A big institutional bet on London offices

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

The London office market is primed for a recovery. Prime yields in the City and Southbank have been stable for five quarters, and that extends to seven quarters in the West End.

Investment volumes are picking up, but slowly and from a low base. Investment transactions rose 35.6% to £1.8bn in Q2, which was the best performance since Q1 2023 but still a little under half the long-run average, according to the latest update from Knight Frank’s Shabab Qadar. The Budget compounded the prevailing uncertainty over the path of borrowing costs and institutions have been sitting tight. Private capital remained the dominant investor group in Q2, accounting for 46% of transactions, followed by private equity at 37%.

It feels significant, then, that Aware Super, one of Australia's largest pension funds, will deploy £1 billion in London offices alongside Delancey in as little as 12 to 18 months "depending on market conditions". In an interview with the FT this morning, Damien Webb, Aware’s head of international and deputy chief investment officer, suggested that values look cheap, and that a shortage of the best buildings with high sustainability ratings will lead to a supply crunch, fuelling rental growth in the years ahead.

An irresistible strategy

This looks a good bet and to some degree it's already happening. Available new space, our closest match to grade A, has a vacancy rate of 1.9%, and is marginally above the long-term average. In the core submarkets of the City and West End, the vacancy rates for new space stand at 0.6% and 0.4% respectively, which are amongst the lowest rates we have recorded. In Canary Wharf, where the total vacancy rate is high, the availability of grade A space is 3% and below the long-term average. These figures have been key to driving rental growth in some submarkets despite there being little to no economic growth.

Our assessment of expected completions beyond 2025 falls below average levels of take-up for prime quality space. The current under-construction speculative pipeline stands at 11.3 m sq ft completing by 2028. That's slightly higher than Q1 but still just over 7m sq ft short of the average levels of the new and refurbished take-up that we expect up to that date.

Buying up buildings that can be retrofitted or refurbished looks to be a great trade. Giving the US perspective to Bloomberg this week, Paul White, who runs a specialized fund for Hines, said it was a simply "irresistible" strategy. Asset managers interviewed by the newswire spoke of doubling their clients’ money in just a few years by renovating older buildings, adding 20% to rents and then cashing in on gains when they sell.

Meeting the challenge

Sounds simple? It isn't. Landlords must balance all sorts of choices when investing in upgrades, both in terms of the level of sustainability and the various amenities worth considering.

Flora Harley lays all of this out in detail in a new report: 'Meeting the commercial property retrofit challenge', which is the second in a series of insight papers on the topic. Upgrading a hypothetical EPC D-rated office building in London to meet the potential EPC B minimum target would cost £113 per square foot, but that climbs to £268 psf when combined with a high level of amenities.

