What are the ESG considerations for occupiers in Asia Pacific?

ESG is influencing many aspects of real estate including access to investment, but what are the key considerations for occupiers in Asia Pacific?

4 minutes to read

With the built environment contributing to 40% of the world’s carbon emissions, as well as the consumption of 40% of energy and 30% of drinking water globally according to NABERS, the real estate industry is looking at how it can address the climate emergency at a global level.

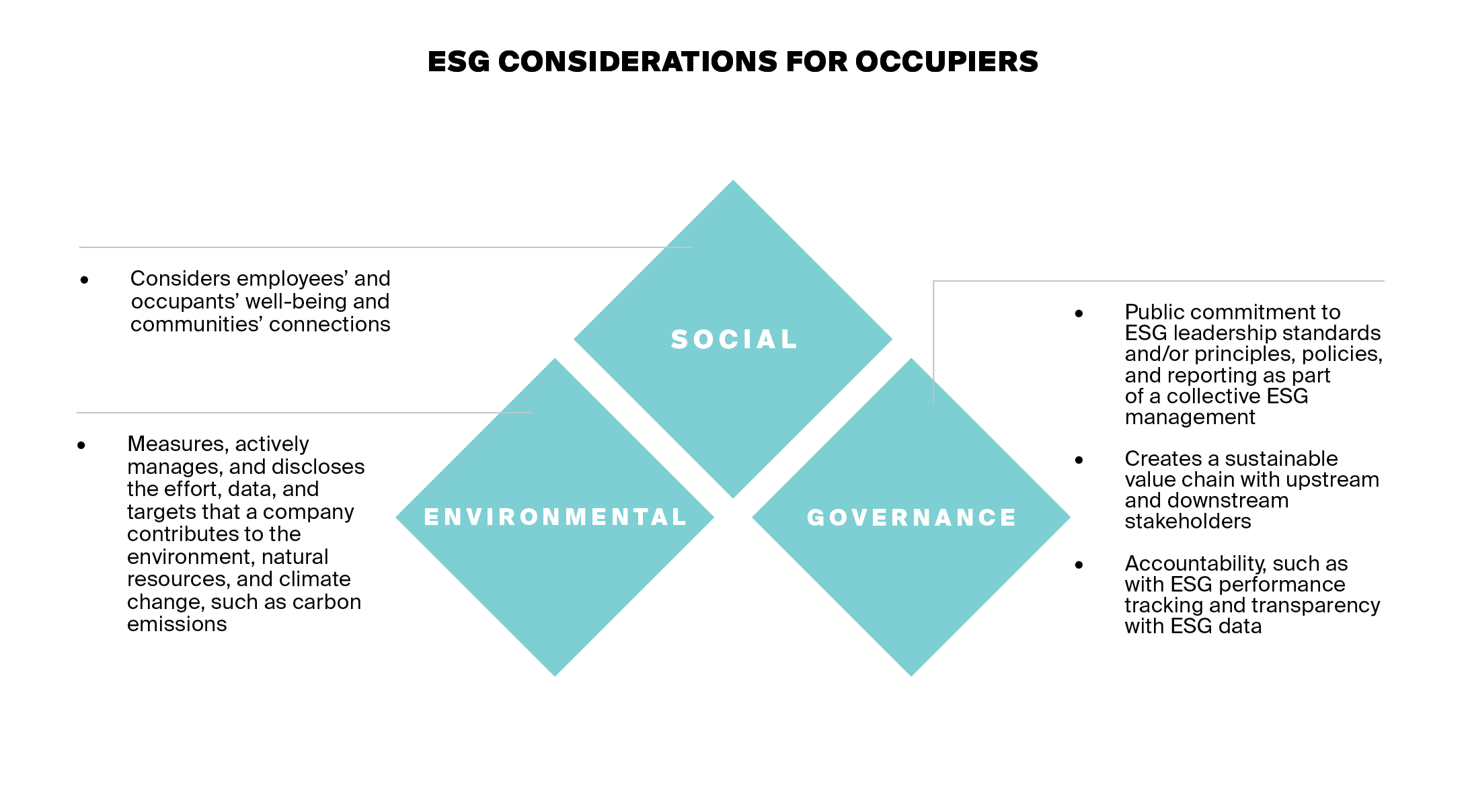

As significant stakeholders, occupiers can play a part and include ESG strategies in their real estate decisions. Although ESG related issues are already very important in the investor's world, occupiers of commercial real estate have historically been slow when it comes to decision making.

