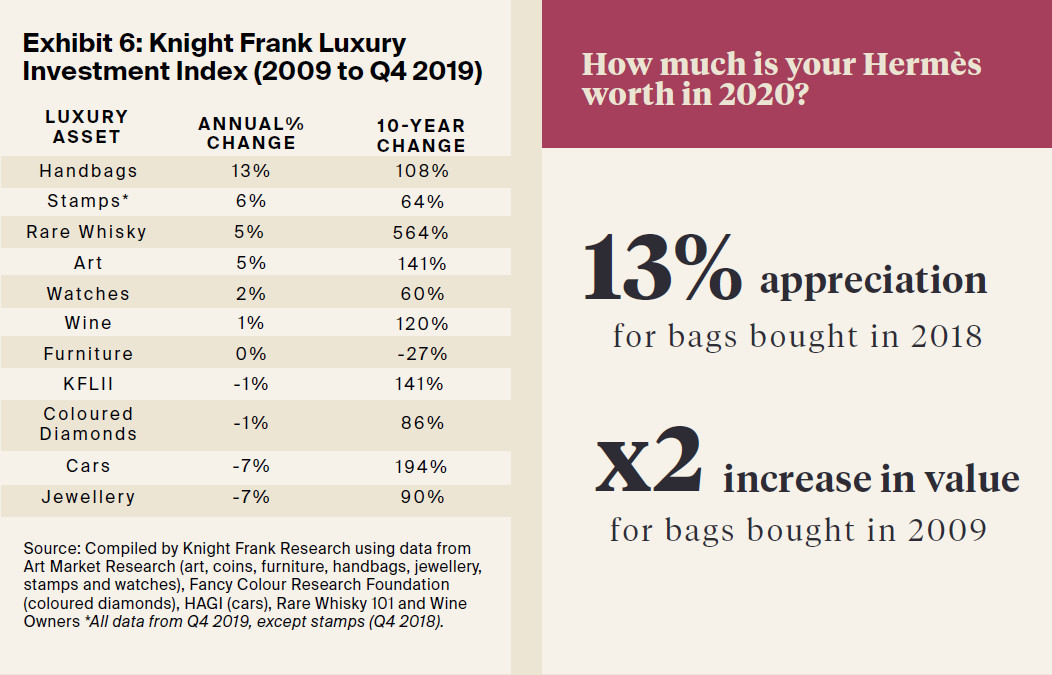

The Knight Frank Luxury Investment Index (KFLII) tracks the performance of a basket of notable, collectible asset classes. The new category entrant of ‘Collectable Handbags’ topped the KFLII, rising in value by 13% between Q4 2018 and Q4 2019 to knock rare whisky off its prior number one position.

In 2017, Christie’s set the world record for the most expensive handbag sold when it successfully auctioned off a rare Hermès Himalaya Birkin with white gold and diamond hardware at an all-time record price that was the equivalent of US$386,000. The secondary market for luxury handbags continued to grow ever since, with pieces fetching dizzying sums on a regular basis.

As with other investments of passion like rare whisky, which has risen sharply in value in recent years, collectible luxury handbags have found a foothold as an investment class in their own right, alongside highly desirable luxury accessories.

The KFLII tracks items that are most sought after as collectibles and investments, using data from Art Market Research (AMR), shown in Exhibit 6. The ‘Collectable Handbags’ index focuses specifically on Hermès bags, which doubled in price value over a 10-year period (108% growth).