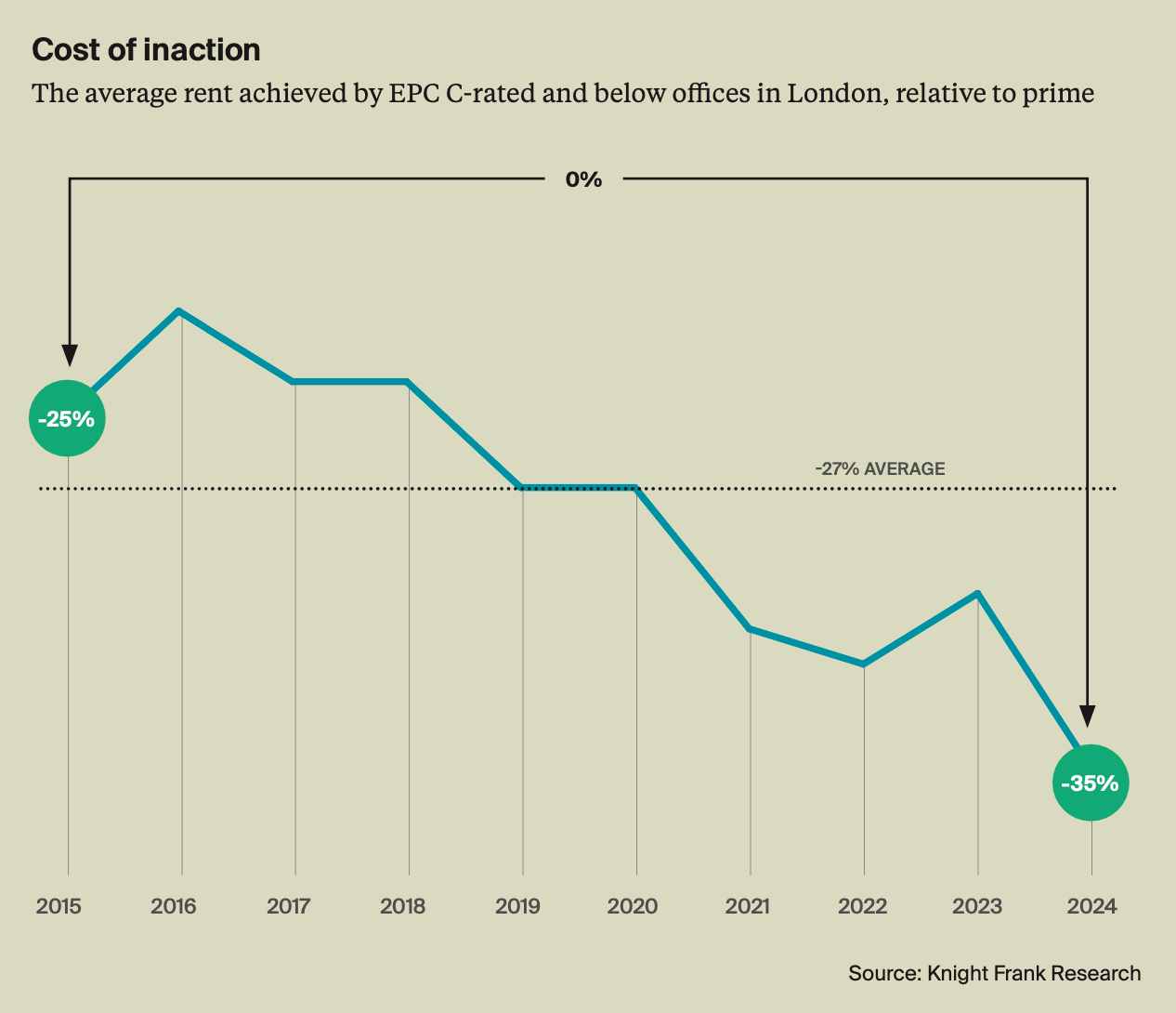

The gains can be substantial: offices that have been retrofitted or refurbished from EPC C (or lower) to EPC B or above, often with added amenities, have on average seen the gap to prime rental levels narrow by 18 percentage points. And that needs to be balanced with the cost of inaction, which is substantial and growing (see chart). See the report for more.

