ECB Rate Cuts, Tax rises and Policy Shifts

Plus, why Europe’s prime cities are seeing weaker price growth

3 minutes to read

Mortgage rates

Last week, the European Central Bank (ECB) announced its second rate cut, reducing the deposit rate to 3.5%, its lowest level since July 2023. This move places the ECB ahead of the Federal Reserve and the Bank of England, both of which have only implemented one rate cut each, the Fed making its first move this week.

Mortgage rates had already started falling following the ECB’s first rate cut in June as we highlighted in our newly-released European Lifestyle Report.

The announcement of a second rate cut signals that additional mortgage rate reductions are on the horizon. This is especially good news for the 20% of households in the European Union with a variable rate mortgage.

In France and Italy, average mortgage rates have dropped to 3.41% and 3.44%, down from previous highs of 3.60% and 4.50% respectively during the last monetary tightening cycle.

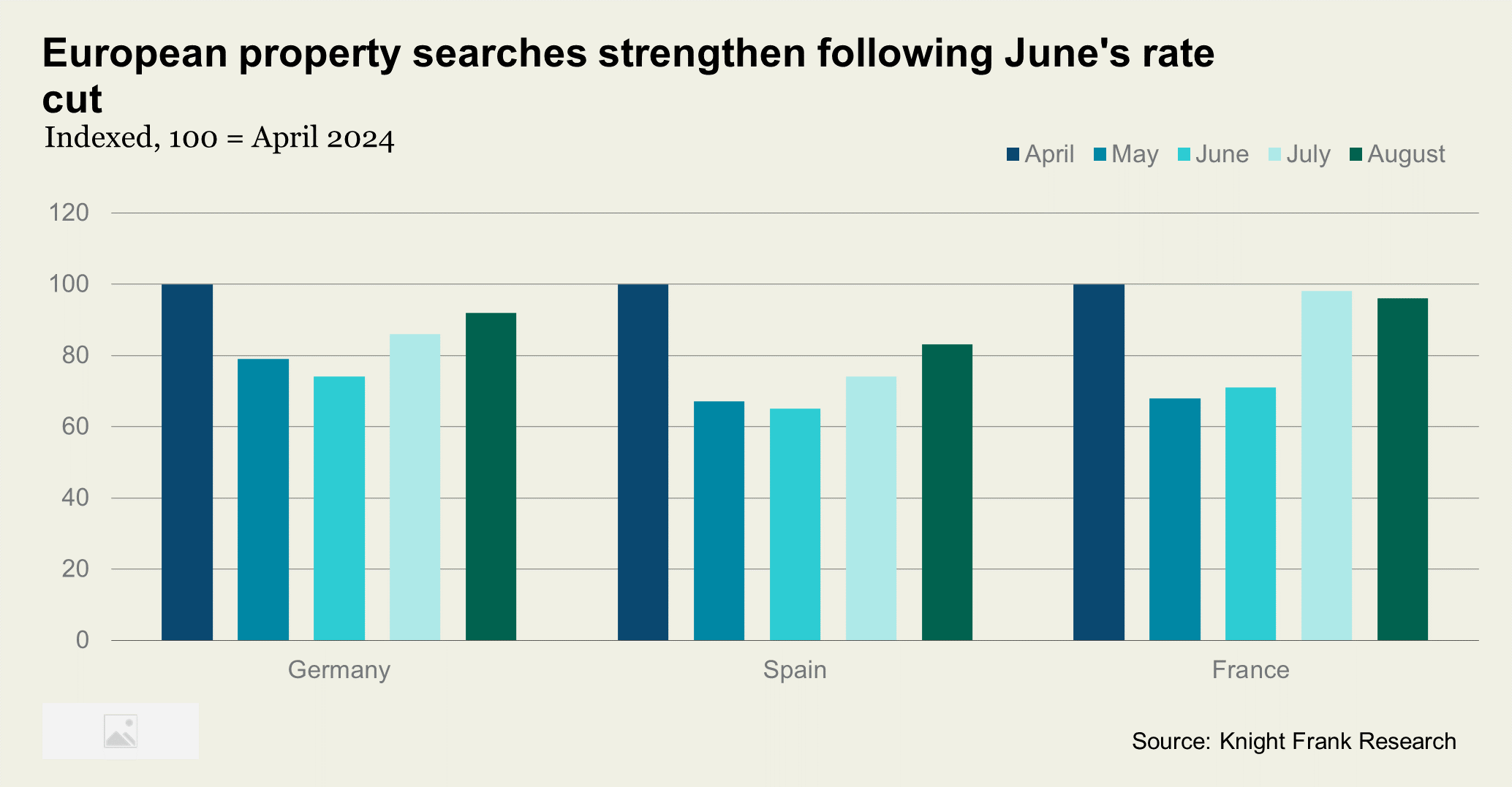

This shift has boosted buyer confidence, with property searches for key European markets via Knightfrank.com increasing 29% since the ECB's initial rate cut on 6th June.

However, uncertainty remains around the European Central Bank's next steps. While President Christine Lagarde suggested further cuts may not come until December, other ECB officials have expressed caution due to ongoing inflation concerns. Strategists from Barclays and Danske Bank have also indicated that the pace of rate cuts may be slower than expected.

Alongside GDP data, the Federal Reserve's policies and their impact on currency markets will likely influence the ECB's future decisions.

Prime prices

Liam Bailey's latest Prime Global Cities Index reveals how luxury residential markets are performing globally.

A deep dive into the European data confirms a trend of slower growth. Annual price growth for luxury properties in 13 European cities averages just 0.8% as of June 2024, compared to 2.6% across 44 global cities.

What’s behind European cities’ weaker growth?

- Interest rate impact: European markets, particularly those with a high proportion of variable-rate mortgages, were hit hard by interest rate hikes starting in 2022.

- Economic and policy influences: Economic uncertainty, depleted pandemic savings, and recent policy and tax changes targeting wealth and property have led to greater caution on the part of buyers.

- Regional variations: Some European cities are outperforming the broader trend. Madrid, Lisbon, and Dublin are exceptions, with prices rising by 6.4%, 4.7%, and 4.5%, respectively. The data suggests a correlation between economic output and prime price performance with southern European economies set to outperform their northern counterparts this year according to Oxford Economics.

Policy shifts

The rapid pace of policy changes across housing markets makes it challenging for even the most dedicated analysts to stay fully informed, and this trend is expected to accelerate in the final quarter of 2024.

Where do things across Europe currently stand?

In short, Italy’s flat tax has doubled, France’s direction on taxes remains unclear although more detail should be imminent following Michel Barnier’s appointment as Prime Minister, the UK is holding out for its Autumn Budget for non-dom clarification, possible changes to Capital Gains Tax and rules around carried interest.

Greece has tightened its Golden Visa rules, Portugal has embarked on a Talent Attraction Scheme, Barcelona is set to ban holiday lets from 2028 and Greece has announced a one-year ban on new holiday lets in three areas around Athens.

For more detail see page 12 of the European Lifestyle Report.

In summary, concerns about housing affordability, over-tourism, and high debt levels in Europe are likely to drive taxes higher, particularly affecting property ownership and rental regulations. Additionally, there will be a broader push for increased transparency, all of which is set to influence market performance.

In other news…

Working from home is most prevalent in northern European cities (Oxford Economics), France, Italy and Spain win key roles in Von Der Leyen’s new European Commission (Bloomberg), and how the Olympics changed Paris (Financial Times)