Robust investment comes in spite of an ongoing challenging investment backdrop

Knight Frank’s quarterly review of the key development and investment themes in the UK student property market

7 minutes to read

Robust investment volumes

Nearly £840 million was invested in the UK purpose-built student accommodation (PBSA) market in the third quarter of 2024 across 15 deals. Investment volumes for Q3 were comfortably above the 10-year average for the quarter of just shy of £700 million. It takes total investment so far in 2024 to £3.3 billion, notably ahead of the £2 billion which had been spent at the same point last year. Whilst investment is up year-on-year, that increase should be viewed through the lens of longer than average transaction completion timeframes, which agents note can take an additional four to six weeks to close. The UK also continues to perform well in a global context, accounting for 46% of total global capital flows into PBSA worldwide so far this year, reinforcing the attractiveness of the asset class and investor appetite. In the UK, overseas investors accounted for 22% of UK deals in 2021, 41% of deals in 2022 and 46% in 2023.

Reading behind the headlines...

Despite a healthy flow of capital invested in UK PBSA in 2024 to date, 30% is associated with just one deal (Singaporean-based Mapletree’s acquisition of the Cuscaden Peak Portfolio in Q2). Breaking deals down further, the vast majority (47%), were for lot sizes valued up to £25 million. This was followed by deals in the £50 million to £25 million category (24%).

Appetite for access

Historically, stabilised PBSA assets have been the most appealing for investors when looking to get a foothold in the UK market. But given the finite opportunity of standing stock acquisitions, alternative pathways to deploying dry powder are strengthening. Land acquisitions are the highest they have ever been annually at 18 site sales over the nine months in 2024. While investors continue to seek exposure to the market, the wider macro-economic picture continues to put pressure on deal structuring. In total, funding deals and joint ventures accounted for just 11 of the 52 deals in the year to date.

