UK BTR market proving its resilience

Investment into UK Build to Rent has been strong so far in 2022, with a significant level of capital committed in the first three quarters of the year.

4 minutes to read

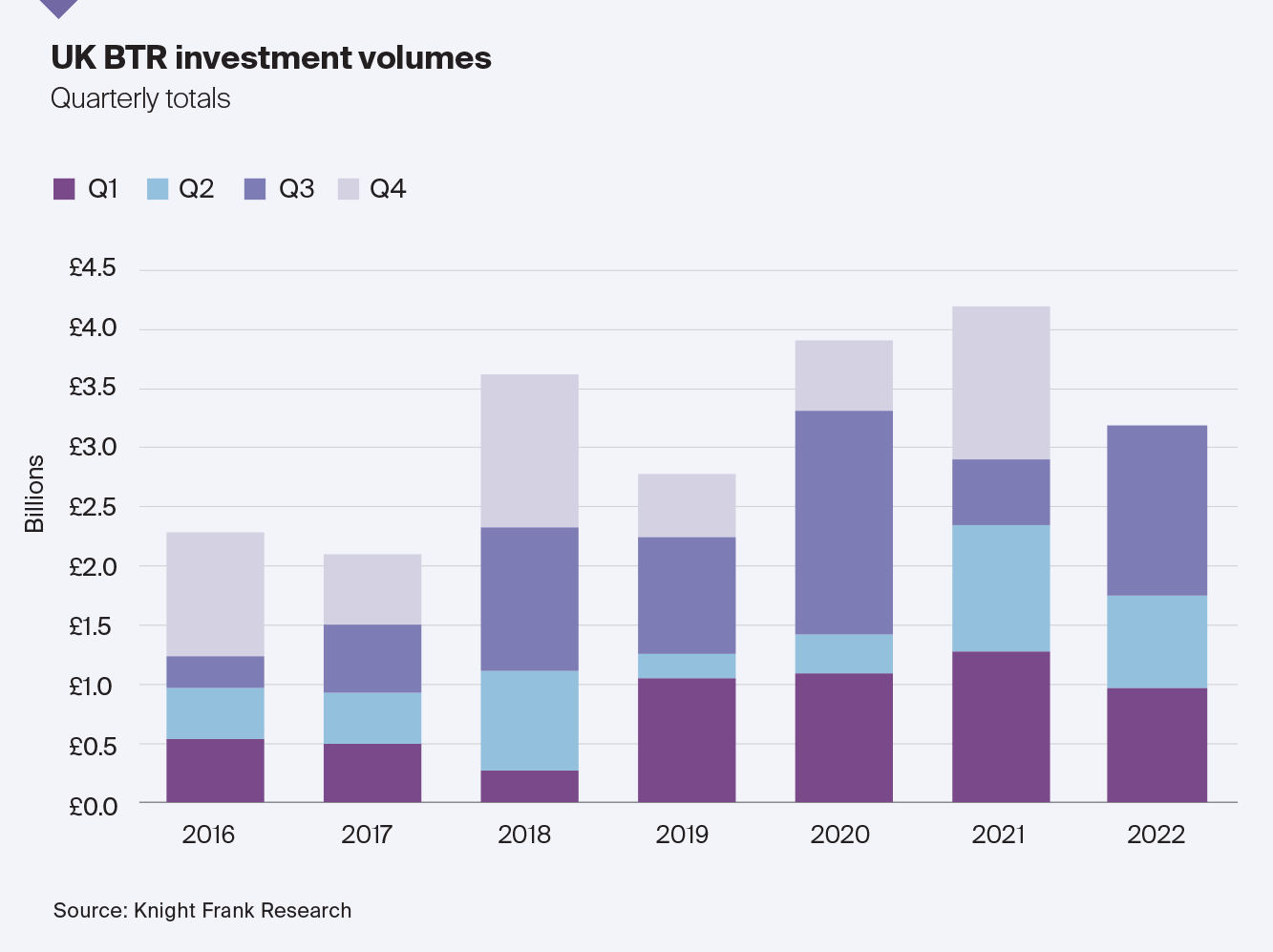

Almost £3.2 billion of capital has been committed to the UK Build to Rent (BTR) sector during the first three quarters of 2022, up 10.2% year-on-year. Some £1.5 billion was spent in the third quarter alone, the second strongest quarterly investment figure on record and 60% higher than the quarterly average for the last five years.

