Reeves gambles on growth

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Expect six more months of speculation over which taxes the government might raise next - that’s the key takeaway from Wednesday’s spring statement.

Chancellor Rachel Reeves left herself the same £9.9 billion buffer to avoid breaking her own fiscal rules. That's about a third of the average £31.3 billion that chancellors have set aside against their fiscal rules since 2010, the Office for Budget Responsibility (OBR) points out. "If you are going to have 'iron-clad' fiscal rules then leaving yourself next to no headroom against them leaves you at the mercy of events," says Paul Johnson of the Institute for Fiscal Studies.

Three factors pose the greatest threat to growth - and to Rachel Reeves' fiscal headroom. First, the OBR's forecast relies on productivity growth averaging 1% a year. If recent weak performance continues and growth slows to just 0.3%, the budget would slip into a 1.4% deficit by 2029–30. Second, the surge in debt costs at the start of the year already wiped out the previous headroom. A modest 0.6 percentage point rise in base rates and gilt yields - well within the 1-point swings seen recently - would be enough to erase it again. Third, global instability looms large: a tit-for-tat 20 percentage point tariff hike between the US and its trading partners, the OBR’s most extreme scenario, would "almost entirely" eliminate the remaining buffer.

"We can surely now expect 6 or 7 months of speculation about what taxes might or might not be increased in the autumn," Johnson continues. "There is a cost, both economic and political, to that uncertainty. The government will suffer the political cost. We will suffer the economic cost."