Bright(er) backdrop

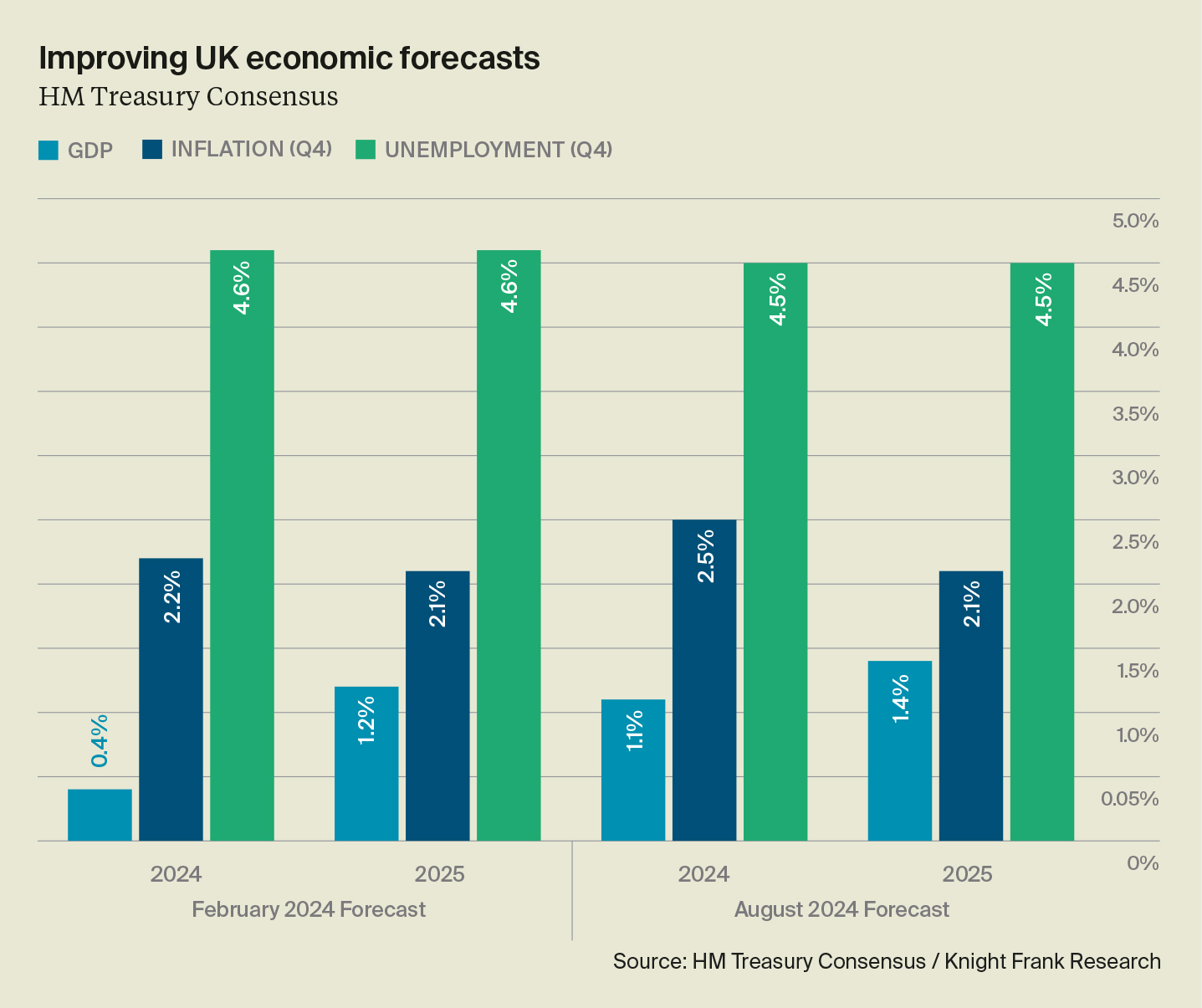

With the first Bank Rate cut now behind us, the conversation has shifted from when the central bank will start cutting rates to where rates are heading. The speed of cuts and the level at which interest rates eventually settle is dependent on a host of factors but a combination of greater political certainty, rising business sentiment and stabilising inflation should support a pick-up in investor appetite in Q4 and as we head into 2025, particularly if it is matched with a drop in borrowing costs. Capital Economics is currently forecasting that rates will settle at 3% by the end of next year. The UK economy outperformed the Eurozone in Q2, with growth only just behind the US. And the latest economic data suggests that this performance is likely to continue into the second half of the year. An analysis of independent forecasts by HM Treasury points to notable improvements in sentiment from earlier in the year. Meanwhile, the OECD now expects the UK will experience the joint-second highest economic growth this year within the G7 group of nations. Despite the looming Budget and talk of fiscal “black holes” prompting some investors to adopt a wait-and-see approach, the brighter backdrop has created a mood of optimism for the UK as a destination to deploy capital, and hints that the UK may be regaining its status as a more stable and dynamic market.

Day 28 Clearing Data

UCAS data from 28 days post Clearing shows that 498,340 students were accepted onto full-time undergraduate courses for the 2024/25 academic year, a 0.9% increase on last year. The overall number of acceptances has been driven by growth in UK 18-year-olds with 277,790 placed in 2024, up 2.8% annually. Notable growth was seen among higher tariff providers, with 104,500 acceptances, a 13% increase year-over-year. By contrast, medium tariffs providers accepted 92,380 UK 18-year-olds, down 1.6% on last year, while lower tariffs providers placed 80,910, down 3.6%.

