Residential rebalancing, some stellar retail figures and the enduring European logistics boom

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Rebalancing

The average asking price for UK homes climbed by £8,000 this month, the biggest jump in more than 20 years, according to data published this morning by Rightmove.

We've talked a lot about the supply/demand imbalance that is fuelling gains. The net balance for new buyer enquiries in the RICS January sentiment survey increased from +9 in December to +16%, the strongest reading since May 2021. New instructions remained in negative territory for the tenth consecutive month. See our monthly round up for more on that.

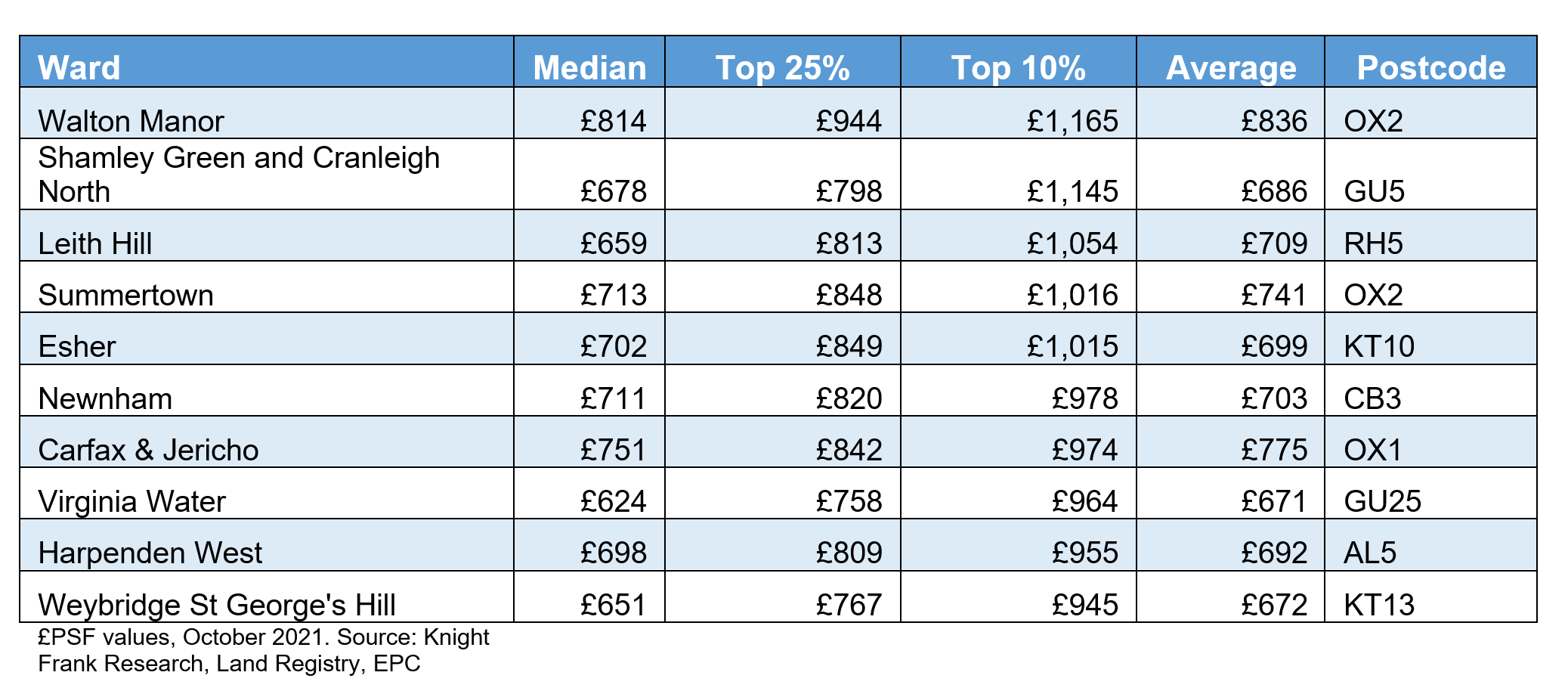

Price growth is on course to create a host of new markets with median prices above £1,000 per square foot, a yardstick once confined to London. There are now five markets where the top 10% of sales exceed £1,000 per square foot. They include two areas in Oxford and three areas to the south-west of London (see chart).

"More areas will join them as property prices across the UK continue to re-balance in coming years, a trend that has been accelerated by the pandemic,” says Tom Bill. See the analysis for more.

The Older People's Housing Taskforce

The government's Levelling Up White Paper, published earlier this month, introduced The Older People’s Housing Taskforce - designed "to look at ways better choice, quality and security of housing for older people can be provided, including how to address regional disparities in supply of appropriate and where necessary specialised housing."

John Tonkiss, chief executive at McCarthy Stone, gives the taskforce his tips in an interview with the Telegraph, namely that ministers should introduce a rule that 10% of new housing should be specially designed for pensioners. Mr Tonkiss says many schemes are held up in planning, which is taking up to a year when it should be taking 13 weeks to get a decision.

We've talked about the supply crunch before. The pace at which the population is aging is dwarfing the rate at which new units are being built. The number of seniors housing units per 1,000 individuals aged 75+ is expected to drop to 120 by 2025, down from 137 in 2010 and 128 currently.

There are a raft of zero cost solutions that will be put forward to the taskforce. They include allocating a percentage of the country’s housing delivery target of 300,000 homes to be built as age-appropriate housing; holding local authorities to account to ensure seniors housing delivery is properly meeting local needs; giving more support to seniors housing in planning policy through its own planning use class; and committing to helping people step off the property ladder, which would indirectly help everyone within the property lifecycle, especially first time buyers.

Logistics

The “supply-demand dynamics in the industrial and logistics sector remain very favourable."

That's from SEGRO chief executive David Sleath, who on Friday reported a blockbuster £4.1bn portfolio valuation uplift and record levels of rental growth. The sector enjoys all sorts of tailwinds that show no signs of abating, from the growth of e-commerce and consumers' desire for same day delivery to the clamour to shore up supply chains in the wake of the pandemic.

The results follow news last week of Blackstone's decision to recapitalise - rather than list or seek a private sale - of its logistics platform Mileway for 21 billion euros. Logistics is one of Blackstone's "highest conviction themes globally", James Seppala, the company's head of Real Estate Europe told Reuters.

Competition between occupiers and investors for the best assets is now fierce. Rental growth will be highest where developable land is in short supply, particularly in urban markets such as London and Paris, according to SEGRO. For more on where the sector is headed, we do some future gazing.

What consumer squeeze?

Stephen Springham gives his verdict on January's stellar retail sales figures:

"An almost inexplicably good set of retail sales figures for January that completely fly in the face of any economic logic. A consumer supposedly so squeezed by spiraling inflation and low wage growth, living in fear of impending energy cost hikes went on an absolute spending splurge in January, buying more and happy to pay higher prices for the privilege. And online was the only area not to benefit.

"An oversimplification of course and context is everything. And the key point is that January last year was a month of full lockdown and this massively distorts the numbers. If nothing else, these latest figures underline, once again, how crippling these periods of lockdown were for the retail sector."

In other news...

In a new Rural Market Update, Andrew Shirley unpacks tightening supply data in the land market.

Elsewhere - the next affordable city is already too expensive (NYT), Canary Wharf launches flexible office service as work patterns shift (FT), green investing: the risk of a new mis-selling scandal (FT), One in 10 job ads is WFH (Times), and finally, bidding wars for rental housing in NYC (Bloomberg).