Which locations offer the most potential for UK BTR?

The number of complete BTR units across the UK has tripled within the last five years, and the pipeline continues to grow. Some 24% of local authorities now have at least one scheme open and operational.

2 minutes to read

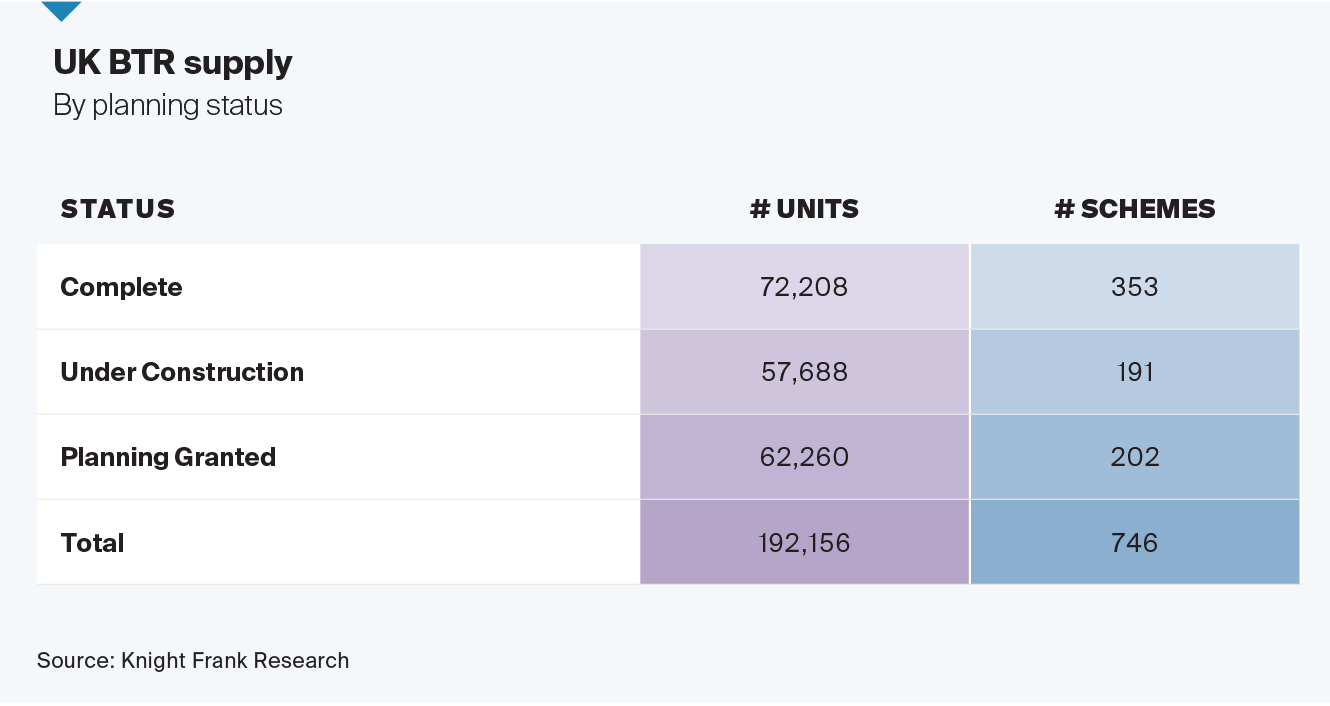

There are just over 72,000 complete and operational BTR homes in schemes of 75 or more units across the UK, according to our database. A further 57,000 units are currently under construction and an additional 61,000 have full planning permission granted. This brings the total BTR pipeline to 190,000 homes.

Which markets should investors target?

When considering specific opportunities, it is important to emphasise a rigorous and site-specific approach, but some locations will naturally boast stronger fundamentals than others. To provide some guidance, we have analysed key BTR metrics relating to supply, demand, value, and market potential for local authorities across the UK. The data has been overlayed with market knowledge from Knight Frank's investment, development, and valuation teams on factors including viability and scale.