Investors have been undeterred by a macroeconomic backdrop characterised by soaring inflation and rising interest rates, but higher financing costs since September’s ‘mini-budget’ mean we expect a slowdown in investment in the final three months of the year as some highly leveraged investors take a pause.

That said, deals are still progressing. Investors previously looking to use debt to finance their purchases are drawing on cash reserves with a view to refinancing later. We have identified a further £650 million in deals in solicitors hands which could trade by year-end, which would take the full year investment figure to £3.8 billion. While that would be slightly down year-on-year, it would be 31% higher than the 2016-20

long-term average.

Our Q4 estimate is a conservative one given ongoing strong demand and the large pipeline of deals currently on the market or under offer, but it accounts for the fact that some of these deals may take longer to complete and be pushed into early 2023. Should access to finance get easier, or other pressures ease, that figure will rise significantly. BTR is a proven counter-cyclical asset class. Investors continue to be attracted to the sector for a number of reasons:

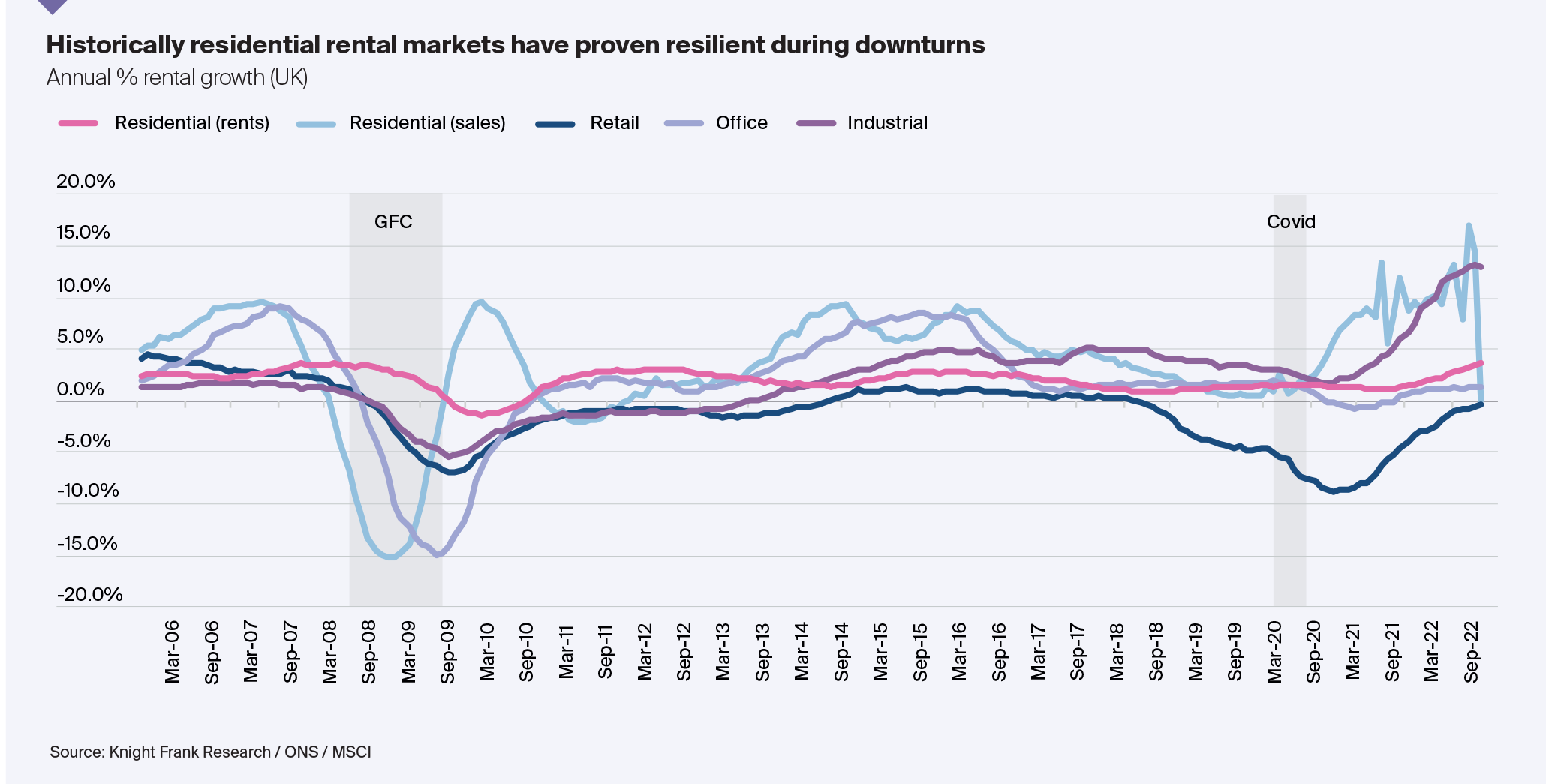

• Low volatility and resilience of the rental market in times of economic turbulence;

• Structural supply shortfall of rental homes and subsequent opportunity for scale;

• Growing tenant demand;

• Positive rental outlook.

Build costs have been a challenge to scheme viability, exacerbated by supply chain delays, as well as labour availability post-Brexit. Current expectations are that costs are easing (BCIS forecasts 3% growth in build costs in 2023, down from 11% currently), which should support development activity and improve viability.

Short term volatility vs long term performance

There are plenty of other reasons to be optimistic. For investors, the rental market has proven its resilience before, most recently through the pandemic, but also through the Global Financial Crisis, where the peak to trough fall in rents was just 1.4%. The fact that 25% of capital committed since 2020 has come from new entrants to the UK market is evidence of more investors looking to the sector for diversification and defensive long-term income.

