Inflation returns to target...for now

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

The UK's annual rate of inflation fell to the 2% target for the first time in three years during May, the ONS reported this morning. The fall is in-line with what analysts had been expecting.

The Bank of England's Monetary Policy Committee will almost certainly opt to hold the base rate at 5.25% when it publishes its latest decision tomorrow. Members of the MPC have paused communications during the election campaign, so would be unable to explain why they had opted to loosen policy in the unlikely event they chose to do so. An August rate cut now looks plausible.

Measures of core inflation continue to illustrate why the MPC is acting cautiously. Core CPI climbed by 3.5%, down from 3.9% in April. Services CPI eased to 5.7%, from 5.9% - still painfully slow progress. These figures are largely in-line with the Bank of England's May forecast, which said inflation would fall to target before rising again to 2.5% due to the "unwinding of energy-related base effects". In other words, favourable comparisons will soon begin to drop out of the annual figures.

Maintain course

For three years, CPI and an MPC decision in the same week has been a recipe for volatility, but this time the housing market is likely to continue as if neither had happened.

After spending weeks cutting and hiking mortgage rates, the lenders are beginning to fall quiet. Activity is sluggish: metrics spanning new buyer enquiries and agreed sales both weakened in May, according to the latest RICS survey.

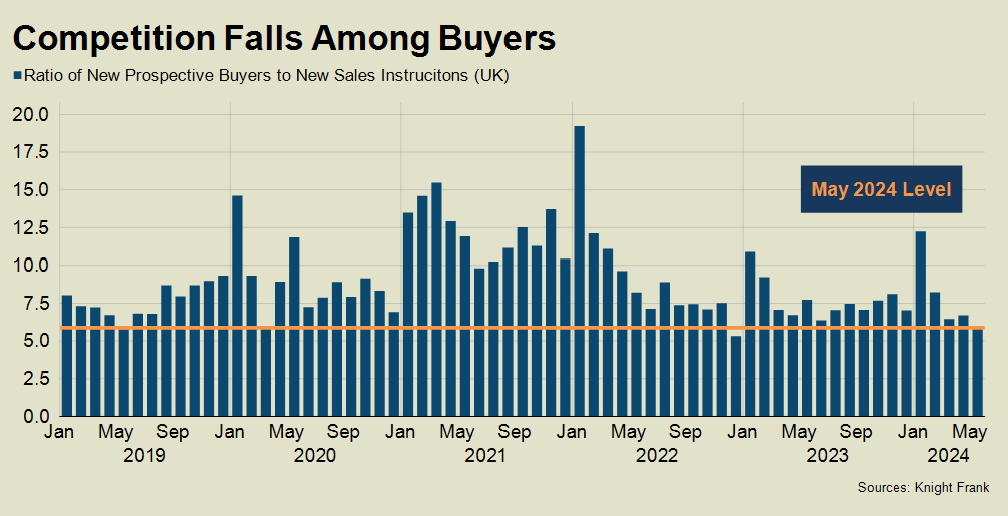

The demand side has weakened as supply is rising, which presents a rare opportunity for buyers that are able to act before conditions change. There were nearly 6 new prospective buyers for every sales instruction in the UK in May, Knight Frank data shows (see chart). Buyers have only faced less competition once during the last five years: two months after the mini-Budget in December 2022.

Lacking urgency

"We continue to see good levels of enquiry for well-located homes built to a high standard of design and quality but recognise that the current lack of urgency in the market is likely to remain until the long-anticipated reduction in interest rates commences."

That was Rob Perrins, Chief Executive of Berkeley, reporting annual results this morning. The company delivered pre-tax profits of £557 million, in line with the guidance provided at the start of the year. The value of Berkeley's net reservations has been consistent through the year at levels around one third lower than the prior year, "reflecting the ongoing elevated political and macro volatility."

The most eye-catching news in the release is the announcement of a new Build to Rent platform, aiming to "maximise returns in today's market conditions." The company has identified some 4,000 homes across 17 of its brownfield regeneration sites as an initial portfolio, which it will build out during the coming decade.

Supply and demand

Our first quarter Build to Rent market update illustrated what investors find so attractive about the sector. There are 5.7 million privately renting households across the UK - current operational BTR supply caters for just 1.9% of that number. The UK’s BTR stock now stands at 109,803 completed homes with a further 63,240 homes under construction and 80,400 with full planning permission granted. Even once all that is built out, the sector would still only cater to 3% of privately renting households.

This supply/demand imbalance looks unlikely to shift. Based on current household growth projections, we estimate there will be an additional 263,000 privately renting households by 2030. If the BTR sector continues to add around 14,000 homes each year, as it currently does, the provision rate would only increase from 1.9% today, to 3.4% by 2030.

That in-part explains why UK BTR investment hit £1.3 billion in the first quarter, up 21% year-on-year and the highest figure recorded for a first quarter. Operational deals accounted for 35% of investment flowing into the sector, the highest proportion since Q1 2021. London accounted for 52% of total investment over the course of the quarter, a sharp reversal of a slower investment market in the capital in 2023 when viability challenges, especially for larger schemes, impacted volumes.

In other news...

Sir George Iacobescu will step down as chair of Canary Wharf Group, to be replaced by former L&G chief Sir Nigel Wilson (FT), why UK private equity is ‘encouraged’ by Labour’s signals on promised tax crackdown (FT), and finally, traders bet on a treasury rally with two 2024 Fed cuts priced in (Bloomberg).