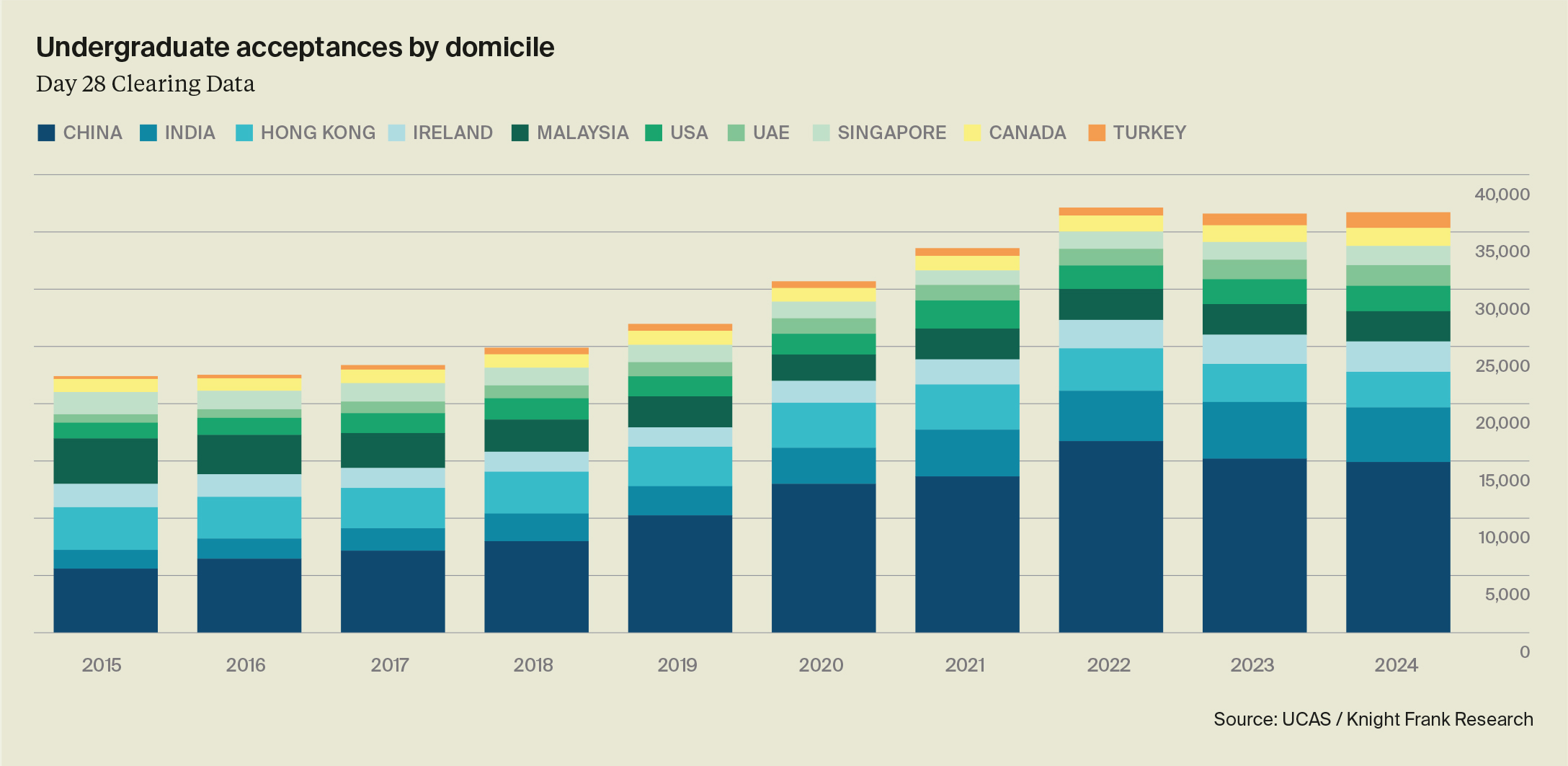

International undergraduates

Some 61,110 international applicants have received a place this year, according to UCAS which captures approximately 60% of international undergraduate acceptances. This was marginally down 0.6% year-on-year, but within the headline figure there are significant differences between domiciles. China remains by far the largest international market with 14,890 acceptances (-1.9% YoY), followed by India with 4,770 acceptances (-3.8% YoY) and Hong Kong with 3,120 acceptances (-6.3% YoY). The biggest growth in nominal terms has been from Turkey with 1,370 acceptances (+35% YoY), Singapore with 1,680 acceptances (+8.4% YoY), and Canada with 1,580 acceptances (+8.2% YoY).

Blueprint for university reform

Universities UK (UUK) have published a detailed document outlining a programme for reform for Higher Education in England over the next decade. Within the blueprint, the five big “shifts” are identified as 1) expanding opportunities 2) improving collaboration 3) generating local growth, 4) securing research and 5) establishing a new global strategy for universities. It is no surprise that the financing of higher education is top of the agenda, with UUK suggesting an indexing of tuition fees to inflation and restoring the teaching grant, so that the public pay more to cover the cost of universities. They have also suggested participation in higher education courses from Level 4 and above should rise to 70% by 2040 amongst 18–25-year-olds. The goal sits within the long-term aim to reach new students and shore up university finances, against a backdrop of prolonged tuition fee freezes, rising costs, and a reduction in international student numbers.

Renters Rights Bill

The Renters’ Rights Bill is pressing ahead with the abolishment of no-fault evictions, known at Section 21, following the commitment made in the 2024 Labour Party Manifesto. For PBSA, although it is likely to be exempt (subject to the provider being signed up to the government-approved codes of practice) there are still a number of areas of uncertainty which will need clearing up. The bill is due to progress to the Bill Committee stage at the end of October, but for now providers are being told to operate ‘business as usual’.

High levels of satisfaction in PBSA…

A consequence of the introduction of tighter regulation and the professionalisation of the rental sector may well be a further erosion of stock in the HMO market as some private landlords look to sell properties or liquidate portfolios. That will, in turn, push more demand into purpose-built stock, reinforcing our expectation that within the next decade the PBSA sector will accommodate the majority of second and third-year students. That view is further supported by data which suggests that students living in purpose-built homes are the most satisfied with their accommodation. According to the 2024 Knight Frank/UCAS Student Accommodation Survey, those living in private PBSA or university-run halls were the most satisfied overall at 76% and 77% respectively. At 70%, a lower proportion of students living in the private rented sector were satisfied overall.