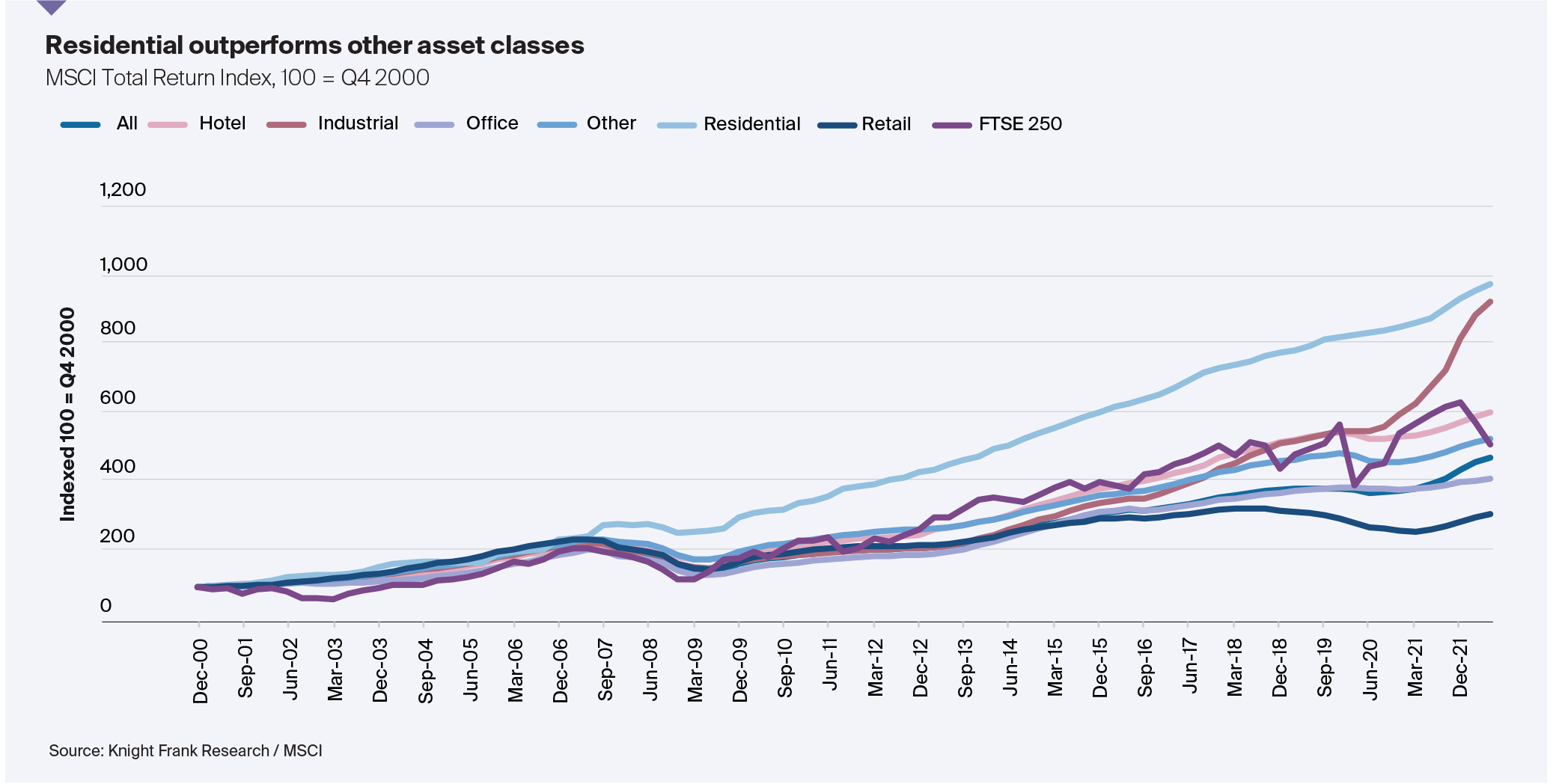

Data from MSCI suggests that over the last 20 years the UK residential sector has delivered the highest total return of all other property types (retail, office, hotels and industrial).

Rental markets also offer some hedge against spiralling inflation thanks to the presence of shorter leases and a frequent turnover of tenants. While the sector is not immune to the more challenging backdrop, we expect that it will again prove its resilience. In turn, this will lead to increased competition for assets and support yields.

Strong renter demand

On the operational side, the supply and demand dynamics in the sector are rock solid. This is reflected by the fact that lease-up and occupancy for schemes launched in the last year has been incredibly impressive. Many schemes stabilised well ahead of expectations in Q3, according to data from Molior London, including some which leased at more than 100 units per month.

Furthermore, the labour market in the UK is tight. The unemployment rate stood at 3.6% in October. Wages are also rising – particularly among the 25 to 34 age cohort – supporting current strong rental growth.

Challenges facing the private sales market, including affordability constraints as a result of spiralling mortgage costs will prevent many first-time buyers from getting on the housing ladder.

Supply squeeze

Added to this are supply-side pinches. The RICS Market Survey continues to report falling landlord instructions, while listings volumes across the UK in October were 43% lower than the five-year pre-pandemic average for the month.

The prospect of further reform impacting the buy-to-let sector could reduce private landlord numbers further. Data from the latest English Private Landlord Survey suggests that recent and forthcoming changes to legislation are the most common reason for landlords choosing to decrease their portfolio size or to leave the sector, a move which will put further pressure on new supply of rental accommodation.

One such legislative proposal is to implement a minimum requirement for letting a property to EPC ‘C’ rating from 2025 (on new tenancies) and 2028 (all tenancies). Our analysis suggests that nearly 60% of existing rental stock falls under that threshold.