Attracting investment

Large institutional investors have publicly declared their support for using ESG criteria to guide their investment decisions, especially when their real estate portfolio is susceptible to climate risk. Investors are also holding companies responsible for providing greater clarity and accountability measures in their ESG efforts.

To remain competitive and not miss out on new opportunities, companies must consider ESG initiatives and align them with industry standards. Occupiers can also benefit from having a better reputation and building a stronger proposition for their brands, aiding them in attracting talents and investments. If a company is trying to achieve, or has already achieved, certain ESG targets, they can apply for sustainable financing too.

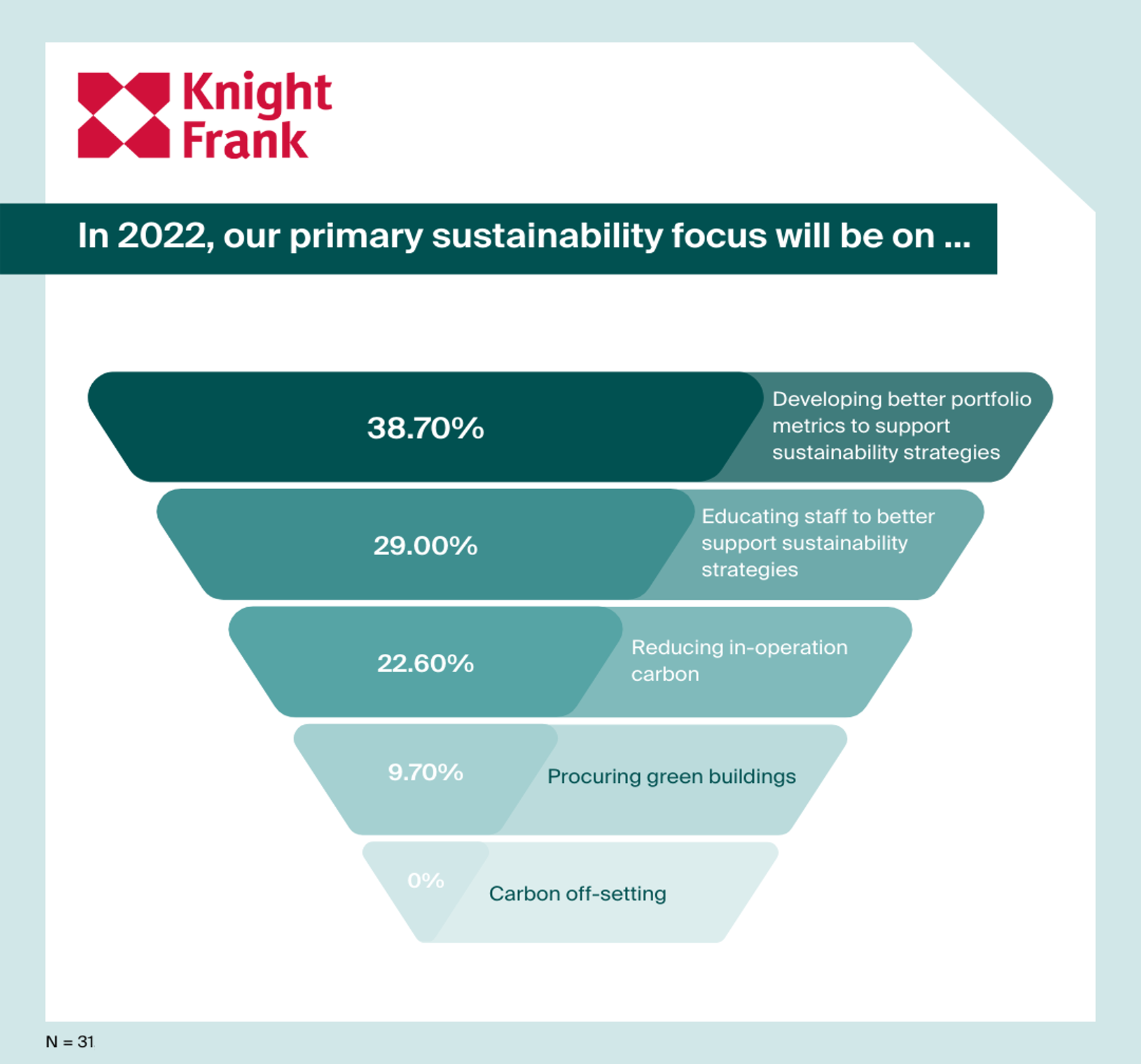

In an APAC occupier webinar at the start of the year, 38% of those polled from financing, tech, transport and government sectors said developing better portfolio metrics to support sustainability strategies will be a primary focus of 2022.

ESG assessments

We start with prioritisation of ESG targets. It’s an exercise that occupiers can carry out with both their internal and external stakeholders to align their ESG priorities. Previously, some of the ESG ambitions could have not been prioritised because they are too costly to implement. The objective is to provide clarity at the organization level and leadership level on the commitments.

There are six basic steps to carry out this assessment, which allows organisations to decide on which sustainability issues to focus on and invest time in.

And very interestingly, according to our survey early this year, four in ten corporate real estate professionals are looking to develop better portfolio metrics to support ESG and another 9.7% would like to procure green buildings. Hence, ESG requirements are now being considered more of a necessity rather than a vanity.

For more than 20 years, the built environment has tried to reduce the amount of energy used to combat global warming. Hence, renewable energy is another area that occupiers place great emphasis on.

Tenants can also start small with the adoption of renewable energy. For example, selecting an office building that utilises renewable energy could be a good starting point. examples of are listed here on the right. Common renewable energy and sustainable building designs include solar and biodiesel, and cooling by natural ventilation.