Methodology

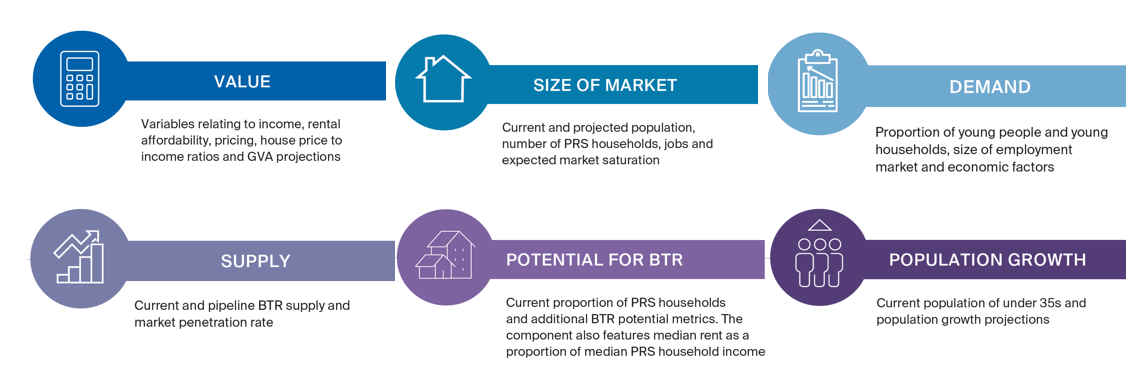

Our study of local authorities across the UK analyses 40 economic and demographic indicators relevant to BTR investment and development grouped across six components: value, size of market, demand, supply, potential for BTR and population growth. While we have put forward two scenarios below which we believe can help with prioritising opportunities for investment and development, the locations highlighted are by no means exhaustive. Different investors will have different priorities, both in terms of returns but also tenant profile, and accordingly the weightings for each of the components can be adjusted.