Valuing the market

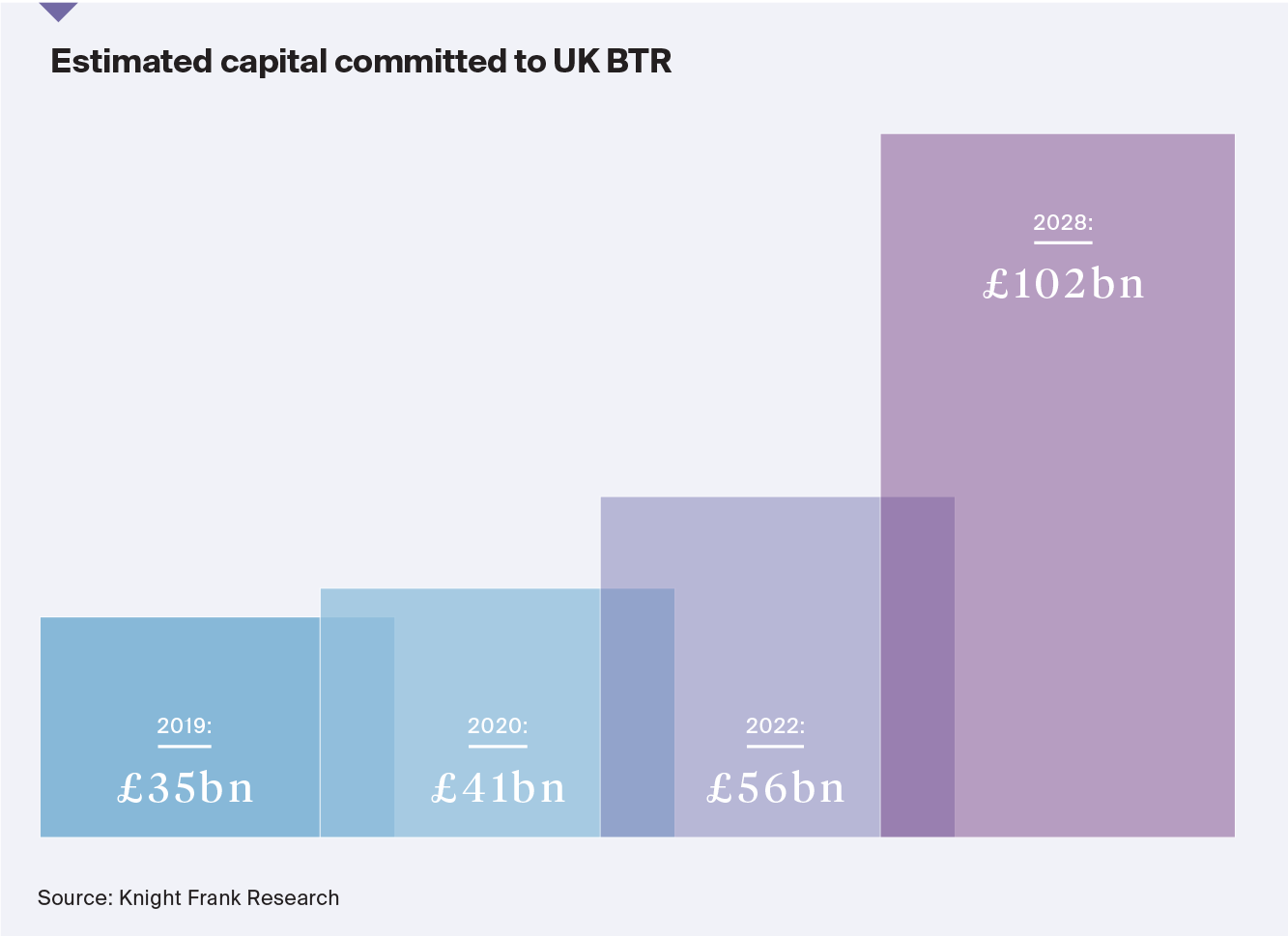

Based on our analysis of current operational BTR stock, and stock under construction, we estimate that the value of the market for professionally managed rental accommodation in the UK is £56 billion, up 60% from £35 billion in 2019. Looking at the future pipeline, we believe this figure has the potential to nearly double in size to £102 billion by 2028.