Building boom

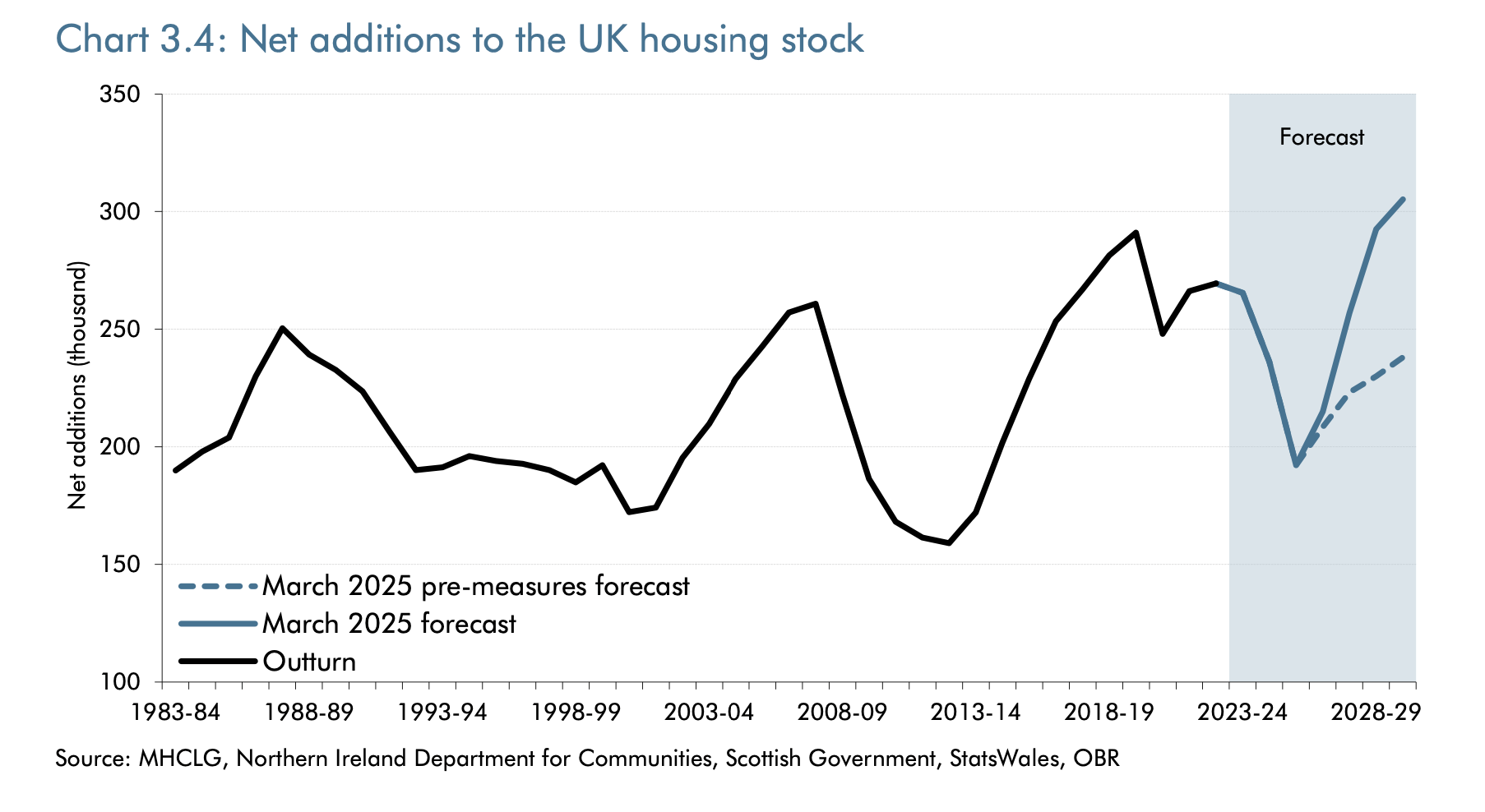

Credit where credit is due: planning reform should result in meaningful increases in housebuilding. The OBR expects net additions to the UK housing stock to hit 305,000 a year by the end of the decade (see chart). It projects around 1.3 million cumulative net additions by 2029–30, of which 170,000 are attributed to reforms to the National Planning Policy Framework.

The OBR forecasts a 2.8% rise in house prices in 2025, followed by average growth of 2.5% per year. Meanwhile, sales are expected to rise from 290,000 per quarter in 2024 to 370,000 by 2029, reflecting easing supply constraints and a gradual recovery in buyer sentiment.

Property-related tax receipts are also set to grow. Stamp duty and other transaction taxes are projected to increase from £15.0 billion in 2024–25 to £26.5 billion by the end of the forecast.