Established and growth markets

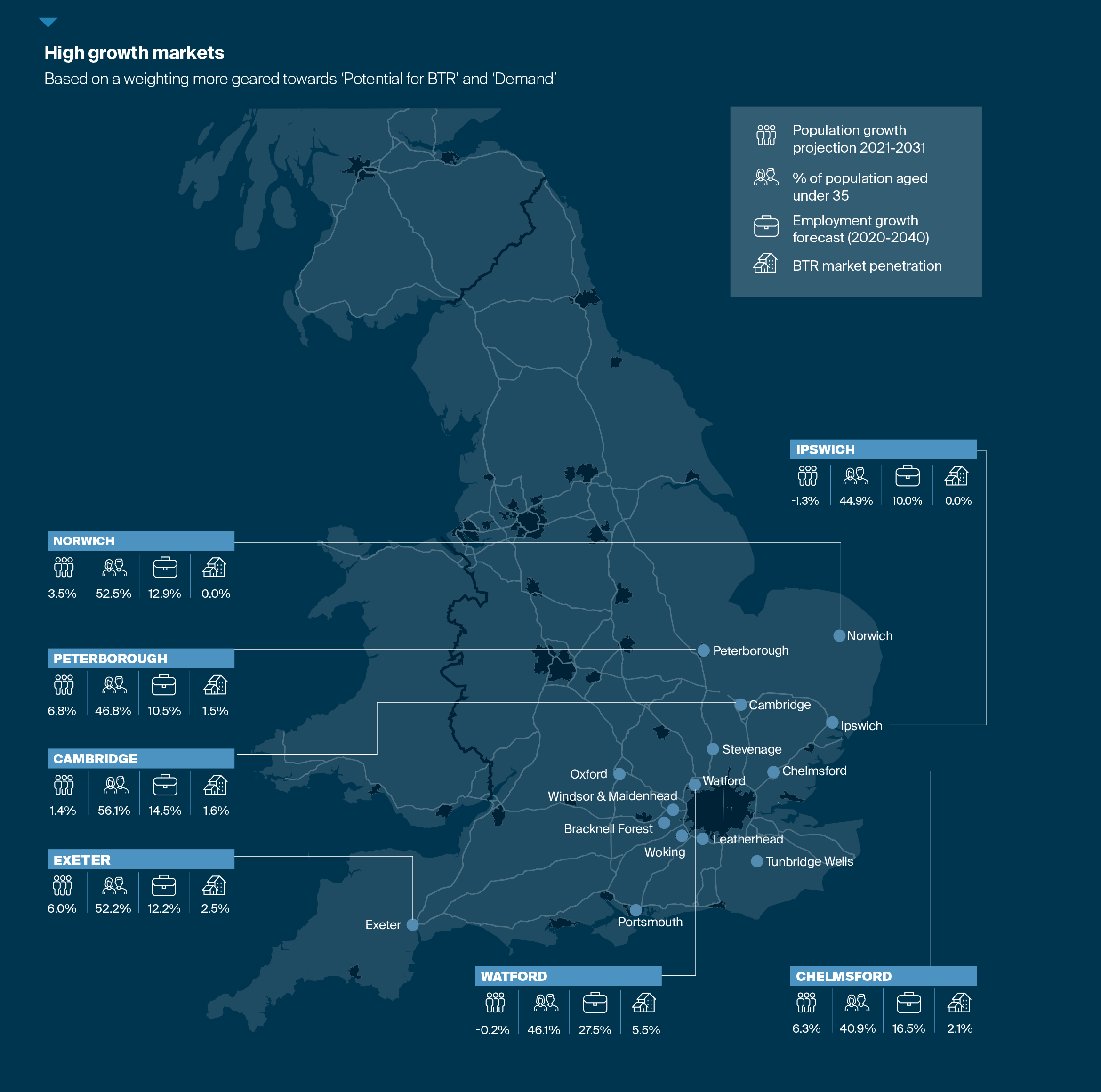

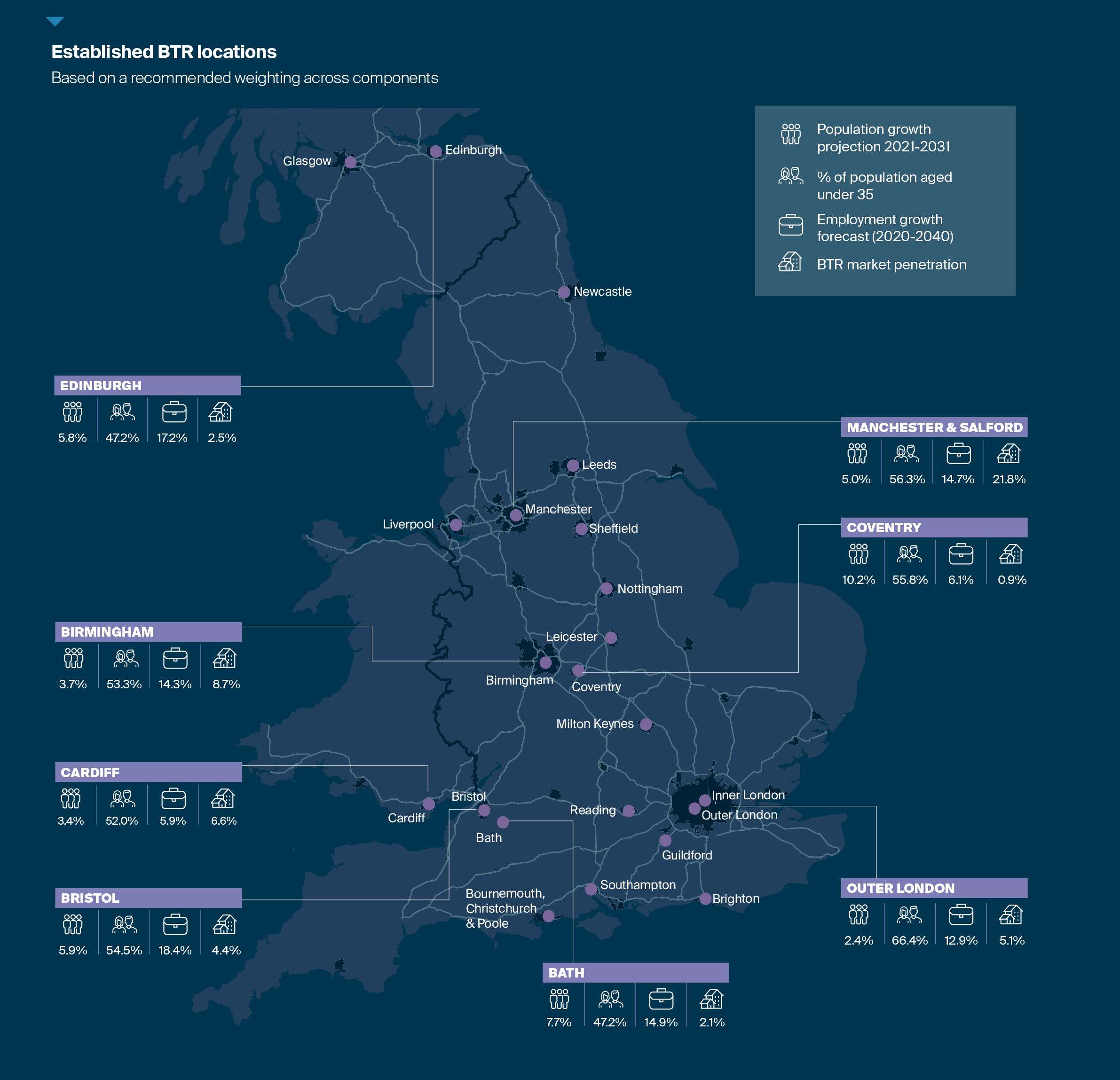

The maps overleaf outline the results of two modelled scenarios, one based on our recommended weighting across metrics, and one more heavily weighted towards market potential (ie. locations with strong demand-side fundamentals, but a small pipeline of BTR units).

In the first scenario, established BTR markets such as London, Birmingham and Manchester score well, supporting the growth trajectory of the market to date.

In the second scenario, the list includes a number of Tier 2 towns and cities which boast strong demand drivers but typically have small pipelines, presenting a strong case for development. Some, such as Oxford and Cambridge, have been on investor’s radars for a while, but it has been challenging for BTR to compete with open market sales schemes.