1.4 million homes need upgrading yearly to reach EPC C target

UK domestic target required for 2033 will need to grow 20 times the current rate in order to be successful.

3 minutes to read

Energy Performance Certificate (EPC) rating of C or above is the minimum standard, proposed by Rt hon Chris Skidmore, to be able to sell homes in the UK by 2033.

The government previously proposed 2035 in the energy efficiency bill in 2021 yet nothing has yet come to fruition.

It’s common knowledge that 42% of UK emissions are influenced by the built environment, and 25% directly controlled by it. A lesser known fact is that of those directly controlled, almost 60% is down to domestic buildings – the lion's share of which is operational, i.e. heating and running homes.

The UK's older (approximately a quarter of homes built before 1919) and 'leakier' housing stock is partially to blame and a crucial part of the UK's road to net zero.

Much has been written about the need to implement minimum energy efficiency standards across all of the UK’s housing stock – with the most recent call for a minimum EPC C-grade by 2033 in the Review of Net Zero by Chris Skidmore.

Minimum efficiency standards are already in place for the private residential sector, requiring an EPC E from 2020 with proposals to raise this to C by 2025 for new tenancies and 2028 for all tenancies – although this may shift beyond this date given inaction.

The retrofit rate required needs to grow 20 times if the proposed 2033 deadline is to be met.

Our latest analysis looks at the entire residential sector to assess the impact of any forthcoming legislation. We found that:

- More than half, 56%, of residential properties in England currently fall below the potential minimum of EPC C.

- On average, over the past five years, some 148,000 properties saw their EPC rating increase.

- Half of these, or 51%, were upgraded to EPC C or above - that equates to just 0.5% of the shortfall each year being brought above the minimum threshold.

- If this rate were to continue, the entire housing stock would take over 200 years to reach the required level of minimum EPC C.

- To meet the 2033 deadline, 9% of those under EPC C, which is 5% of the total housing stock, needs to be upgraded annually; that's 1.4 million homes, notwithstanding exemptions.

- Even if we consider the UK GBC Net Zero Whole Life Carbon Roadmap 'National Retrofit Strategy', which aims to retrofit 97% of homes by 2040, there is still a requirement for almost 630,000 homes needing upgraded each year – ten times the current level.

The numbers make for stark reading and demonstrate that more needs to be done to substantially increase the pace of retrofitting UK homes and address operational emissions from the domestic sector.

Listed properties a unique challenge

Listed properties are likely to be exempt from minimum efficiency standards, but they may be some of the weakest performers.

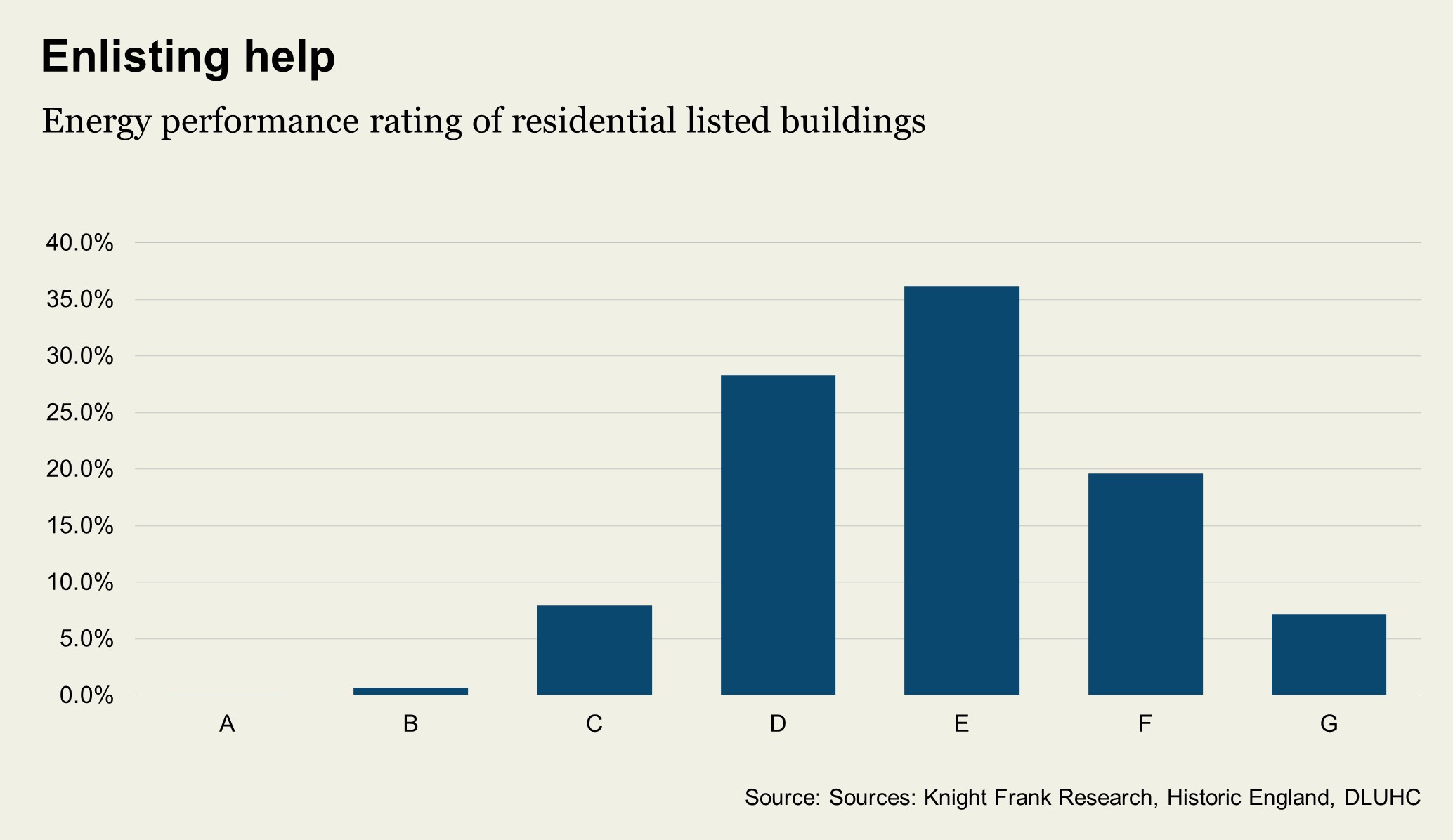

Around 198,000 residential properties in England, or fewer than 1%, are listed. When we examine EPC ratings, 91% are EPC D or below, with less than 1% rated EPC A or B.

The greatest barrier to upgrading remains cost, for the private rented sector we estimate a potential cost of £17.9 billion of upgrades by landlords, notwithstanding exemptions. For listed buildings, there is an added layer of complexity and possible cost depending on the permissions required.

As we have previously spoken about, there is a value uplift for upgrading homes, not to mention potential cost savings. Yet to reach any quantum both the carrot and stick will be needed.

As put forward by the UKGBC this could include measures such as: variable stamp duty rates; removal of VAT on refurbishment work; council tax reform considering variable rates dependent on energy performance; incentivise banks and lenders to offer low interest mortgage extensions and retrofitting loans for landlords and homeowners; and direct government grants for low-income households.

What is clear is the scale of the challenge. Innovation and incentives need to be introduced and importantly aligned to move the dial significantly.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here