Green leases

Green leases are also gaining traction in a number of markets across Asia Pacific. A green lease is an agreement between a landlord and a tenant to improve the environmental performance of a property, for example, by cutting energy or water use and reducing waste. It’s still at nascent stage which only very few large tenants and landlords are working on together, and penalty mechanisms will kick in if any party fails to comply.

Currently, green leases are mostly offered by landlords voluntarily. The reduction in emission counts towards tenants’ emissions as well.

Studies have shown that reusing a building avoids 50-75% of the embodied carbon emissions that a new building would generate. Therefore, sustainable fit-out or refurbishment could help to reduce major environmental impact. One key consideration is minimising waste – this includes energy, water, electronics.

DBS being both an occupier and a landlord has gone one step further to retrofit a 30-year-old building to make it net zero. This building used to consume about 845,000 kwh each year.

Social

From the social perspective, this mostly boils down to the relationship between employees’ health and the built environment. In the industry, we have these two most prominent standards, WELL by International WELL Building Institutes, and Fitwel by the Centre of Active Design, which is more popular in the US.

Governance

From the governance perspective, occupiers are assessing and put more pressure on landlords’ governance issues since ESG is a combined effort. Many MNC clients are now proactively requesting their landlords to co-sign green leases. To assist them, our KF brokerage team is currently designing the terms, including setting up a committee, and different renewable energy and reduction targets.

As many buildings were completed some time back, the building specs may not be up-to-date. Therefore, tenants might need the help of landlords to fulfil the criteria. For instance, some tenants have asked landlords to buy or import renewable energy if they are not able to provide. Another common request is for the provision of EV charging points. To cater to this trend, CapitaLand for example, has installed more than 1,300 EV charging points at 72 CapitaLand managed properties in its core markets.

Click here to download the full report.