A long way short

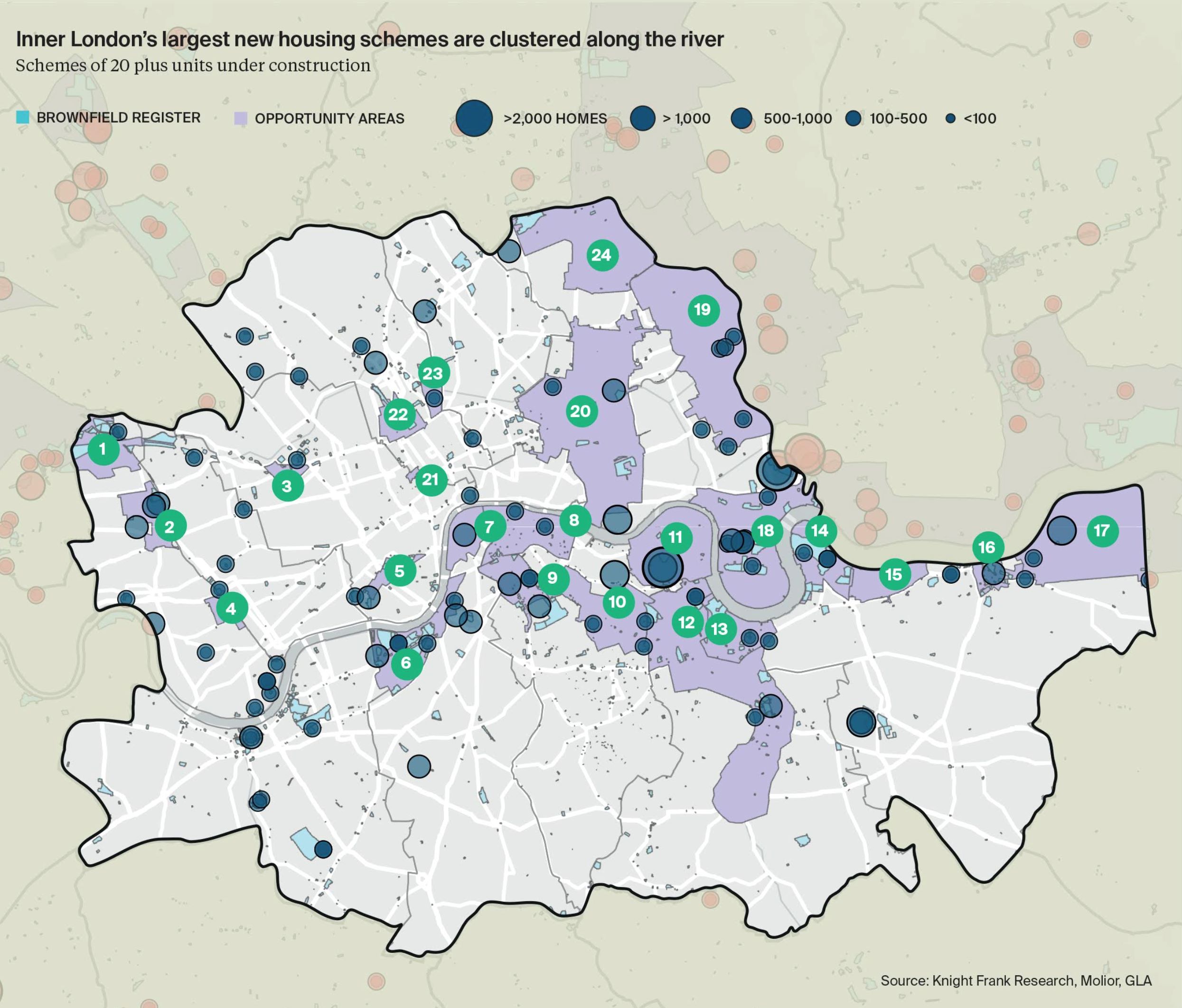

Rising costs, labour shortages and planning delays have had a significant impact on housing delivery in London. There are about 41,000 homes at varying stages of construction across the capital, which is a long way short of the Mayor's new target for 80,000 homes to be delivered per year.

Anna Ward breaks down the pipeline in a new report. Around a quarter of the units recorded underway in the second quarter were Build-to-Rent, Molior data shows. Tower Hamlets, Barnet and Greenwich are the top three boroughs with the most homes currently under construction. In total, just 1,879 units started construction (in schemes of 20 plus homes) in the second quarter, one of the lowest levels on record.

That said, there are plans for large-scale schemes in the works. The capital’s 20 plus unit pipeline includes over 105,000 homes that were granted full planning permission within the last three years. So far this year, developers have put in applications for a further 23,000 homes.

Sentiment among housebuilders is improving, but it's going to take time. Mortgage rates have plateaued in recent weeks and even ticked up a little. Both business and consumer sentiment have been knocked by Budget speculation. In a strong set of results published Wednesday, the newly-named Barratt Redrow said the private bookings rate for the combined group jumped about 37% during the August 22nd to October 13th period, compared with the corresponding year-ago figures from the two businesses. It expects to build between 16,600 and 17,200 homes in its fiscal year ending June 30th.

In other news...

Rachel Reeves confirms change to UK fiscal rules to help fund £20bn of annual investment (FT), US mortgage rates increase for a fourth week (Bloomberg), how squeezing the rich through tax may backfire (FT), and finally, are bosses right to insist that workers return to the office? (The Economist).