Covid 19 – Rural property and business update

The following is a brief round-up of some of the Covid-19 related issues affecting rural property owners and businesses

4 minutes to read

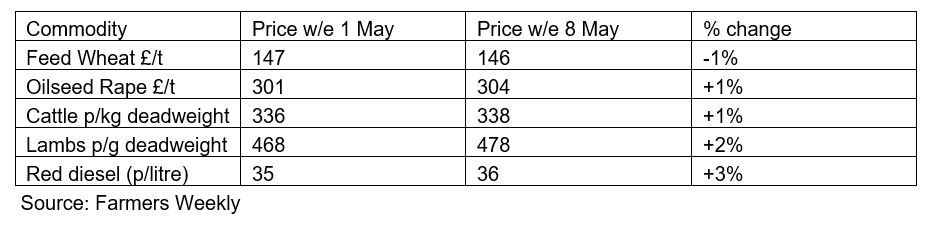

Commodity prices

Prices rose modestly for a number of agricultural commodities last week, unfortunately including red diesel, the value of which has been falling off the back of sliding oil prices. Better growing conditions conditions and a forecast drop in European demand helped pull back feed wheat and barley prices.

Covid-19 support for dairy farmers

After concerted pressure from rural lobbying groups like the CLA and NFU, the government has backtracked by announcing a hardship package for producers who have had to discard milk or seen the price paid for it fall due to the epidemic. Eligible dairy farmers will be entitled to up to £10,000 each, to cover 70% of their lost income during April and May to ensure they can continue to operate and sustain production capacity without impacts on animal welfare.

Meanwhile, across the Atlantic, Donald Trump has handed US farmers - already suffering the fallout of the US/China trade war - affected by the virus a lifeline worth a cool $19 billion. Pig prices have slumped by over 30%, according to US-based journalist Caroline Stocks writing in the Farmers Weekly.

Milk marketing plan

Following on from the new beef promotional strategy mentioned last week, the dairy sector is set to benefit from a joint venture between the UK governments and the AHDB. The £1 million campaign to encourage people to consume more milk “will mainly focus on driving the tea, coffee and milky drink occasions as they have the largest volume opportunity and are the centre point of most human connections. Whether it’s a virtual cup of tea with family or a frothy latte with friends, milk has always been there and will support those connections in this time of crisis”.

Rural Sentiment Survey and Agricultural Bill

Thank you to the many of you who took our Rural Sentiment Survey. The full results will be available in the soon-to-be-published 2020 edition of The Rural Report (please get in touch if you’d like a copy), but to offer you a sneak preview the survey reveals that the countryside is taking a significant hit from Covid-19. The vast majority of respondents expect their profitability to fall this year, with a good percentage predicting a “significant” drop.

Most respondents also said the Covid-19 crisis should encourage the government to make food security a higher priority. A far lower percentage believed this would actually happen.

The government has an opportunity to prove them wrong when the Agriculture Bill returns to House of Commons this week. MPs will be able to propose amendments to the bill, one of which demands that there should be legal assurances that any food imports will be required to meet the same environmental and animal welfare standards as domestic production. Some may see this as common sense.

Latest farm income figures released

At least, however, there is some good news to report from last year. Defra has just released it first estimate for the UK’s Total Income from Farming (TIFF) in 2019. An increase in the value of cropping output, in particular cereals, helped push TIFF up by £398m (8%) to £5.3 billion. However, it is worth noting that the income derived from EU subsidy payments was £3 billion, a significant chunk of the total that is not guaranteed in the future following Brexit.

The Defra stats also show that UK’s total agricultural fixed and current assets are valued at £275 billion against long and short-term liabilities of £20.5 billion. As my colleague Tom Heathcote, who heads up our Agri-business team points out, this represents a gearing of 7.5% and “highlights the relative liquidity that is available to the industry to invest, adapt and respond to the new agricultural sector that is evolving”.

Cost of long-term financing plunges

Bearing in mind the previous point, if you’re thinking of refinancing debt or acquiring more land, lenders are apparently keen to help, despite Covid-19. Andrew Greasley, a rural property specialist at Knight Frank Finance, reports there is still a large appetite from private banks to lend to the rural sector with some tempting deals on offer. For land purchases, a10-year deal is available for 2.6%, while two-year money is available for 1.3% plus base rate.

Dust-mask shortage

Farmers are the latest group of workers worried about a shortage of PPE. Health & safety requirements mean dust masks are crucial for those working in grain stores during harvest time.