UK Commercial property space could be at-risk of non-compliance

With the Minimum Energy Efficiency Standards now in effect, we estimate that as much as 5% of commercial property space could be at-risk of non-compliance.

3 minutes to read

From 1 April, all tenanted commercial property buildings across the UK, including shops, offices and warehouses, needed to have an energy performance certificate (EPC) rating of at least an E under the Minimum Energy Efficiency Standards (MEES).

We crunched the numbers and estimate that some 5% of commercial property floorspace falls into this category. Those landlords whose buildings are rented out but fall short of the new regulations, face being named and hit with a fine of up to £150,000.

What properties will be affected?

Whilst some will not be subject to regulation, due to owner-occupation or a number of exemptions, that equates to around 364 million sq ft of property.

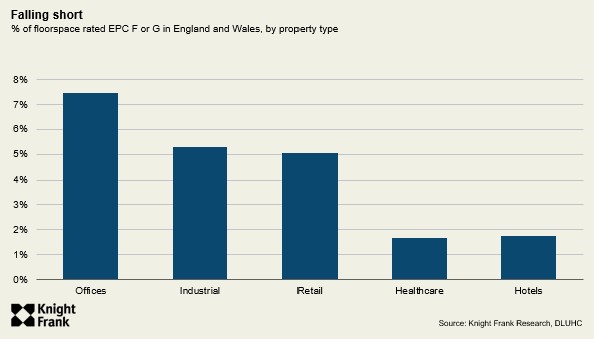

The sector most at risk is offices, with 7.5% of floorspace, almost 139 million sq ft, falling into EPC F or G, with hotels being the least with under 2%. However, my colleague Philippa Goldstein notes that “often hotels are not leased but owner-operated or operated under management agreement and therefore many don’t require EPC ratings until such time that a sale process is executed” so it’s possible for this to be an underestimate.

Of course, there are nuances to the numbers. For example, the 5% of retail space failing to reach the required E grade may be due to “the ability to enhance sustainability often coming with a hefty price-tag, which landlords ultimately must weigh against the benefits. For many of those falling below the EPC E there will be a large bias of owner-occupation, particular in smaller high street locations,”

Stephen Springham, Knight Frank Head of Retail Research noted: “From a retail perspective, the findings are very sobering, but perhaps not altogether surprising. As a challenged, often cash-strapped sector undergoing long-term structural change, ESG concerns are not always top of retail’s agenda. Retailers will always opt for a store where they are going to make the most money, regardless of EPC credentials.

By their very nature, many F and G-rated stores are going to be low-grade, low-quality stock that invariably are the preserve of independent operators and small traders. If they are deemed ‘unlettable’, what is to be become of them? Could we see a clash of E and S?”

What regions will be impacted most by MEES?

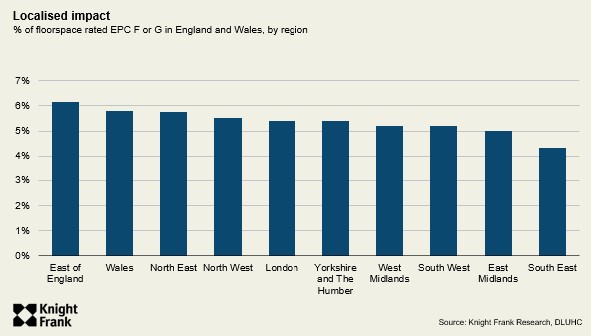

Looking geographically and the East of England faces the biggest challenge with 6% of floorspace EPC F or G rated, followed by Wales with 5.8%.

London sits in the middle with 5.4%, and of those, 59% are offices whereas in the East of England, the majority, 41%, is for industrial units with 30% offices.

The region with the least exposure, the South East with just 4.3% of stock rated EPC F or G, is fairly evenly split with 41% of these being offices, and a quarter of each industrial and retail.

The push towards more sustainable or ‘green’ buildings however is not just regulatory, there is a growing demand from occupiers for sustainable real estate. This is leading to what our previous research found, that green-rated office buildings in central London can command a rental premium of up to 12.3% and sales premium up to 10.5%.

Yet we cannot ignore that this is the start of regulation which is likely to get more stringent. Whilst not yet in law, and omitted from any recent announcements, there has been consultation on increasing the minimum EPC requirement to C by 2027 and B by 2030. We have covered previously what this looks like for London and major regional cities.

Despite any indication on if, and when, this standard will be raised was omitted from recent announcement, the formation of the Energy Efficiency Taskforce may see this come to light.

A short guide to MEES

Read our snapshot explanation of what MEES changes will mean for property when the changes come into effect in April.

Subscribe for more

For more market-leading research, expert opinions and forecasts, subscribe below.

Subscribe here