Buying Opportunity Arises as Election Manifestoes Launched

Competition among buyers has fallen ahead of the election, which is putting downwards pressure on prices.

3 minutes to read

The performance of the UK housing market this year will be shaped by events of 22 May.

Ten hours after inflation numbers were released that morning, Rishi Sunak called a general election.

Next month’s vote has certainly received more attention, but the cost-of-living data will have a bigger impact on buyers and sellers.

Before we explore why, what did we learn from the party manifestoes last week?

A quick look at our latest policy table shows that all parties have once again over-estimated their ability to influence how many houses are built in the UK.

Housebuilders deliver houses based on demand, which ebbs and flows according to economic not political cycles. Recent low levels of delivery have largely been caused by higher mortgage rates not growing blockages in the planning system.

Not that anyone is suggesting the planning system is in perfect working order. But when a politician says “we” need to build more houses, it’s unlikely they are planning to pick up a trowel themselves.

Will any of these lofty one million-plus housebuilding targets be hit? Highly unlikely, as my colleague Oliver Knight explains here.

Elsewhere, the Conservatives plan to help first-time buyers by reviving Help to Buy, extending the deposit guarantee scheme and keeping stamp duty at zero for sales under £425,000. Six months ago, you could reasonably have guessed that all three measures would be included in their manifesto.

There were equally few surprises from Labour, whose plans include a 1% stamp duty surcharge for overseas buyers and its own set of similar proposals to make life easier first-time buyers.

An analysis of both parties’ plans to change the current non dom tax rules can be found here. Given Labour has put wealth creation at the heart of its manifesto, how it treats the wealthy if it wins power will come under scrutiny.

Amid the political fanfare of the last three weeks, the fact financial markets have pushed out their rate cut expectations to November has slipped under the radar.

It is largely thanks to the stubbornly-high services inflation number of 6% released on 22 May, although the picture has since become hazier. Last week, strong UK private sector wage growth won’t have helped the case for an early cut but falling US inflation will.

Overall, mortgage rates are unlikely to fall meaningfully any time soon and that, together with a degree of political uncertainty, is keeping demand in check.

Ironically, it has rarely been a better time to be a buyer in recent years.

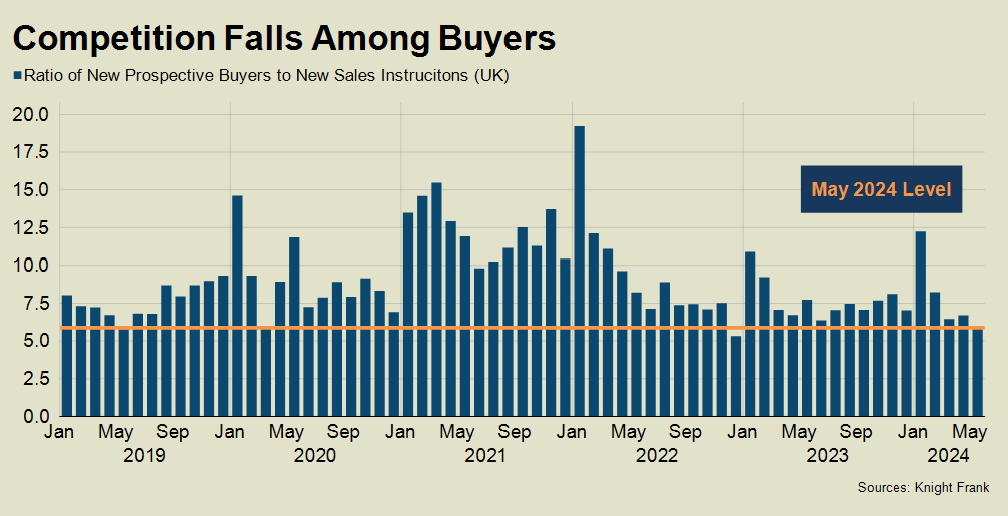

There were 5.9 new prospective buyers for every sales instruction in the UK in May, Knight Frank data shows. Buyers have only faced less competition once during the last five years, two months after the mini-Budget in December 2022, as the chart shows.

As the Nationwide and Halifax indices have demonstrated in recent months, higher supply and lower demand is putting downwards pressure on prices. It is something that sellers should bear in mind, together with the reality that a wave of owners are rolling off sub-2% mortgages, as we explored here.

The autumn market is likely to begin with greater political certainty, but will it be further buoyed by a rate cut?

Inflation data this Wednesday will provide a good steer as to whether current expectations for November look too gloomy or if a cut is more likely in August or September.

Whatever month it happens in, buyers can certainly expect stiffer competition after the summer.