Easing Covid-19 restrictions, a bounce in business activity

Discover key economic and financial metrics, and what to look out for in the week ahead.

1 minute to read

Here we look at the leading indicators in the world of economics. Download the dashboard for in-depth analysis into commodities, trade, equities and more.

The end of an era?

This week sees the removal of Covid-19 restrictions in the UK, while border and travel constraints are easing across the world. We expect this to be one of a number of factors that will help unlock global investment in commercial real estate this year. Indeed, as highlighted in our Active Capital research, we predict 2022 will be a record year for cross border capital flows.

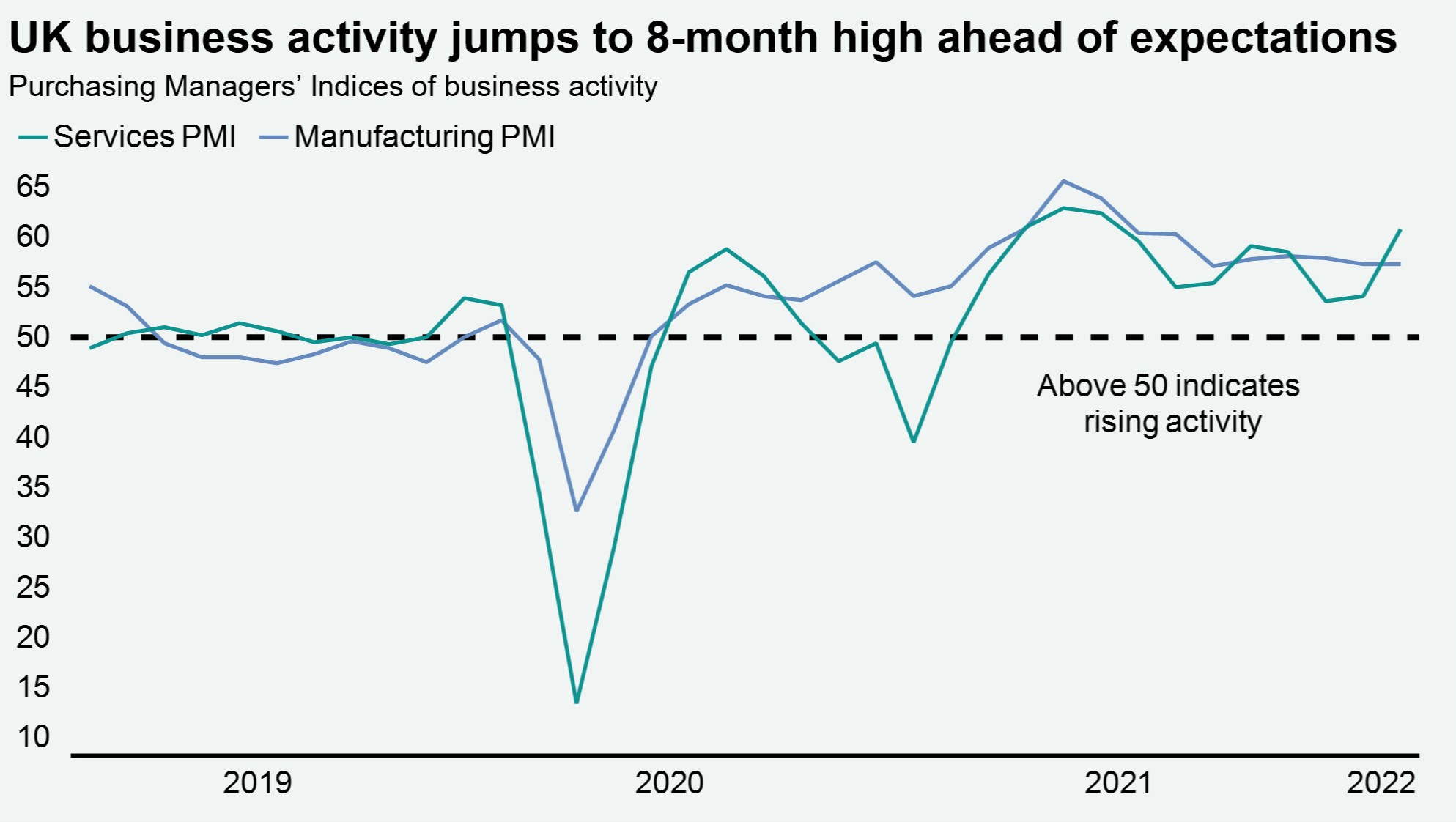

UK business activity rebounds sharply in February

Coming in at 60.2, the latest PMI data overwhelmingly outstripped expectations in February and showed a rebound in business activity across the UK. This positive momentum is reflective of a desire for expansion, particularly amongst services firms, and we expect this to translate into (further) growth in occupational demand for office space.

Borrowing hits a surplus

UK borrowing levels recorded a £2.9bn surplus in January, the first monthly surplus since the pandemic started. While overall borrowing remains elevated at £138.5bn, this is £20bn less than the OBR’s forecast. With Rishi Sunak’s spring statement due next month, we expect part of this windfall will be focused on addressing cost of living issues.

Download the latest dashboard