Suburban surge

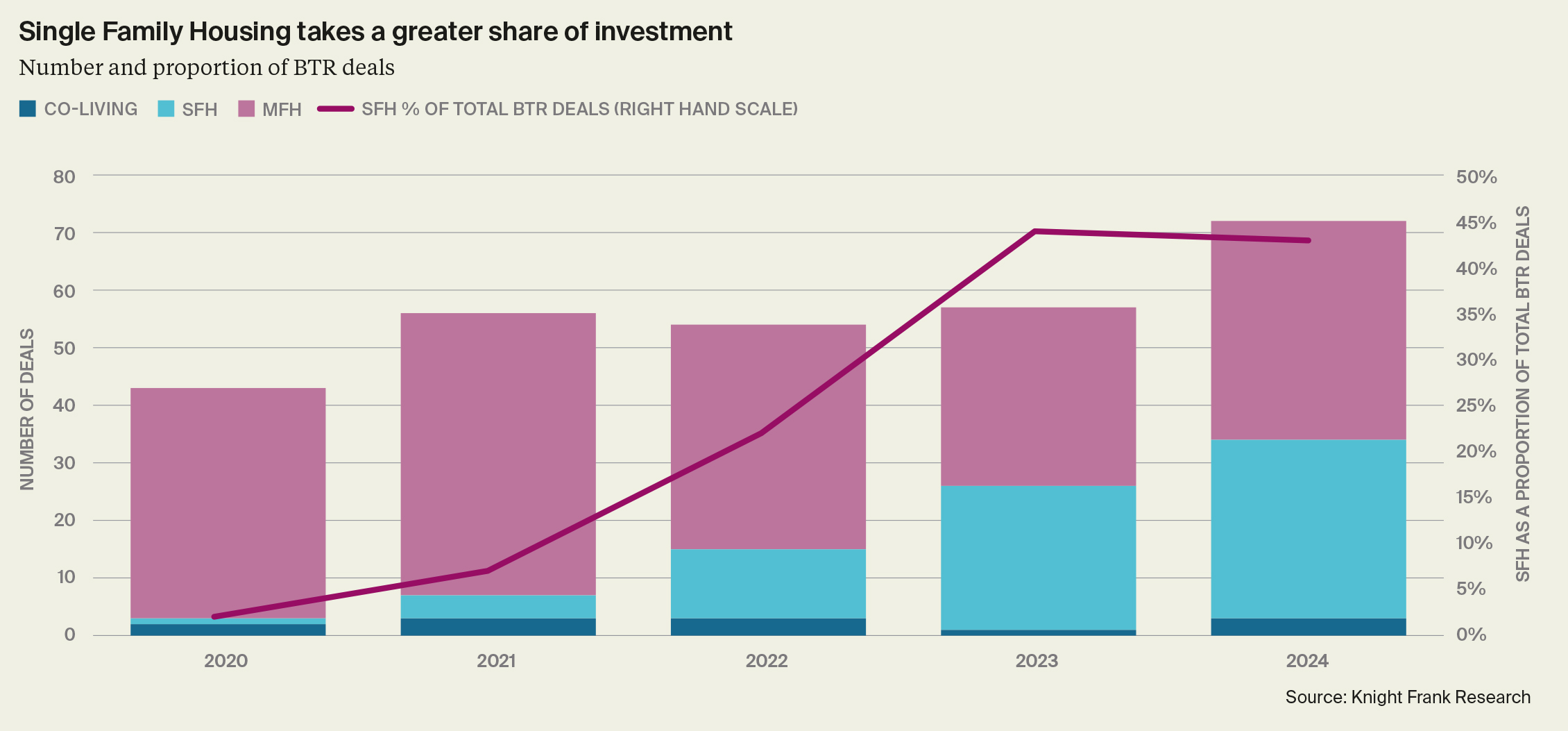

New Knight Frank figures reveal the remarkable growth of the UK's single-family housing (SFH) investment market. Investment hit a record £1.8 billion in 2024, bringing the total invested since 2020 to £4.4 billion.

Nationwide, 31 deals completed during the year - double the volume of 2022 - and SFH represented 43% of total Build to Rent (BTR) activity, up from just 2% four years ago.

More than 3,000 SFH homes were delivered in 2024, with over 11,000 under construction across 132 local authorities. In total, there are now 14,353 complete and operational units within 212 schemes. Much of the recent activity has centred on the South East and East of England, which together accounted for 71% of investment last year.

Nearly half of all transactions in 2024 were structured as forward commitments, up from 24% in 2023 - a clear sign of growing investor confidence. International investors are increasingly keen to enter the UK market. Cross-border capital accounted for more than £1 billion in transactions during the year, a 45% increase compared to 2023. A Knight Frank survey of nearly 60 major investors across UK Living Sectors found that 71% plan to target SFH over the next five years, up significantly from 41% currently invested.

Data drive

SEGRO and Pure Data Centres’ £1 billion joint venture to develop a fully fitted data centre in Slough marks an evolution in the market. Unlike typical land-only or shell-and-core strategies, the scheme will be delivered as a turn-key solution - SEGRO will retain a 50% stake post-completion.

The deal is part of a broader surge in interest in digital infrastructure. Transaction volumes across the EMEA data centre market hit £1.8 billion in H1 2024, a 168% year-on-year rise, according to Knight Frank figures. The sector accounted for 12% of all commercial real estate investment in Greater London during Q2 2024.

AI-linked occupiers continue to drive leasing activity, while capacity constraints, rising power prices, and land scarcity are fuelling rental growth.

In other news...

The UK's key housing target is at the mercy of wary housebuilders (Bloomberg).