Red flags and maple leaves

Canada’s collapse in international student recruitment is a red flag to the UK. The Canadian government announced in January that it would cut the number of study visas from 436,600 in 2023 to 292,000 in 2024, a drop of about a third. However, the effect of this announcement, combined with other policy changes, means that universities are now expected to fall well short of that cap. Projections by admission firm Apply Board indicate that just 231,000 permits will be approved by the end of the year, a fall of 47%. Despite the obvious financial challenges this will bring to Canadian institutions, the longer-term picture of reputational damage could have larger ramifications for the attractiveness of Canada as a place of study for international students.

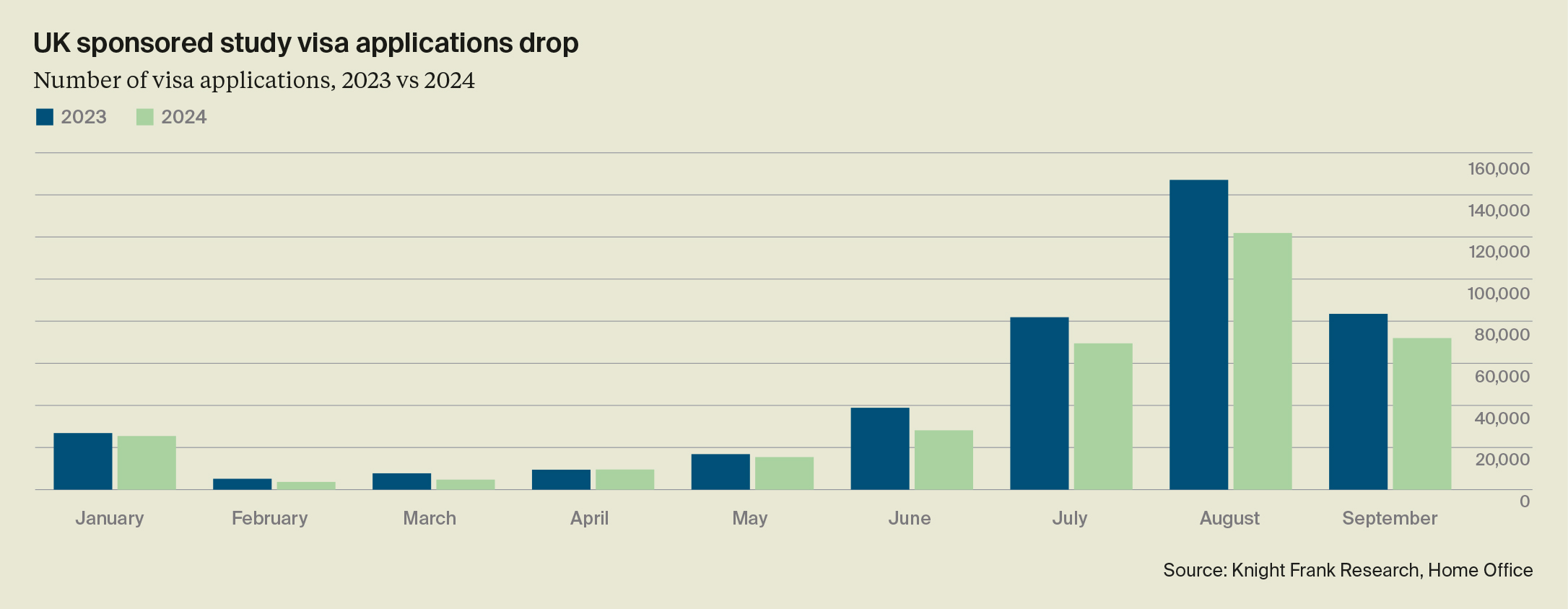

Lessons from down under

Beyond the local impact, Canada’s experience is being seen as a lesson for other leading anglophone sectors battling increased hostility to immigration, namely Australia and UK. Australia’s government has announced plans to cap international student enrolments in publicly funded universities at 145,000, roughly the same as 2019 levels, from 2025 onwards. Although legislation behind the limits is yet to be approved, growing visa delays and refusals have been hampering institutions’ recruitment efforts. Following structural visa reform that took place in January, the number of prospective students applying for UK visas is down 16% in September 2024, despite Labour adopting a much more stable tone towards international students.